Please use a PC Browser to access Register-Tadawul

Is Maximus' Expanded Buyback Authorization Shaping a New Capital Allocation Story for MMS?

MAXIMUS, Inc. MMS | 84.43 | -0.67% |

- On September 8, 2025, Maximus announced an increase in its equity buyback authorization, raising the remaining amount available for share repurchases to US$400 million.

- This move signals management’s confidence in the company’s financial health and highlights a commitment to returning value to shareholders through buybacks.

- We'll now examine how the expanded buyback authorization may reinforce Maximus’ investment narrative and shareholder value priorities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Maximus Investment Narrative Recap

To be a Maximus shareholder today, you need to believe in government clients continuing to outsource critical, high-complexity programs as new regulations expand demand, and that technology shifts or budget volatility won’t meaningfully disrupt major contracts in the near term. The expanded buyback authorization reaffirms management’s confidence, but the most important catalyst remains new legislative rollouts for Medicaid and SNAP; the biggest risk, rapid automation adoption shrinking the addressable market, remains unchanged by this news.

Among recent announcements, the raised earnings guidance (now US$5.375 billion to US$5.475 billion in FY 2025 revenue) stands out, supporting the company’s case for steady operating momentum in the midst of regulatory and budget pressures. That improved outlook, taken with the buyback increase, underscores Maximus’ emphasis on disciplined capital returns paired with expansion into federal technology contracts, both key themes for supporting near-term catalysts.

Yet, despite rising buybacks and positive guidance, investors should be aware that if governments accelerate automation and self-service technology adoption, Maximus could face...

Maximus is projected to reach $6.1 billion in revenue and $486.5 million in earnings by 2028. This outlook assumes 3.9% annual revenue growth and an increase in earnings of $170.3 million from the current $316.2 million.

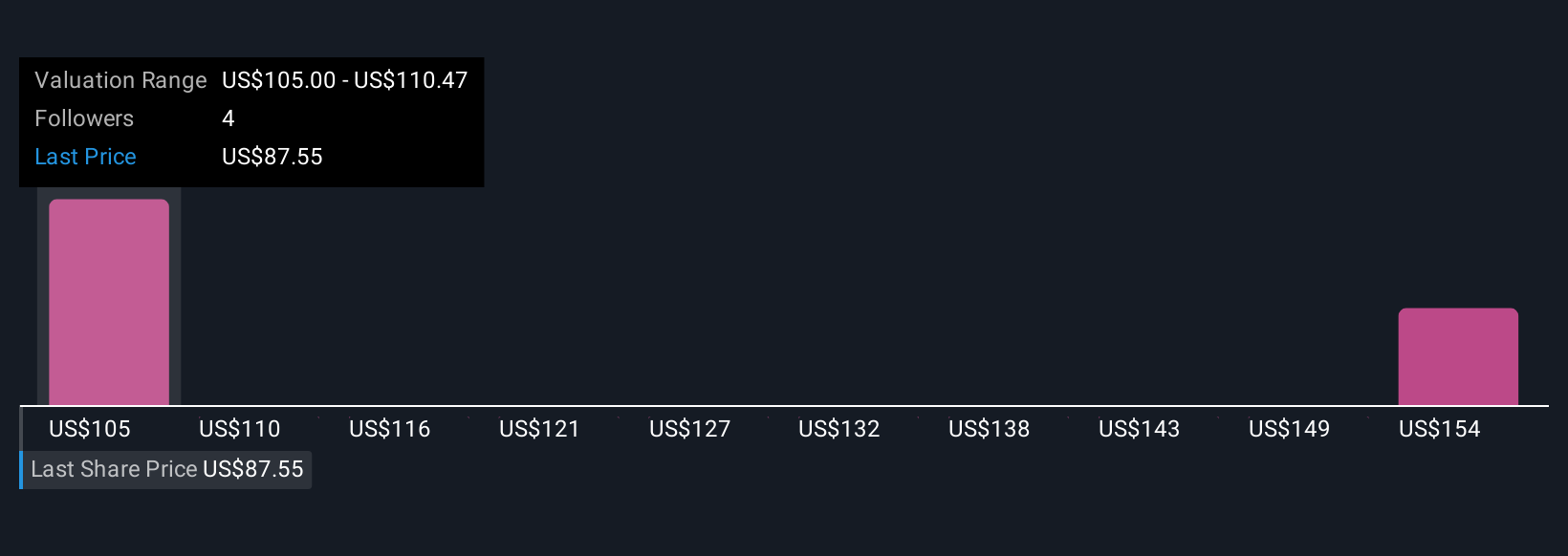

Uncover how Maximus' forecasts yield a $105.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community investors set fair values for Maximus between US$30.09 and US$105 across 2 opinions. As you read, consider how automation risk could reshape future growth assumptions.

Explore 2 other fair value estimates on Maximus - why the stock might be worth less than half the current price!

Build Your Own Maximus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maximus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Maximus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maximus' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.