Please use a PC Browser to access Register-Tadawul

Is Massive Investment in AI Really Paying Off? Morgan Stanley: Tangible Returns Already Seen in Three Major Sectors!

Morgan Stanley MS | 182.91 | -1.18% |

Target Corporation TGT | 111.30 | +1.62% |

Walmart Inc. WMT | 127.71 | +2.94% |

①Morgan Stanley's AI Adopter Survey shows AI exposure and adoption rates are rising, with the financial sector already seeing related returns;

② Furthermore, the real estate and consumer sectors show the most significant changes in AI application. The adoption rate among consumer durables and apparel companies rose from 20% to 44%, while REITs increased their engagement with AI technology.

Ever since ChatGPT ignited the artificial intelligence (AI) boom, investors have been eager to know whether massive investments in AI-related technologies are truly generating returns for companies. Morgan Stanley (Morgan Stanley)(Morgan Stanley(MS.US)) provides an affirmative answer.

The latest AI Adopter Survey from Morgan Stanley shows that AI exposure and adoption rates are clearly on the rise.

Specifically, the survey reveals that the financial sector has already seen returns related to artificial intelligence over the past few months. Among insurance companies, the proportion of adopters rose from 48% to 71% since January 2025. During the same period, the number of adopters among financial services companies increased from 66% to 73%.

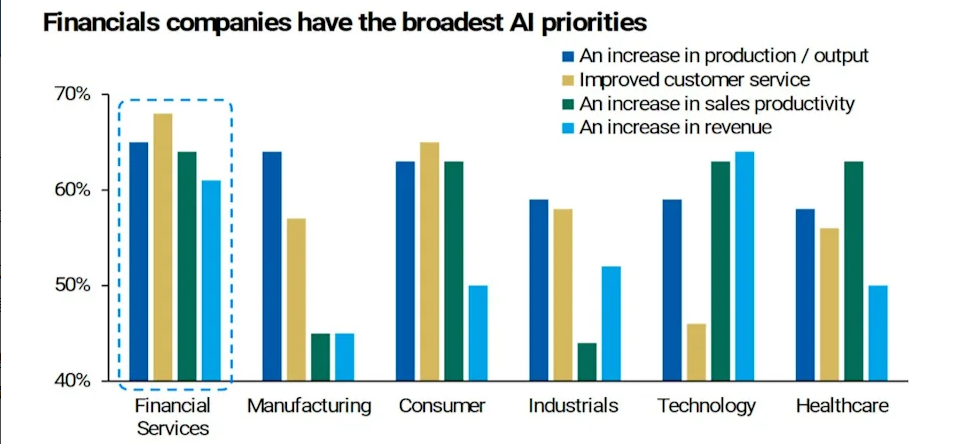

Morgan Stanley wrote in its July 2025 edition of the AI Adopter Survey: "In our specialized survey of 400 companies applying GenAI (Generative AI) to their products, financial companies show the most low-cost opportunities in both cost and revenue."

Companies in this sector have been heavily investing in AI capabilities to automate customer service and enhance risk and compliance protocols.

Additionally, the real estate and consumer sectors show the largest magnitude of change in AI application.

Morgan Stanley found that nearly 30% of consumer durables and apparel companies increased their focus on AI, meaning greater engagement with AI technology. Overall, the adoption rate among such companies rose from 20% to 44%.

A significant portion of AI application in the consumer sector comes from supply chain optimization – for instance, retailers like Target (Target Corporation(TGT.US)) and Walmart (Wal-Mart Stores, Inc.(WMT.US)) are using the technology to manage inventory.

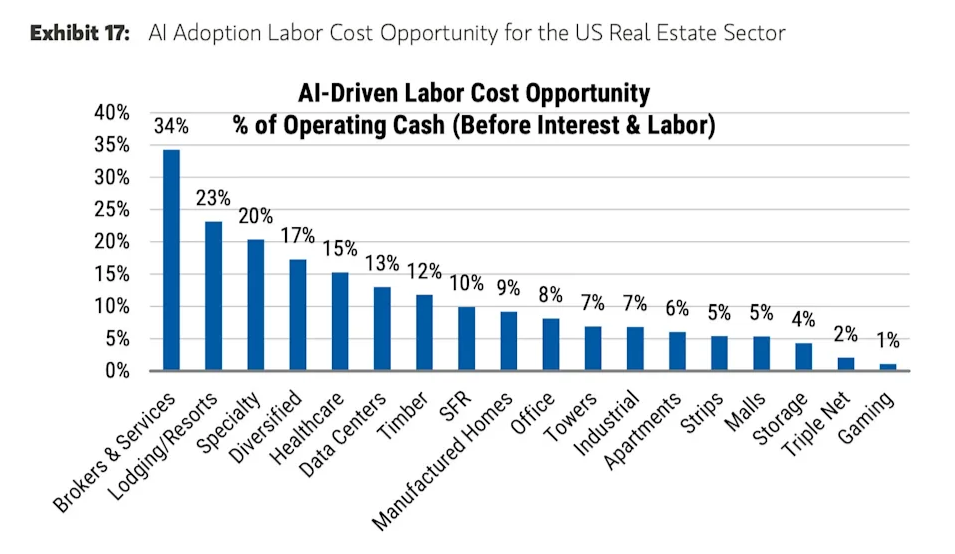

In the real estate sector, 32% of Real Estate Investment Trusts (REITs) currently have significantly more exposure to AI technology than during the January survey. Ron Kamdem, Head of US REIT and Commercial Real Estate Research at Morgan Stanley, stated that roughly 37% of tasks across the 525,000 positions in the public REIT and commercial real estate services industry could be automated.

For example, leasing services, property management, and risk management are all real estate areas where efficiency can be enhanced through AI, with the largest gains coming from automation within the brokerage and services segments of the real estate industry.

Morgan Stanley added that, regarding earnings revisions, companies exposed to AI are clearly outperforming those that haven't integrated the technology.

"There are clear signs that AI is playing a very significant role within enterprises – evident in relative price performance and earnings revisions," the analysts wrote.

Looking ahead, the gap between companies successfully adopting AI and those not adopting it will only continue to widen. Morgan Stanley stated that as the stock market continues its upward trend amidst higher earnings revisions, AI adopters with strong pricing power are leading the gains with higher earnings revisions, while companies impacted by AI are experiencing negative revisions.