Please use a PC Browser to access Register-Tadawul

Is Teradata (TDC) Turning Enterprise-Grade Cybersecurity Into Its Next Strategic Differentiator?

Teradata Corporation TDC | 30.91 | -3.77% |

- Teradata Corporation recently appointed Ken Ricketts as Senior Vice President and Chief Information Security Officer, tasking him with overseeing enterprise-wide security across cloud and AI-driven platforms, risk and compliance, product security, and operational security.

- By bringing in a veteran who has led security programs at cloud-native enterprises and advised a wide portfolio of software companies, Teradata is signaling that enterprise-grade cybersecurity and secure AI enablement are becoming central pillars of its business proposition.

- Next, we’ll examine how Ricketts’ focus on strengthening Teradata’s cloud and AI security posture could influence the company’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Teradata's Investment Narrative?

For Teradata, the investment case really hinges on whether you believe its transition toward cloud and AI-driven analytics can translate into durable, high-quality earnings, even as overall revenue growth expectations remain muted. Recent share price weakness, despite solid profit improvement and a valuation that screens as relatively undemanding against peers, suggests the market is still cautious about that story. In that context, the appointment of Ken Ricketts as CISO looks less like a short term catalyst for the numbers and more like a reinforcing signal about Teradata’s priorities: enterprise-grade security, compliant cloud deployments, and “safe AI” as part of the core offer. It may not move revenue near term, but it could influence win rates, customer retention, and execution risk around AI products, which are increasingly central to the thesis.

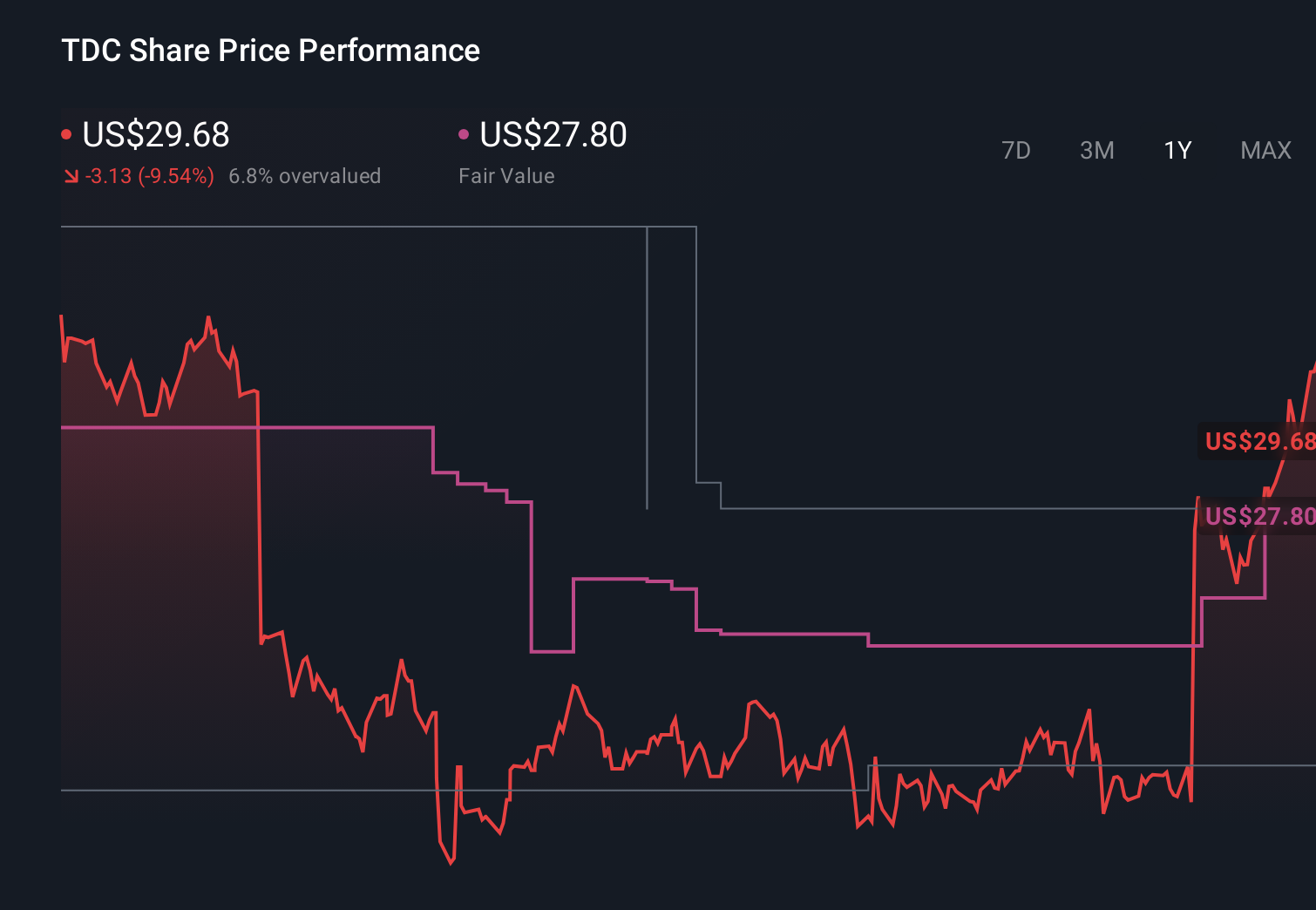

However, there is one business risk that current and prospective investors should not ignore. Despite retreating, Teradata's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on Teradata - why the stock might be worth over 2x more than the current price!

Build Your Own Teradata Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradata research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Teradata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradata's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.