Please use a PC Browser to access Register-Tadawul

Is MSA Safety’s (MSA) Balanced Approach Signaling Resilience or Heightened Caution Amid Industry Uncertainty?

MSA Safety, Inc. MSA | 168.54 | -0.44% |

- In early August 2025, MSA Safety Incorporated reported second quarter earnings with sales of US$474.12 million and net income of US$62.77 million, while reaffirming its low single-digit organic sales growth outlook for the full year and cautioning about ongoing macroeconomic and regulatory risks.

- The company's cautious guidance, share repurchase activity, and continued dividend payments highlight management's efforts to balance growth initiatives with shareholder returns amidst industry uncertainty.

- We will now explore how MSA Safety’s reaffirmed sales outlook and risk management approach shape its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

MSA Safety Investment Narrative Recap

To be a shareholder in MSA Safety, you need to believe in the company's ability to deliver resilient, moderate growth by capitalizing on advanced safety technology and steady demand for protective equipment, despite facing mature markets and industry-wide risks. The recent reaffirmation of low single-digit sales growth does not substantially change the importance of NFPA standard approvals or the key risk of margin pressure from supply chain factors and tariffs, which continue to be pivotal short-term dynamics for the stock.

The updated share repurchase announcement, with US$30 million allocated in the latest quarter and over US$69 million completed since May 2024, closely relates to current efforts to enhance shareholder value during a period where organic sales outlooks remain modest and regulatory approvals could affect near-term revenue catalysts. With ongoing dividend payments and buybacks, MSA is clearly communicating its commitment to shareholder returns while awaiting further clarity on external risks.

However, with regulatory processes like NFPA standard updates still pending, investors should also be aware that...

MSA Safety's narrative projects $2.1 billion revenue and $377.8 million earnings by 2028. This requires 5.2% yearly revenue growth and a $100.9 million earnings increase from $276.9 million today.

Uncover how MSA Safety's forecasts yield a $187.20 fair value, a 9% upside to its current price.

Exploring Other Perspectives

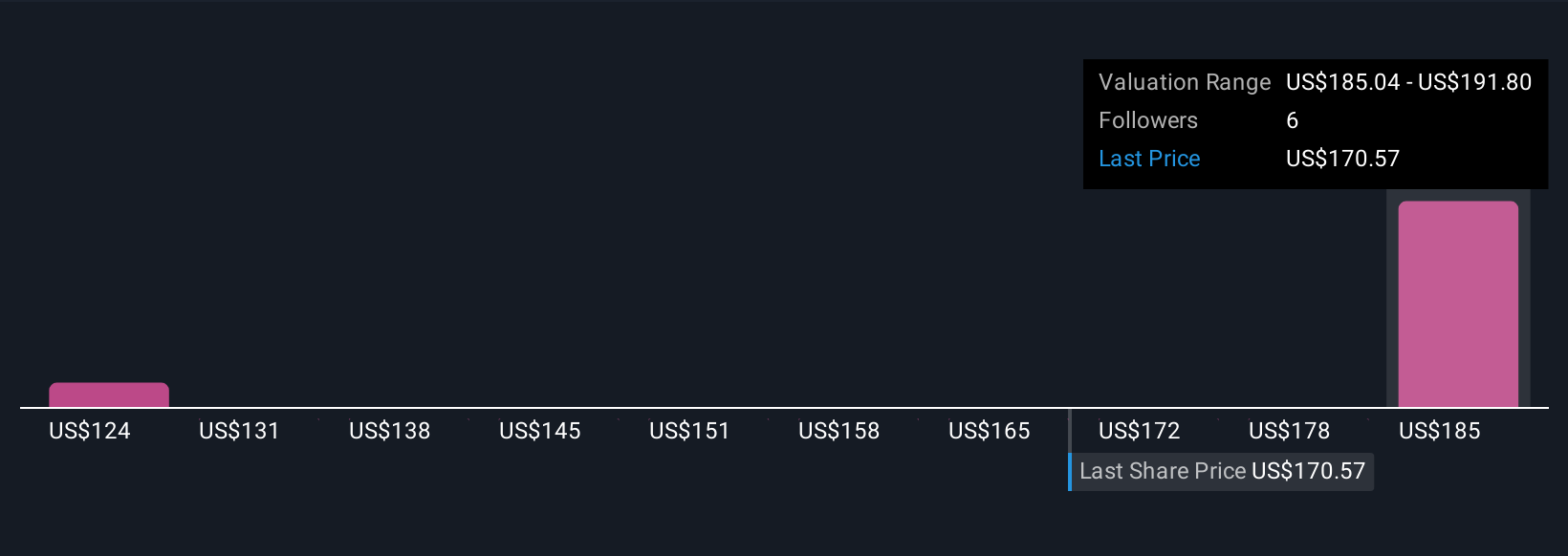

Three fair value estimates from the Simply Wall St Community range widely from US$124.23 to US$192.58 per share. As these can differ sharply from consensus analyses, keep in mind that regulatory and supply chain risks could lead to different performance outcomes than expected, so it’s well worth reviewing a variety of alternative viewpoints on MSA Safety before making up your mind.

Explore 3 other fair value estimates on MSA Safety - why the stock might be worth 28% less than the current price!

Build Your Own MSA Safety Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSA Safety research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MSA Safety research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSA Safety's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.