Please use a PC Browser to access Register-Tadawul

Is Reddit (RDDT) Turning Its Ad Engine And Data Deals Into A Durable Business Model?

Reddit, Inc. Class A RDDT | 150.17 | +2.76% |

- In the days leading up to its scheduled 5 February 2026 report of fourth-quarter and full-year 2025 results, Reddit (NYSE:RDDT) has drawn heightened attention as investors watch for updates on its advertising, user growth, and enterprise data-licensing businesses.

- The combination of strong prior execution versus guidance, mixed analyst sentiment, and vocal media commentary has turned this earnings release into a key test of how Reddit’s evolving monetization model is being received.

- We’ll now examine how this upcoming earnings announcement, particularly around ad monetization trends, could shape Reddit’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Reddit's Investment Narrative?

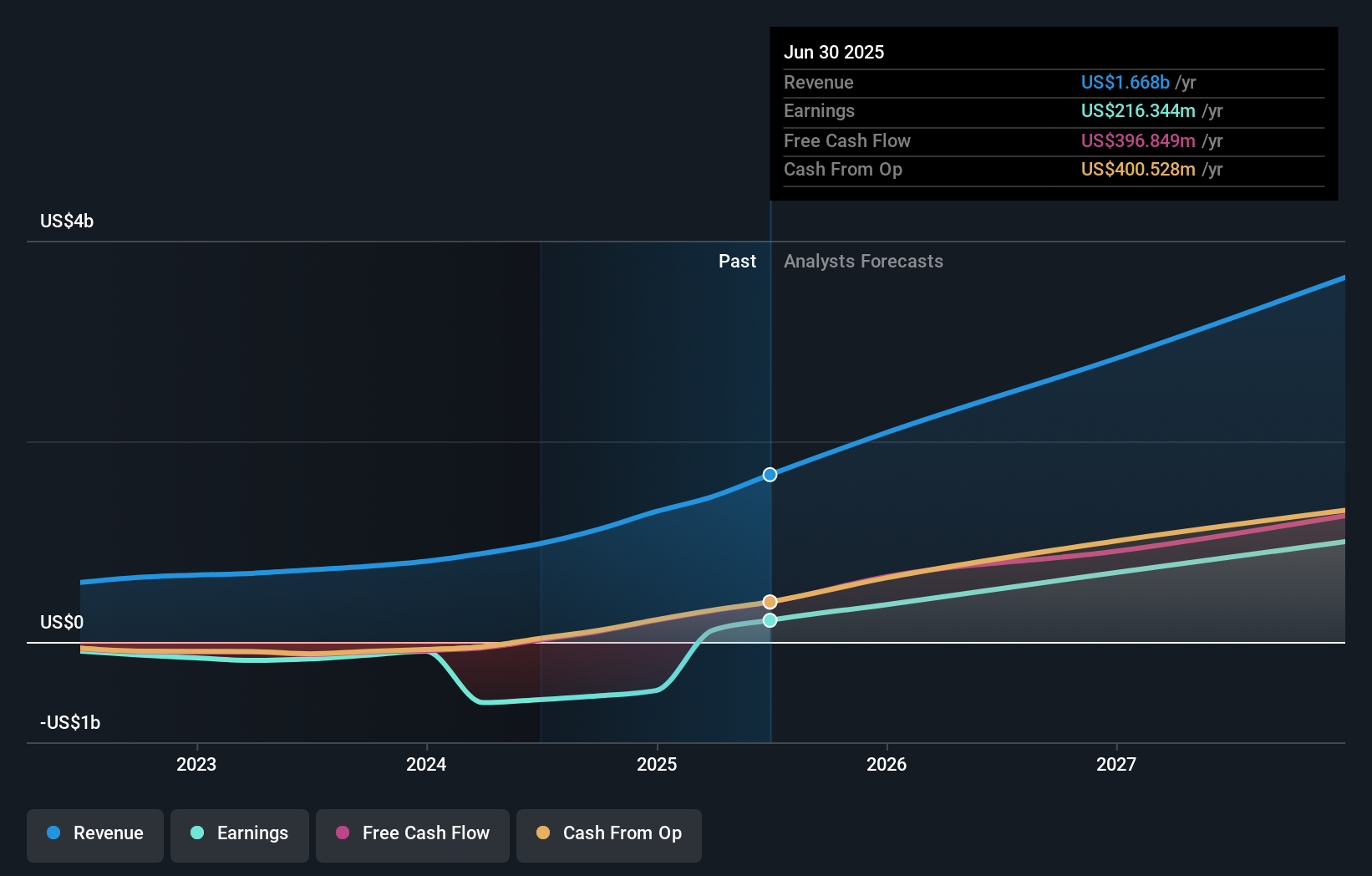

To own Reddit today, you need to believe its mix of advertising, data licensing, and tools for brands can keep deepening monetization without alienating its communities. The latest pre-earnings news reinforces that this Thursday’s call is a real sentiment check: the stock has sold off sharply in recent weeks even as analysts still model very large revenue and earnings growth and a fair value well above the current price. Management’s commentary on ad performance, AI- and API-driven partnerships, and data licensing traction now sits alongside one more short term catalyst: how the market reacts to any confirmation or revision of those expectations. At the same time, CEO stock sales, a high earnings multiple, recent underperformance, and mixed analyst rankings keep execution risk and volatility firmly in focus.

However, one key risk around Reddit’s rich valuation and recent share price swings is easy to miss. Despite retreating, Reddit's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 25 other fair value estimates on Reddit - why the stock might be worth over 2x more than the current price!

Build Your Own Reddit Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reddit research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Reddit research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reddit's overall financial health at a glance.

No Opportunity In Reddit?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.