Please use a PC Browser to access Register-Tadawul

Is PureCycle (PCT) Turning High-Profile Sports Branding Into a Credible Capacity-Build Strategy?

PureCycle Technologies Inc PCT | 8.99 | -2.81% |

- PureCycle Technologies recently announced a collaboration with Churchill Container and 4ocean to supply Run It Back souvenir cups made with its PureFive recycled resin at the College Football Playoff National Championship, while also revising its construction agreement for a future recycling facility in Augusta, Georgia, including a US$500,000 payment to AEDA and updated project milestones.

- Together, the high-visibility sustainability initiative at a major sporting event and the recalibrated Augusta build-out plan spotlight how PureCycle is pairing brand exposure with measured capacity planning.

- We’ll now examine how the Run It Back cup initiative with 4ocean and Churchill Container shapes PureCycle’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is PureCycle Technologies' Investment Narrative?

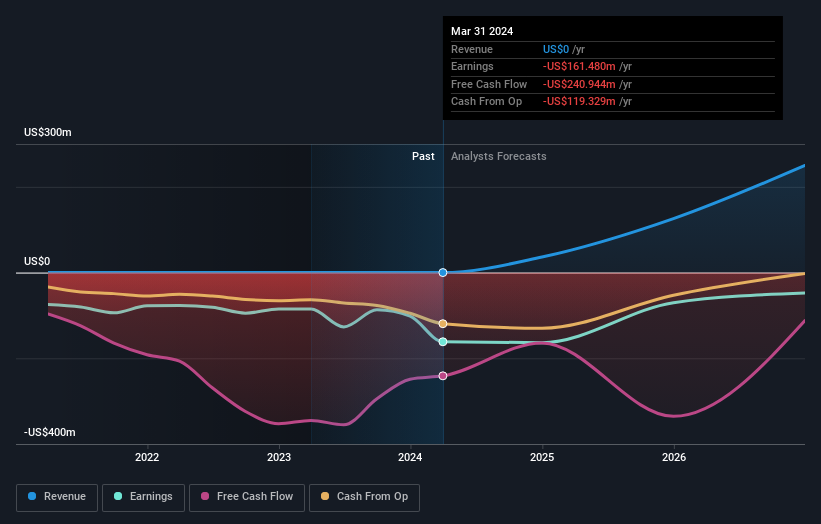

To own PureCycle, you really have to buy into the idea that its purification tech can turn into a scaled, commercially relevant recycled resin platform before the cash runway runs too thin. The recent Run It Back cup collaboration at the College Football Playoff looks more like brand building than a financial swing, but it does reinforce the company’s push to get PureFive resin into visible, real-world use cases alongside existing wins in caps and stadium cups. By contrast, the revised Augusta construction agreement is more meaningful for near term catalysts and risks: a slower, milestone driven build with a US$500,000 payment to AEDA tempers capacity expectations and puts more scrutiny on funding, execution and timing. That is where the stock’s story can shift quickest from here.

However, tighter Augusta timelines and funding needs introduce execution risk that investors should not ignore. PureCycle Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on PureCycle Technologies - why the stock might be worth less than half the current price!

Build Your Own PureCycle Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PureCycle Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free PureCycle Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PureCycle Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.