Please use a PC Browser to access Register-Tadawul

Is S&P 1000 Inclusion Changing the Investment Landscape for Kinetik Holdings (KNTK)?

Kinetik Holdings Inc. - Class A Common Stock KNTK | 34.19 | -3.74% |

- Kinetik Holdings Inc. was recently added to the S&P 1000 and presented at the Barclays 39th Annual CEO Energy-Power Conference in New York, reflecting growing recognition within the industry and broader financial community.

- Index inclusion often prompts increased interest from institutional investors and funds that track the S&P 1000, potentially affecting demand for Kinetik’s shares.

- We'll examine how S&P 1000 inclusion may influence Kinetik's investment outlook and exposure to new institutional investors.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Kinetik Holdings Investment Narrative Recap

To be a shareholder in Kinetik Holdings, you need to believe in the company’s ability to capitalize on long-term Permian Basin growth and execute major infrastructure projects that boost volumes and cash flows, while navigating periods of commodity price volatility and high capital intensity. The recent S&P 1000 index inclusion may increase visibility and demand for shares but does not directly impact the most important short-term catalyst, infrastructure ramp-up, or address key risks like concentration in a single production region and significant capital needs.

One relevant update is Kinetik’s ongoing share buyback program, with over 4 million shares repurchased in recent months. While this enhances shareholder return and can potentially support the share price, it does not reduce operational risks tied to regional activity in the Permian, nor insulate the company from fluctuations in input costs and competition, factors that remain central to Kinetik’s near-term outlook.

However, despite index recognition and capital returns, investors should be aware that heavy reliance on Northern Delaware volumes exposes Kinetik to...

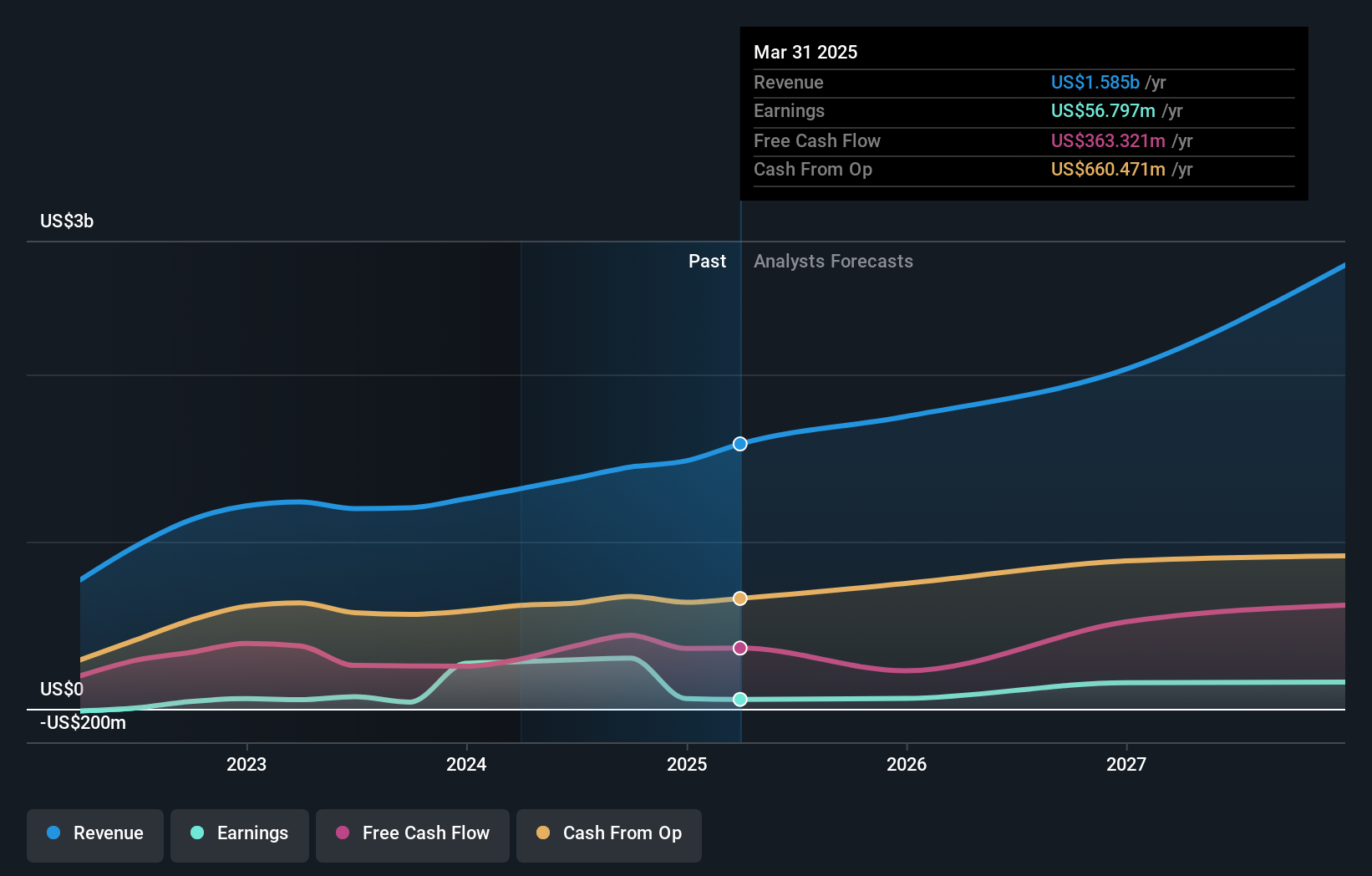

Kinetik Holdings' outlook points to $2.8 billion in revenue and $167.1 million in earnings by 2028. This is based on an expected 19.0% annual revenue growth rate and a $122.6 million increase in earnings from the current $44.5 million.

Uncover how Kinetik Holdings' forecasts yield a $51.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Two different fair value estimates from the Simply Wall St Community range from US$51.50 to US$65.85 per share, showcasing varied outlooks among private investors. Against this backdrop, concentration risk tied to Permian Basin drilling and production rates continues to shape the company’s future, so consider several opinions before forming your own view.

Explore 2 other fair value estimates on Kinetik Holdings - why the stock might be worth just $51.50!

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.