Please use a PC Browser to access Register-Tadawul

Is Record Q3 And Expanding Crypto Offerings Altering The Investment Case For Interactive Brokers (IBKR)?

Interactive Brokers Group, Inc. Class A IBKR | 71.34 71.34 | -2.11% 0.00% Pre |

- Interactive Brokers Group recently reported a strong third quarter, delivering record financial results driven by a double-digit rise in net interest income, higher commission revenue, and robust securities lending activity supported by heightened IPO and M&A volumes.

- The company also continued to scale newer offerings such as crypto trading, forecast contracts, and overnight trading, while advancing stablecoin funding and crypto staking capabilities through its stake in Zero Hash, underscoring efforts to broaden its product ecosystem.

- We’ll now examine how this record quarter, particularly the jump in net interest income and newer products, shapes Interactive Brokers’ investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Interactive Brokers Group Investment Narrative Recap

To own Interactive Brokers, you have to believe in its ability to keep attracting active, globally focused investors while monetizing client cash and trading activity through cycles. The record third quarter strengthens the near term catalyst of higher net interest income, though it does not eliminate the key risk that lower market volatility or shifts in central bank policy could quickly cool trading volumes and compress interest margins.

The most relevant recent update is management’s Q3 commentary that securities lending, crypto trading, forecast contracts, and overnight trading are gaining traction. For investors watching catalysts, these products matter because they diversify revenue beyond traditional commissions and interest, potentially softening the impact if trading volumes or rate driven income slow.

Yet, while recent results look strong, investors should also be aware of how quickly changing interest rate policy could affect...

Interactive Brokers Group's narrative projects $5.9 billion revenue and $740.3 million earnings by 2028. This requires 5.9% yearly revenue growth and roughly a $42 million earnings increase from $698.0 million today.

Uncover how Interactive Brokers Group's forecasts yield a $77.11 fair value, a 20% upside to its current price.

Exploring Other Perspectives

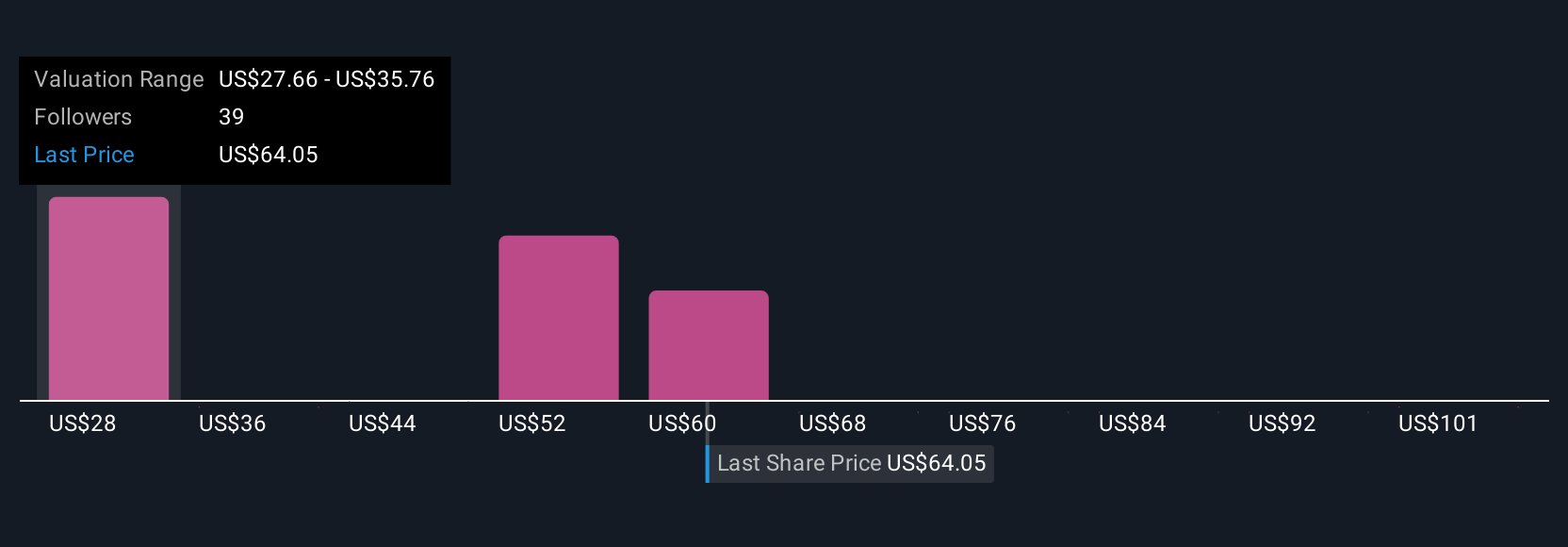

Eleven fair value estimates from the Simply Wall St Community span roughly US$34 to US$77 per share, showing how far apart individual views on IBKR really are. Against that backdrop, the reliance on trading volumes and net interest income as key earnings drivers gives these differing viewpoints real weight for anyone thinking about the company’s future performance.

Explore 11 other fair value estimates on Interactive Brokers Group - why the stock might be worth as much as 20% more than the current price!

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.