Please use a PC Browser to access Register-Tadawul

Is Sunrun’s (RUN) US$500 Million VPP Deal Quietly Reframing Its Long‑Term Profit Engine?

Sunrun Inc. RUN | 20.28 | +1.20% |

- Sunrun recently announced a partnership with HA Sustainable Infrastructure Capital to finance 300 megawatts of new home-based power plants, with HA committing US$500 million over 18 months while Sunrun retains ownership of the assets.

- This deal highlights how Sunrun is grouping thousands of residential systems into virtual power plants that can supply utilities with grid-supporting capacity as electricity demand evolves.

- Next, we’ll examine how this US$500 million virtual power plant financing partnership influences Sunrun’s investment narrative and long-term growth positioning.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Sunrun's Investment Narrative?

To own Sunrun, you have to believe that rooftop solar plus batteries can mature into a reliable, utility-like cash flow stream, not just a hardware-selling business. The new US$500 million virtual power plant JV with HA Sustainable Infrastructure Capital reinforces that idea in a tangible way, because it channels third-party capital into 300 megawatts of home-based capacity while Sunrun keeps long-term ownership. In the near term, this can support deployment volumes and project financing, which are key catalysts as the company works toward sustained profitability after a period of improving quarterly results. At the same time, it slightly shifts the risk mix: execution risk around complex virtual power plant operations and maintaining strong liquidity under the amended credit facility now sit alongside familiar concerns such as cash runway, insider selling and sector volatility.

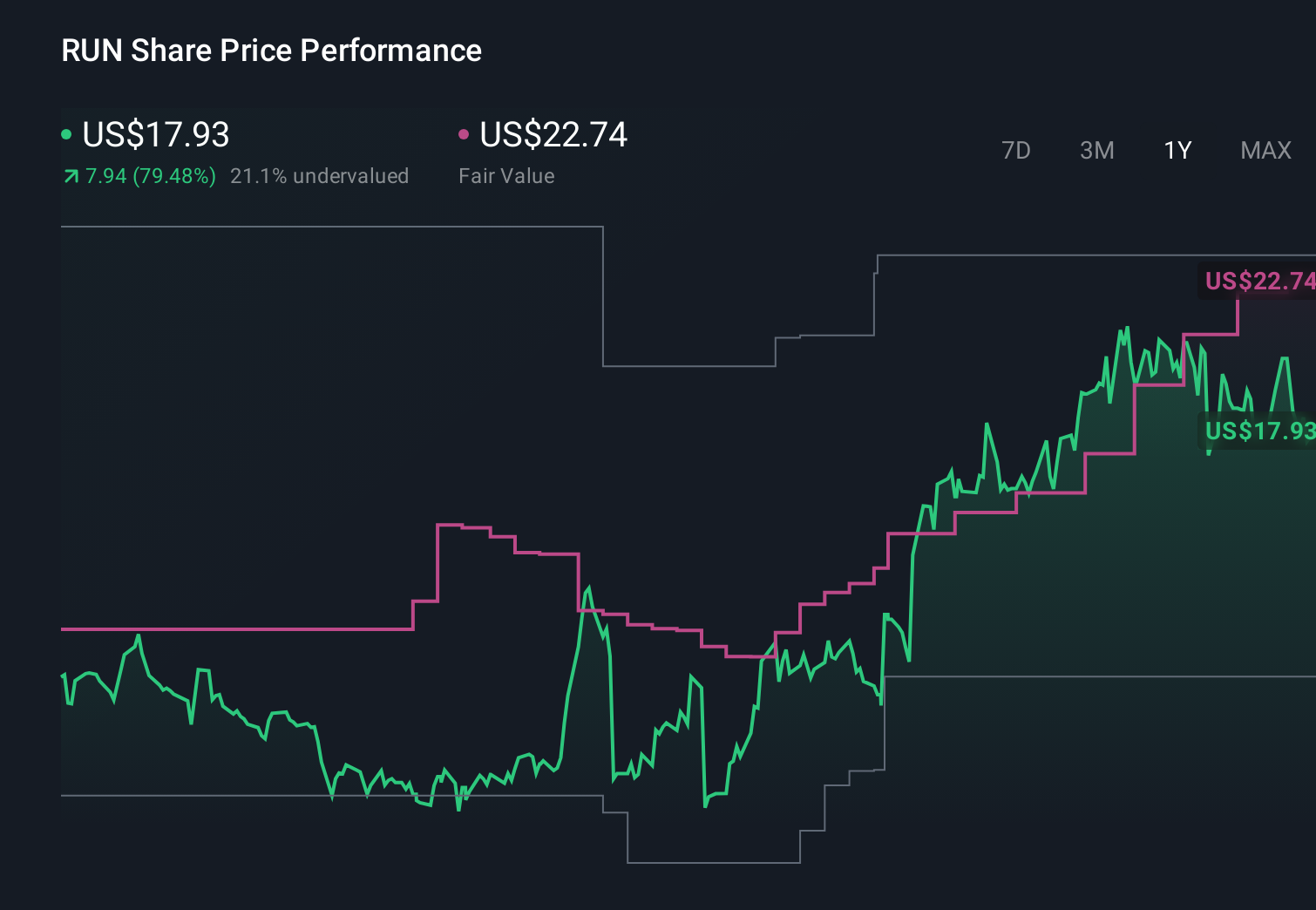

However, there is one financing-related risk in particular that shareholders should not overlook. According our valuation report, there's an indication that Sunrun's share price might be on the cheaper side.Exploring Other Perspectives

Explore 6 other fair value estimates on Sunrun - why the stock might be worth 37% less than the current price!

Build Your Own Sunrun Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 110 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.