Please use a PC Browser to access Register-Tadawul

Is Projected 23 Percent Revenue Growth Reshaping the Investment Case for ESCO Technologies (ESE)?

ESCO Technologies Inc. ESE | 204.17 204.17 | -1.15% 0.00% Pre |

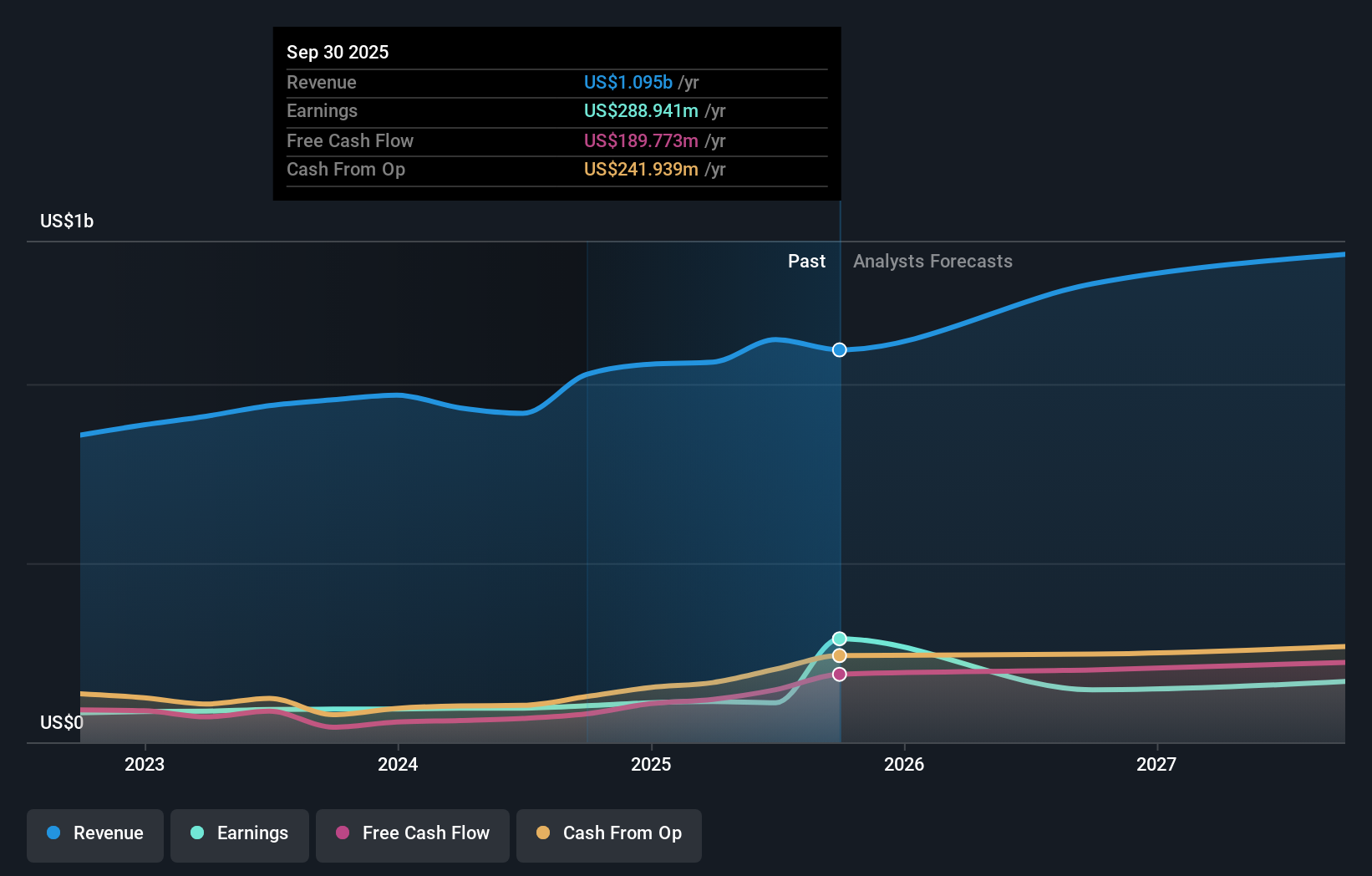

- Recent analysis projects ESCO Technologies to achieve 23.1% revenue growth over the next 12 months, supported by expanding market share and strong profitability.

- This outlook reflects increased investor confidence as ESCO's operational strengths and sector dynamics underpin expectations of robust near-term growth.

- We'll explore how the projected revenue growth supports ESCO's overall investment narrative and future business outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

ESCO Technologies Investment Narrative Recap

To be an ESCO Technologies shareholder today means believing both in the company’s ability to keep expanding market share and delivering solid profitability, while recognizing that execution risks remain. The recent projection of 23.1% revenue growth should give momentum to the company’s short-term growth catalyst, continued demand for power reliability and grid modernization, but does not fundamentally change the current biggest risk: potential challenges from integrating its Maritime acquisition and maintaining net margins. The impact of this news reinforces ESCO's outlook but does not materially alleviate those longer-term operational risks.

Of the recent company announcements, the increased full-year 2025 revenue guidance to between US$1.075 billion and US$1.105 billion stands out, closely aligning with these growth projections and underscoring management’s confidence in near-term demand drivers. This signals that ESCO’s ability to convert sector trends into recurring revenue remains central to its investment narrative, even as integration costs and industry trends require close attention.

However, investors should also be mindful of risks tied to ongoing integration efforts, especially if synergies from the Maritime acquisition take longer to materialize than expected or if associated costs start to pressure net margins over time...

ESCO Technologies' outlook forecasts $1.5 billion in revenue and $199.7 million in earnings by 2028. This implies an annual revenue growth rate of 10.7% and an $89.7 million increase in earnings from the current $110.0 million.

Uncover how ESCO Technologies' forecasts yield a $225.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place ESCO’s fair value between US$211.99 and US$225 across two perspectives. While profitability and revenue growth remain front of mind for many, integration risks and operational execution may influence future consensus, so review multiple viewpoints before deciding your stance.

Explore 2 other fair value estimates on ESCO Technologies - why the stock might be worth as much as 7% more than the current price!

Build Your Own ESCO Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ESCO Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ESCO Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ESCO Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.