Please use a PC Browser to access Register-Tadawul

Is Options Activity and LTL Resilience Altering The Investment Case For XPO (XPO)?

XPO, Inc. XPO | 209.87 | +3.21% |

- In recent days, XPO has drawn attention as institutional investors sold deeply out-of-the-money put options ahead of its Q4 2025 earnings, while the company’s North American Less-Than-Truckload business continued to gain share with firm pricing despite a soft freight backdrop.

- Alongside this, XPO announced that two of its drivers were selected as Captains for the 2026–2027 America’s Road Team, underscoring the company’s emphasis on safety, leadership, and industry advocacy.

- With this combination of institutional options activity and resilient Less-Than-Truckload performance, we’ll explore how these developments shape XPO’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is XPO's Investment Narrative?

To own XPO, you really have to believe in its Less-Than-Truckload engine: that the company can keep defending yield, holding share gains and managing a high debt load while earnings catch up with a rich valuation. The latest options activity, with institutions selling deeply out-of-the-money puts ahead of Q4 2025, hints at confidence in near term resilience, but by itself does little to change the core catalysts around pricing, cost control and buybacks. Likewise, the America’s Road Team appointments strengthen XPO’s safety and culture story, yet they are unlikely to move the financial needle. The bigger swing factors remain freight demand, execution on margins after a year of softer profit, and whether current expectations already bake in most of the upside.

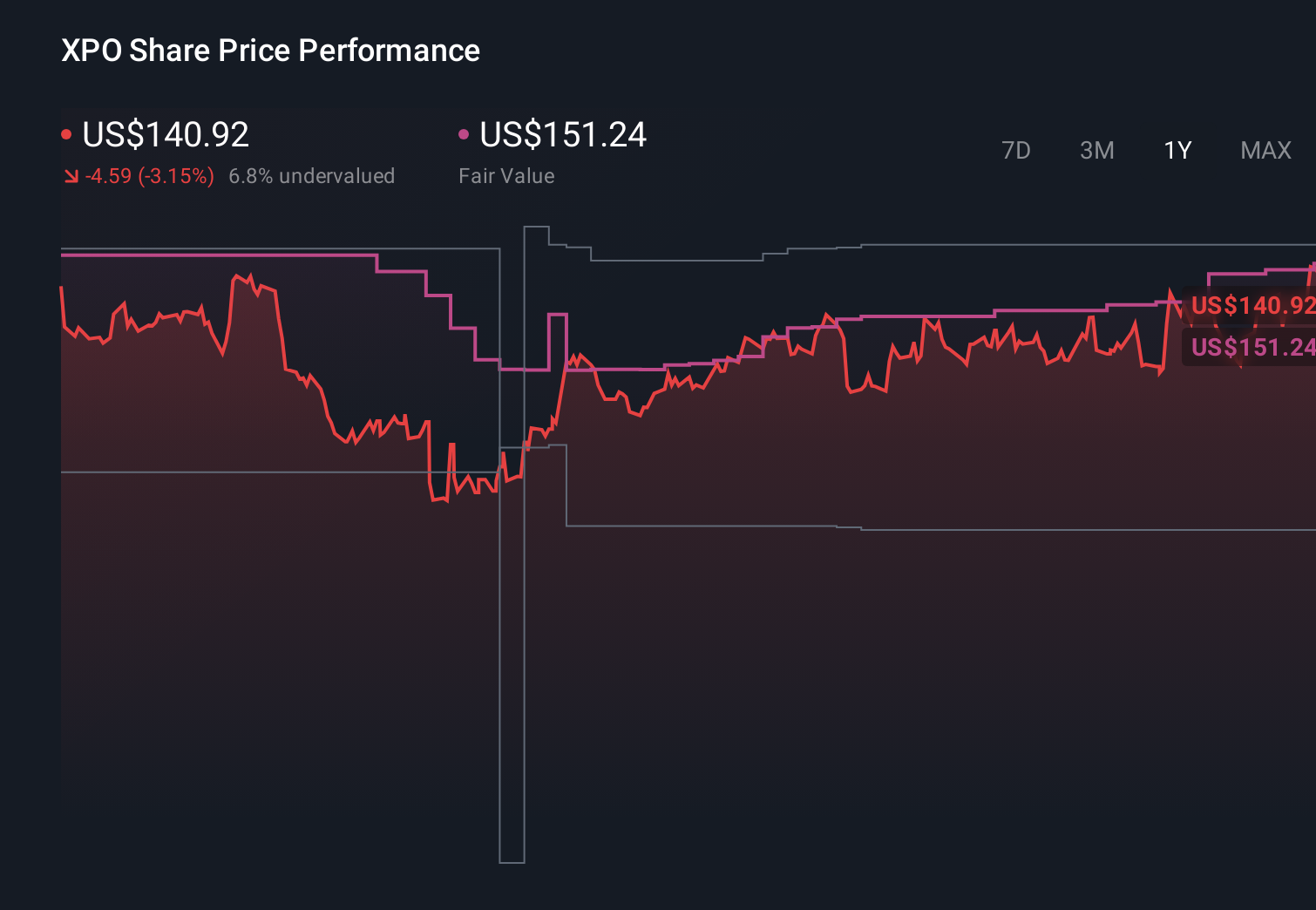

However, XPO’s elevated valuation still leaves less room for disappointment if freight or margins slip. XPO's shares have been on the rise but are still potentially undervalued by 6%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on XPO - why the stock might be worth 18% less than the current price!

Build Your Own XPO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free XPO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPO's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.