Please use a PC Browser to access Register-Tadawul

Is the Blue Sky Collaboration With JetBlue a Game Changer for United Airlines' (UAL) Loyalty Strategy?

United Airlines Holdings UAL | 112.48 | +4.44% |

- JetBlue Airways Corporation and United Airlines Holdings, Inc. recently announced the completion of the U.S. Department of Transportation review of their Blue Sky collaboration, clearing the way for integration of loyalty programs, reciprocal access to each airline's networks, and phased rollout of new customer benefits beginning this fall.

- This collaboration will allow customers to earn and redeem MileagePlus and TrueBlue points across both airlines, enable easier cross-airline bookings, provide United with access to valuable slots at JFK Airport, and introduce cross-platform technological enhancements via JetBlue's Paisly platform.

- We'll explore how Blue Sky's integration of loyalty programs and expanded airport access may influence United's long-term investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

United Airlines Holdings Investment Narrative Recap

To be a shareholder in United Airlines Holdings, it helps to believe in the company's ability to leverage both international expansion and premium product growth while managing the industry's persistent operational and cost pressures. The Blue Sky collaboration with JetBlue brings incremental benefits in loyalty integration and airport access, but does not materially change the near-term focus on growing premium revenue or address core risks such as debt and margin pressures.

Among the recent announcements, United’s Q2 2025 results stand out: revenues grew to US$15,236 million, but net income fell year-over-year. This highlights the ongoing margin challenges, even as United pursues customer-facing initiatives like the Blue Sky partnership, the biggest short-term catalyst remains passenger demand in high-yield segments, while rising costs and debt levels linger as the key risks.

In contrast, investors should be aware that recurring operational complexity and exposure to congested, high-cost hubs...

United Airlines Holdings is projected to reach $67.6 billion in revenue and $4.2 billion in earnings by 2028. This outlook assumes a 5.2% annual revenue growth rate and a $0.9 billion increase in earnings from the current $3.3 billion.

Uncover how United Airlines Holdings' forecasts yield a $107.55 fair value, a 21% upside to its current price.

Exploring Other Perspectives

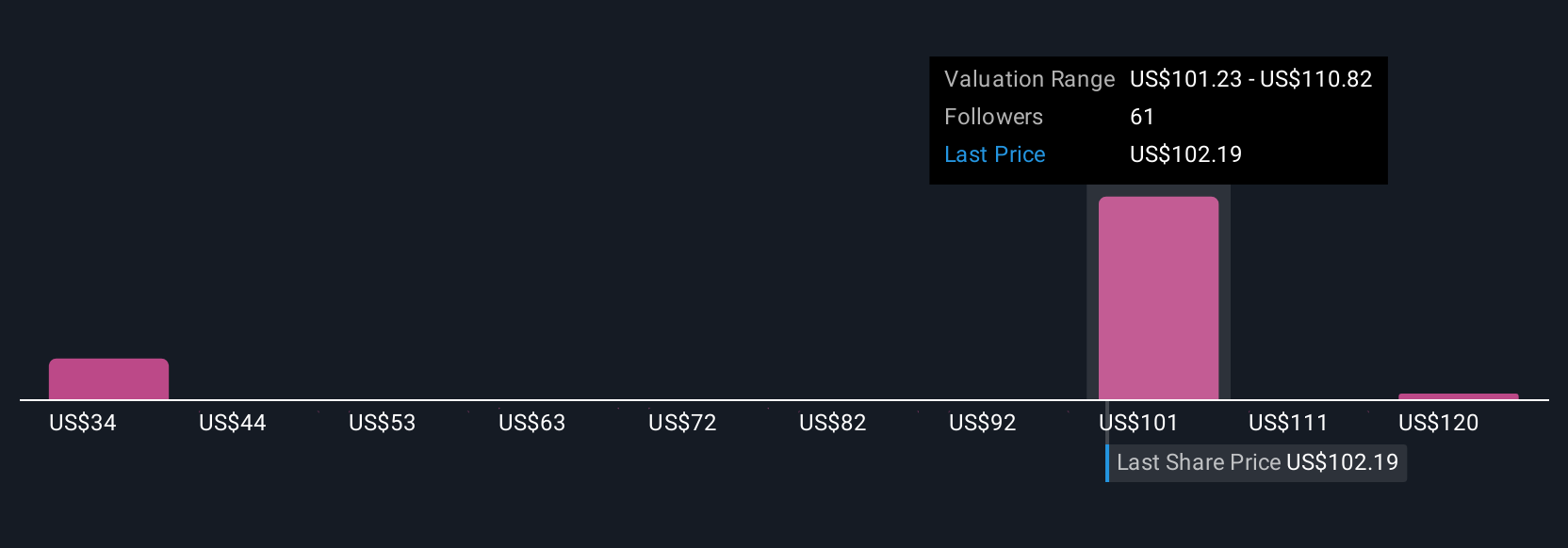

Seven fair value estimates from the Simply Wall St Community span a wide range, from US$32 to US$130 per share. While many see opportunity, United’s heavy reliance on debt for fleet and network upgrades can impact earnings flexibility, inviting you to weigh several unique viewpoints on its future resilience.

Explore 7 other fair value estimates on United Airlines Holdings - why the stock might be worth less than half the current price!

Build Your Own United Airlines Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Airlines Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Airlines Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Airlines Holdings' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.