Please use a PC Browser to access Register-Tadawul

Is Stifel’s Expansion Into Life Sciences Banking a Game Changer for Its Growth Outlook (SF)?

Stifel Financial Corp. SF | 126.25 | +1.25% |

- In late September, Stifel Financial Corp. announced the expansion of its Venture Banking team, bringing in a cohort of experienced senior bankers from Silicon Valley Bank with substantial expertise in life sciences and healthcare.

- This move highlights Stifel’s increased commitment to supporting innovation-driven companies and signals a targeted push into key sectors like biotech, diagnostics, and healthtech.

- Let's explore how Stifel’s addition of life sciences banking expertise may influence its growth outlook and investment case.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Stifel Financial Investment Narrative Recap

To be a shareholder in Stifel Financial, you need confidence in the company’s ability to grow earnings through initiatives in wealth management, investment banking, and targeted lending, despite market volatility and legal risks. The expansion of its Venture Banking team with experienced life sciences bankers may broaden revenue opportunities in new sectors, yet this move isn’t expected to materially change short term catalysts, as overall market activity and asset flows remain the critical factors to watch for now.

Of the recent company announcements, the Q2 2025 earnings report stands out. Revenue grew to US$1.49 billion while earnings and margins declined compared to the prior year, underscoring the ongoing impact of legal expenses and modest asset flows, key issues that frame the company’s near-term risk and reward profile.

By contrast, the lingering legal costs and unpredictability of further charges remain a real risk investors should be aware of…

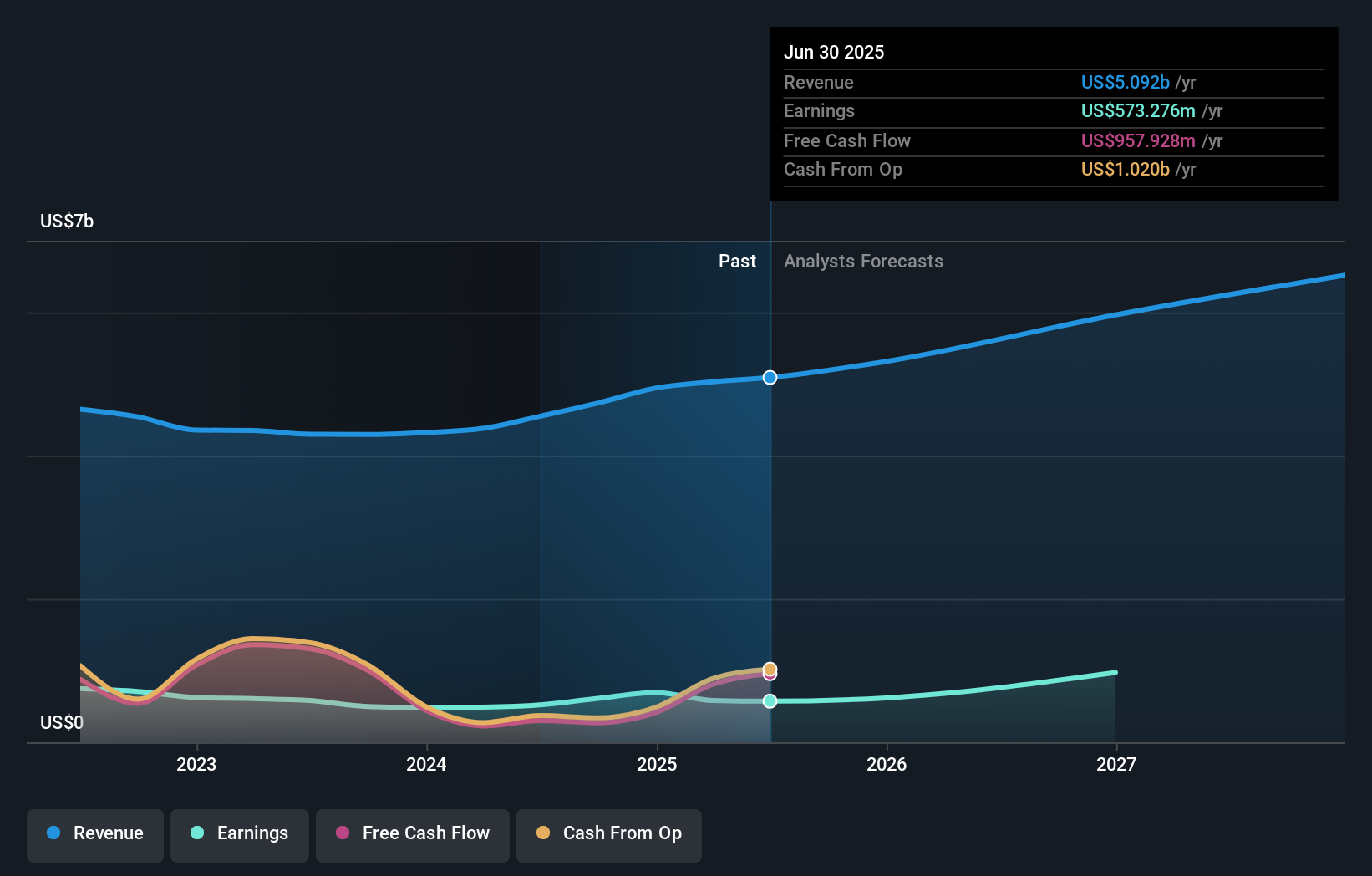

Stifel Financial's outlook anticipates $6.5 billion in revenue and $1.3 billion in earnings by 2028. This is based on an annual revenue growth rate of 8.8% and a $716.5 million increase in earnings from the current $583.5 million.

Uncover how Stifel Financial's forecasts yield a $126.83 fair value, a 12% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community's only fair value estimate for Stifel is US$84.89, notably below the current share price. While community opinions can vary widely, ongoing legal expenses and market volatility are important factors many may be weighing when assessing Stifel's future. Explore how these differing views might impact your own outlook.

Explore another fair value estimate on Stifel Financial - why the stock might be worth as much as $84.89!

Build Your Own Stifel Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stifel Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Stifel Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stifel Financial's overall financial health at a glance.

No Opportunity In Stifel Financial?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.