Please use a PC Browser to access Register-Tadawul

Is Teamsters Wage Dispute Altering The Investment Case For Costco (COST)?

Costco Wholesale Corporation COST | 860.39 | -0.02% |

- Costco Wholesale is facing a complaint from the Teamsters Union, which alleges the company breached a wage agreement, raising concerns about employee relations and operational continuity.

- The dispute highlights how labor relations and agreements can play a significant role in shaping both short-term operations and longer-term cost structures for large retailers.

- We'll examine how the Teamsters Union wage dispute may alter Costco's outlook, particularly its impact on operating expenses and margins.

Costco Wholesale Investment Narrative Recap

Costco shareholders typically have confidence in the company’s recurring membership revenue, operational efficiency, and disciplined cost management. The recent Teamsters Union wage dispute highlights how labor costs remain a key short-term catalyst and one of the biggest ongoing risks, but at this stage, there is no indication that the current complaint will materially impact operations or near-term profitability.

Of the recent announcements, Costco’s continuing buyback program stands out, with more than US$209 million allocated to share repurchases in May 2025. While this signals confidence in the business and can support shareholder value, it does not directly address the underlying labor cost risks connected to employee negotiations or their potential impact on future margins.

However, some investors may overlook how persistent wage pressures could ultimately affect Costco’s long-term cost structure and...

Costco Wholesale's narrative projects $323.2 billion in revenue and $10.0 billion in earnings by 2028. This requires a yearly revenue growth rate of 7.0% and a 32% increase in earnings from $7.6 billion.

Exploring Other Perspectives

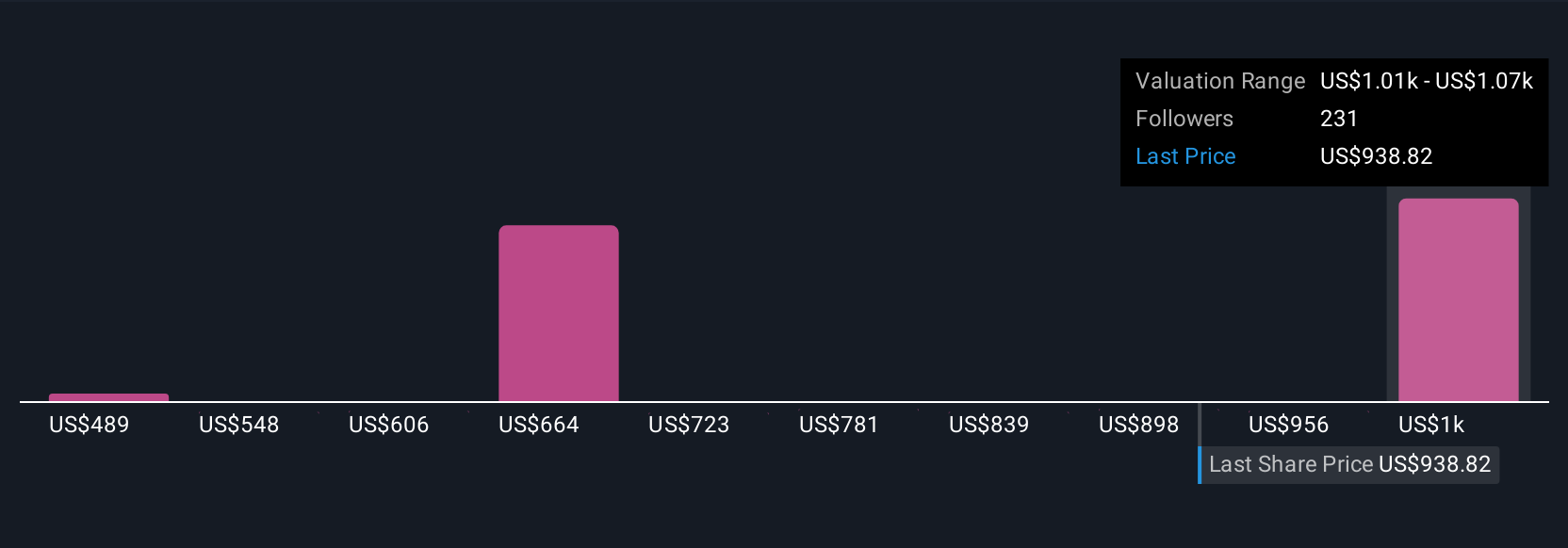

Simply Wall St Community members submitted 23 fair value estimates for Costco ranging from US$489.26 to US$1,050.31 per share. With labor costs still a key issue, your interpretation could influence how you view future profitability and resilience.

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.