Please use a PC Browser to access Register-Tadawul

Is nVent Electric (NVT) Using Investor Day to Recast Its Long‑Term Growth Playbook?

nVent Electric plc NVT | 116.87 | -0.01% |

- nVent Electric plc recently announced plans to host its 2026 Investor Day on February 24, featuring senior leadership presentations on updated medium-term financial objectives and the next phase of its growth strategy, with live and on-demand webcasts available via its Investor Relations website.

- This event underscores management’s effort to provide greater transparency around the company’s growth priorities, offering investors a closer look at how its electrical connection and protection portfolio is being positioned for future opportunities.

- With this upcoming Investor Day spotlighting refreshed medium-term financial objectives, we’ll examine how the announcement shapes nVent Electric’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is nVent Electric's Investment Narrative?

To own nVent Electric, you have to buy into a story of an established electrical connection and protection business that is still investing for its next leg of growth, even after a very large multi‑year total return and a share price that some models suggest sits above intrinsic value. The upcoming 2026 Investor Day fits squarely into that story: management is signaling confidence by laying out updated medium term financial objectives and a new phase of its growth strategy, on top of steady dividend increases, an active buyback and fresh capital from its expanded credit facilities. In the near term, the event may sharpen or reset expectations around growth and margins, which matter given recent earnings volatility, high leverage and a rich earnings multiple. If those refreshed targets disappoint, valuation and balance sheet risk could move back into focus quite quickly.

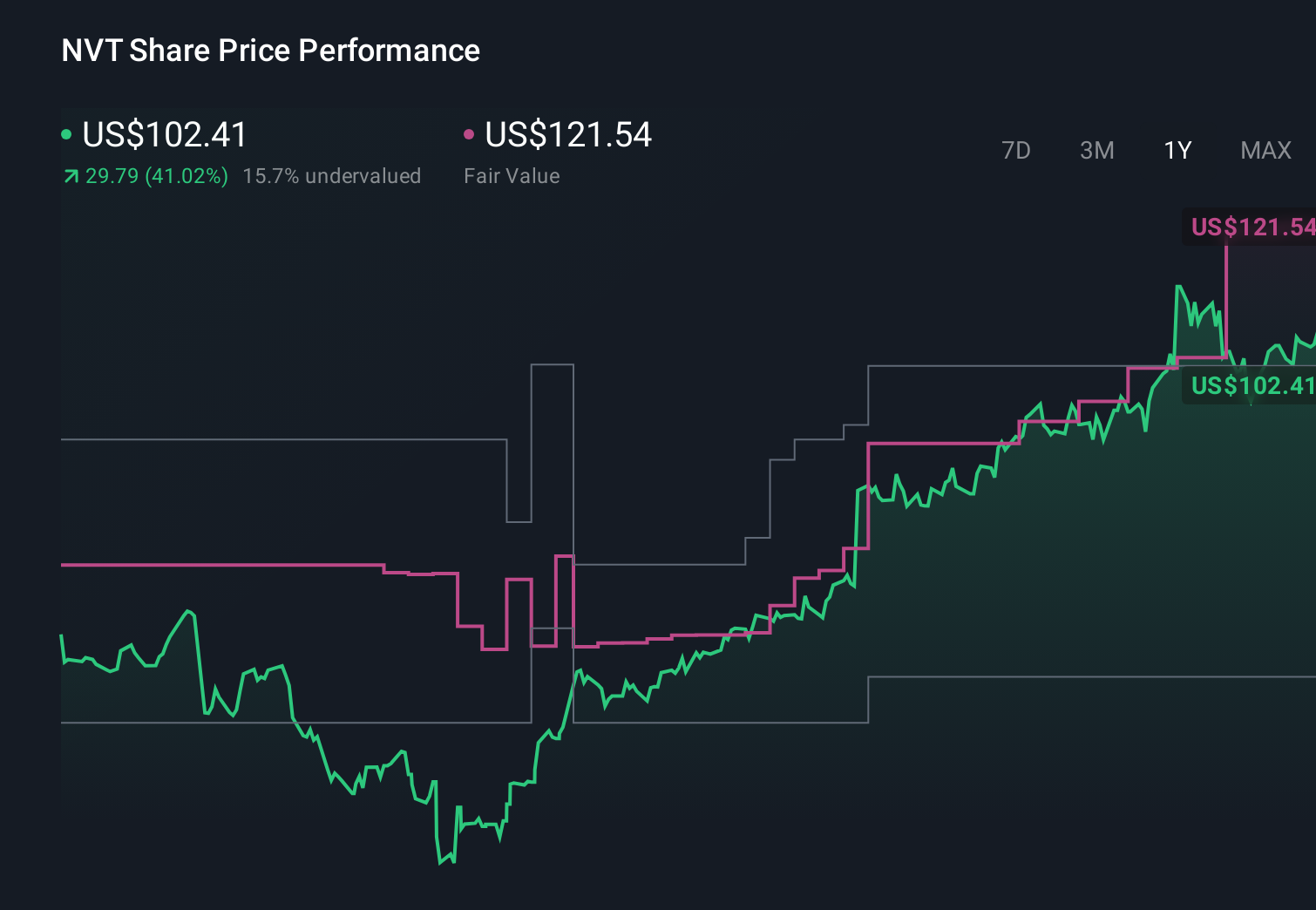

However, investors should also be aware of how nVent’s high earnings multiple interacts with its current debt load. nVent Electric's shares are on the way up, but they could be overextended by 35%. Uncover the fair value now.Exploring Other Perspectives

Explore 5 other fair value estimates on nVent Electric - why the stock might be worth as much as 21% more than the current price!

Build Your Own nVent Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.