Please use a PC Browser to access Register-Tadawul

Is Sunrun (RUN) Quietly Redefining Grid Reliability With Its Expanding Virtual Power Plant Footprint?

Sunrun Inc. RUN | 19.93 | +5.06% |

- In early 2026, Sunrun reported that in 2025 it rapidly scaled its distributed power plant programs, enrolling more than 106,000 customers and dispatching nearly 18 gigawatt-hours of home battery energy across 17 programs to support stressed U.S. grids.

- This expansion signals Sunrun’s growing role as a source of flexible, dispatchable capacity comparable to fossil-fuel peaker plants, highlighting how residential solar-plus-storage is becoming integrated into mainstream grid reliability planning.

- We’ll now examine how Sunrun’s rapid growth in distributed power plant participation shapes the company’s investment narrative and future positioning.

AI is about to change healthcare. These 108 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Sunrun's Investment Narrative?

For Sunrun, the core belief you’d need as a shareholder is that residential solar-plus-storage can evolve into a meaningful, grid-level capacity resource, not just a rooftop product. The 2025 distributed power plant results fit directly into that thesis: a fivefold jump to 106,000 participating customers and 18 gigawatt-hours dispatched shows Sunrun can aggregate and operate a large virtual fleet when grids are under strain. In the near term, that strengthens key catalysts already on the table, such as recurring grid services revenue, the new HASI joint venture, and utility partnerships in Texas and California. It may also slightly rebalance the risk profile. Sunrun’s limited cash runway and reliance on securitizations still matter, but execution risk around scaling and delivering reliable dispatch now sits more squarely alongside financing and policy risk.

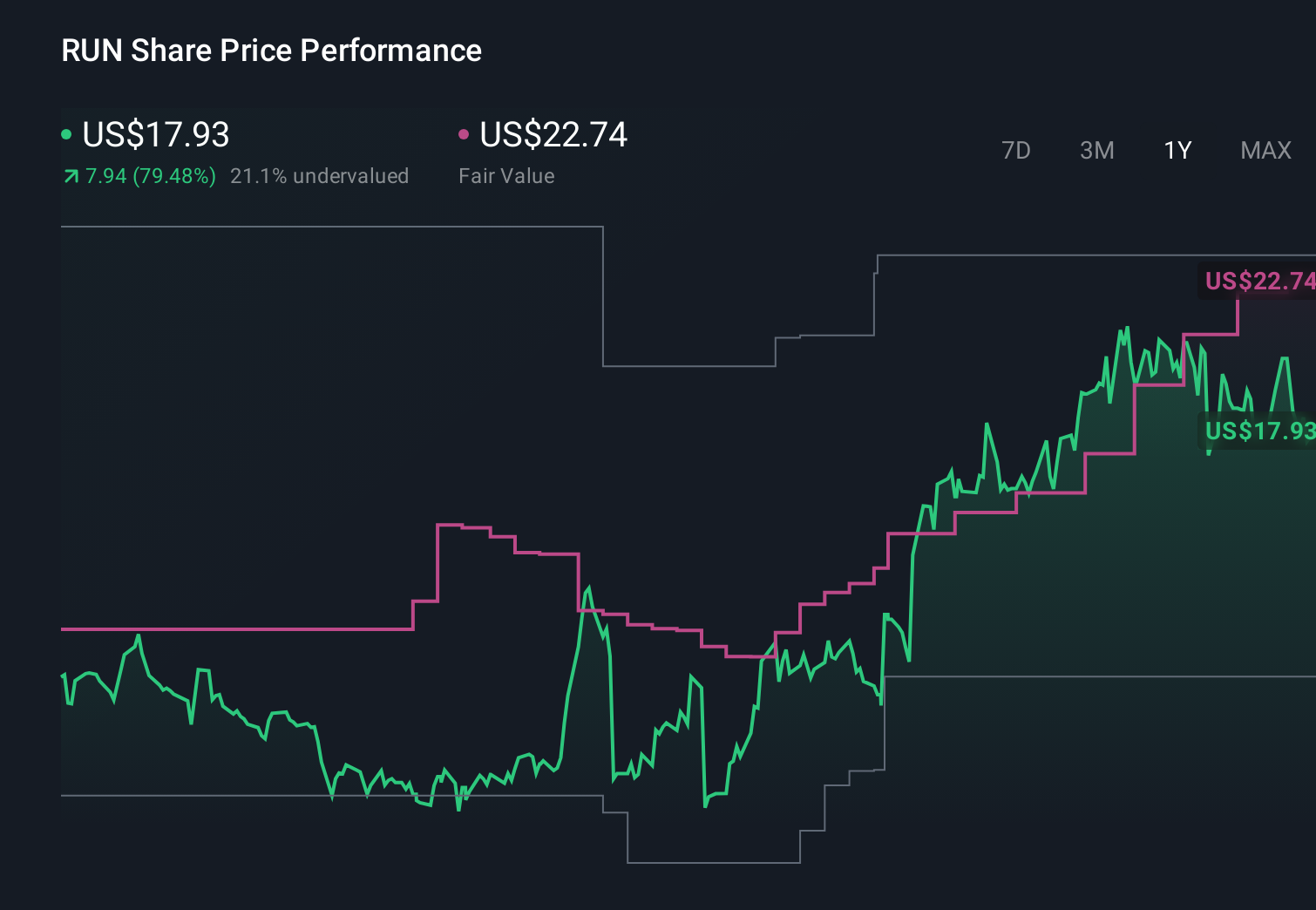

However, this grid-services push also raises new questions around capital intensity and program profitability that investors should watch closely. The valuation report we've compiled suggests that Sunrun's current price could be quite moderate.Exploring Other Perspectives

Explore 6 other fair value estimates on Sunrun - why the stock might be worth 29% less than the current price!

Build Your Own Sunrun Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.