Please use a PC Browser to access Register-Tadawul

Is Square's Chip City Deal a Clue to Block's (XYZ) Restaurant Tech Ambitions?

Block XYZ | 64.58 | -0.26% |

- Chip City Cookies previously announced it partnered with Square to support its rapid national expansion, using Square’s all-in-one restaurant platform for everything from point-of-sale to back-end operations and loyalty programs.

- This collaboration highlights how Square’s integrated technology can play a crucial role in enabling emerging restaurant brands to scale efficiently and secure significant venture capital investment.

- We'll now explore how Square's role in powering Chip City's expansion adds to Block's investment narrative around scaling business solutions.

This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

Block Investment Narrative Recap

Block's investment narrative hinges on investors believing in the company's ability to drive sustained growth by powering both consumer and business ecosystems, mainly through Cash App and Square. The Chip City Cookies partnership underlines Square’s relevance as it enables brands to expand using integrated technology, but the immediate impact on Block’s most important short-term catalyst, new product momentum and business adoption, may not be material given the partnership's limited scale; the biggest risk continues to be the intense competition in both fintech and payment processing, which could pressure revenue growth and margins.

Among Block’s recent announcements, the expanded partnership with Purdys Chocolatier stands out as particularly relevant to the Chip City news. Both highlight Square’s rapid adoption among growing food and retail brands, reinforcing how its business solutions are becoming key drivers for expansion and continued market traction even as competitive and operational risks persist.

Yet, with increased adoption comes the contrasting risk of fee pressure and commoditization in payments that investors should...

Block's outlook projects $32.8 billion in revenue and $2.4 billion in earnings by 2028. This assumes 11.3% annual revenue growth but a decrease in earnings of $0.6 billion from the current $3.0 billion.

Uncover how Block's forecasts yield a $85.16 fair value, a 17% upside to its current price.

Exploring Other Perspectives

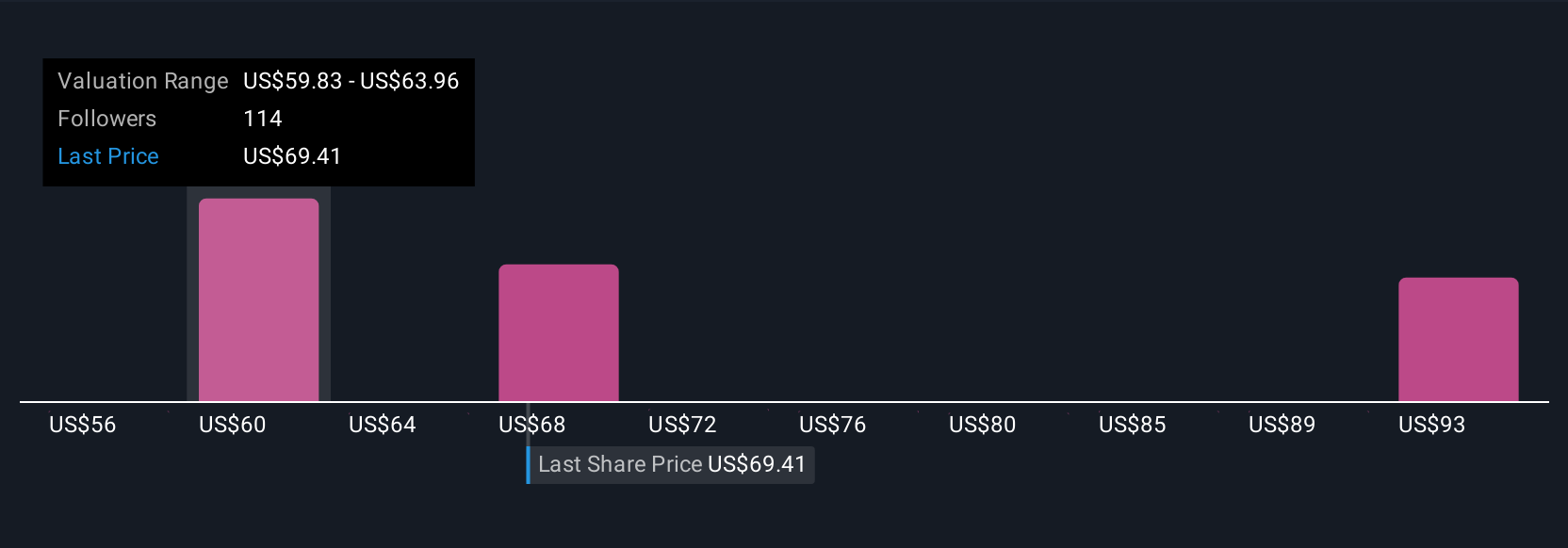

Sixteen members of the Simply Wall St Community gave Block, Inc. fair value estimates ranging from US$60.37 to US$104 per share. While these opinions vary, keep in mind that competition and potential margin pressure remain relevant themes for anyone considering the company's longer-term prospects.

Explore 16 other fair value estimates on Block - why the stock might be worth 17% less than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.