Please use a PC Browser to access Register-Tadawul

Is MYR Group's (MYRG) Recent Valuation the Real Test of Its Operational Turnaround?

MYR Group Inc. MYRG | 218.40 | -3.50% |

- KeyBanc Capital Markets recently downgraded MYR Group from "Overweight" to "Sector Weight," citing fair valuation even as the company showed continued operational improvements and progress overcoming project execution challenges.

- Acknowledging these advancements, the change in analyst outlook highlights a shift in market sentiment that emphasizes current valuation rather than underlying business momentum.

- We will consider how this analyst downgrade, driven by fair value concerns despite business gains, may alter MYR Group’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MYR Group Investment Narrative Recap

To be a shareholder in MYR Group, you need to believe in the company’s ability to capitalize on North American electrification trends through long-term utility contracts and a solid backlog of public and private infrastructure work. The recent KeyBanc downgrade, prompted by fair value concerns after a strong run, does not materially alter the most important short-term catalyst, the scale-up of major multi-year contracts, but does add focus to the biggest risk, which is increasing reliance on core T&D and C&I markets if renewables exposure continues to drop.

Among recent company announcements, MYR Group’s five-year, over US$500 million master service agreement with Xcel Energy stands out. This commitment significantly broadens recurring revenues and backlog visibility, serving as a foundation for continued top-line growth as the company navigates changing project mix and shifting industry demand.

Yet, despite strengthening fundamentals, investors should be aware that if core utility or industrial demand falters, MYR Group’s revenue streams could quickly become exposed...

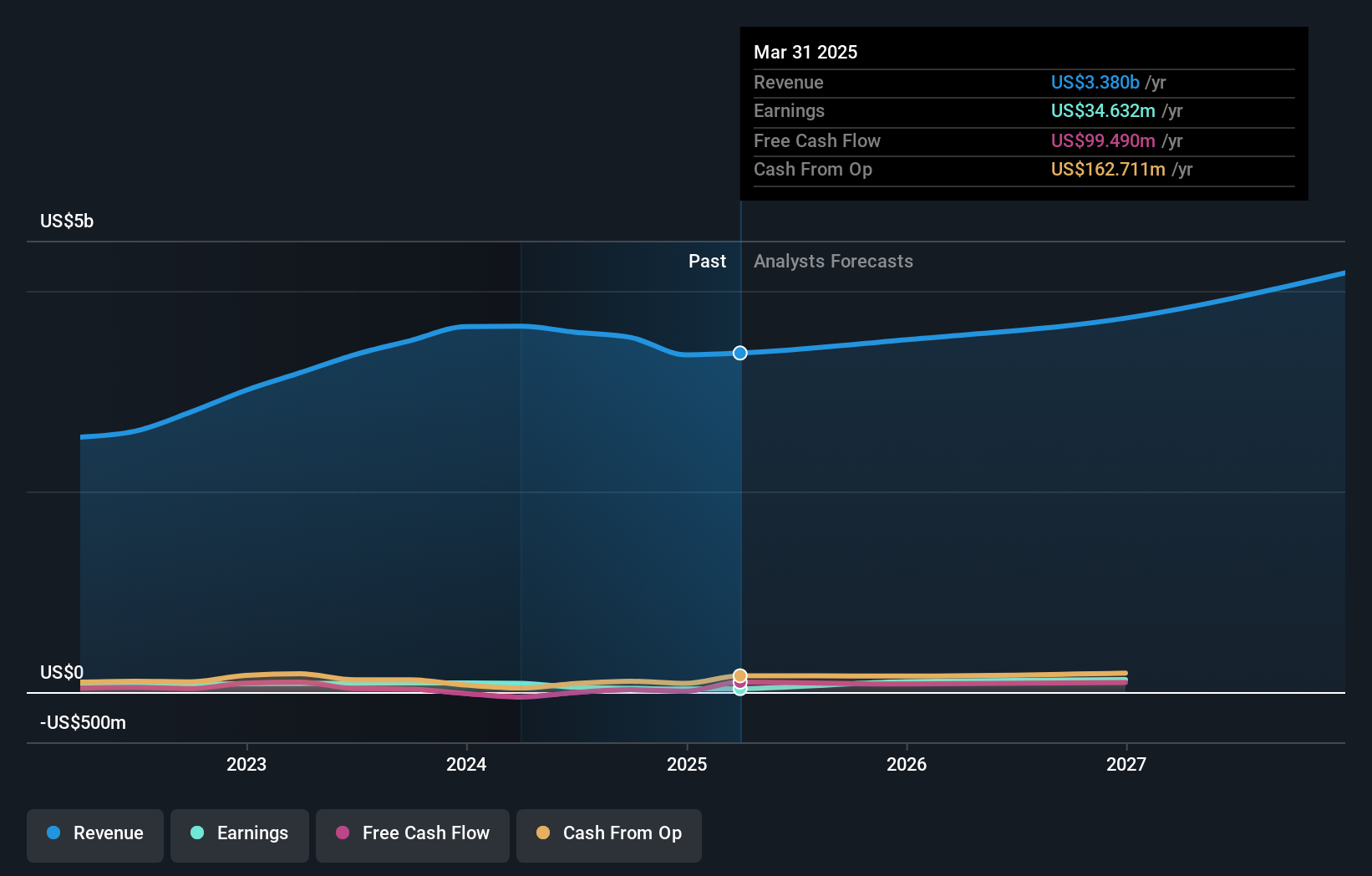

MYR Group's outlook anticipates $4.3 billion in revenue and $157.2 million in earnings by 2028. This is based on an 8.0% annual revenue growth rate and a $80.8 million increase in earnings from the current $76.4 million.

Uncover how MYR Group's forecasts yield a $209.60 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members valued MYR Group shares between US$206.45 and US$209.60, using their own forecasts. With reliance on major contracts now in sharper focus, you can see how investors’ opinions on the future can differ and why it’s essential to explore several viewpoints.

Explore 2 other fair value estimates on MYR Group - why the stock might be worth just $206.45!

Build Your Own MYR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MYR Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MYR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MYR Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.