Please use a PC Browser to access Register-Tadawul

Is There Now an Opportunity in Costamare After Robust Charter Market Developments?

Costamare Inc. CMRE | 15.92 15.92 | +2.12% 0.00% Pre |

If you're eyeing Costamare and wondering whether now is the right time to jump in, you're definitely not alone. Plenty of investors are watching the company these days, trying to read between the lines of recent stock movements. After all, Costamare has seen its price move all over the map recently, dipping 4.6% over the last week but managing a slight 0.3% uptick across the past month. Year-to-date, the stock is down 11.6%. If you look just a little further back, you'll see a dramatic 14.3% gain in the last year and an impressive 99.8% climb over three years. Stretching to a five-year view, the return is a massive 216%. This is the kind of long-term growth that grabs attention and suggests something more than just short-term noise is at work.

Market sentiment toward shipping stocks, especially container ship owners like Costamare, has shifted as global trade patterns evolve and charter rates fluctuate. Recent developments, such as renewed demand for shipping capacity and a rebalancing in the supply of vessels, have played a significant role in both increasing optimism and introducing fresh risks. These changes explain the short-term volatility, but also hint at real upside potential for patient investors.

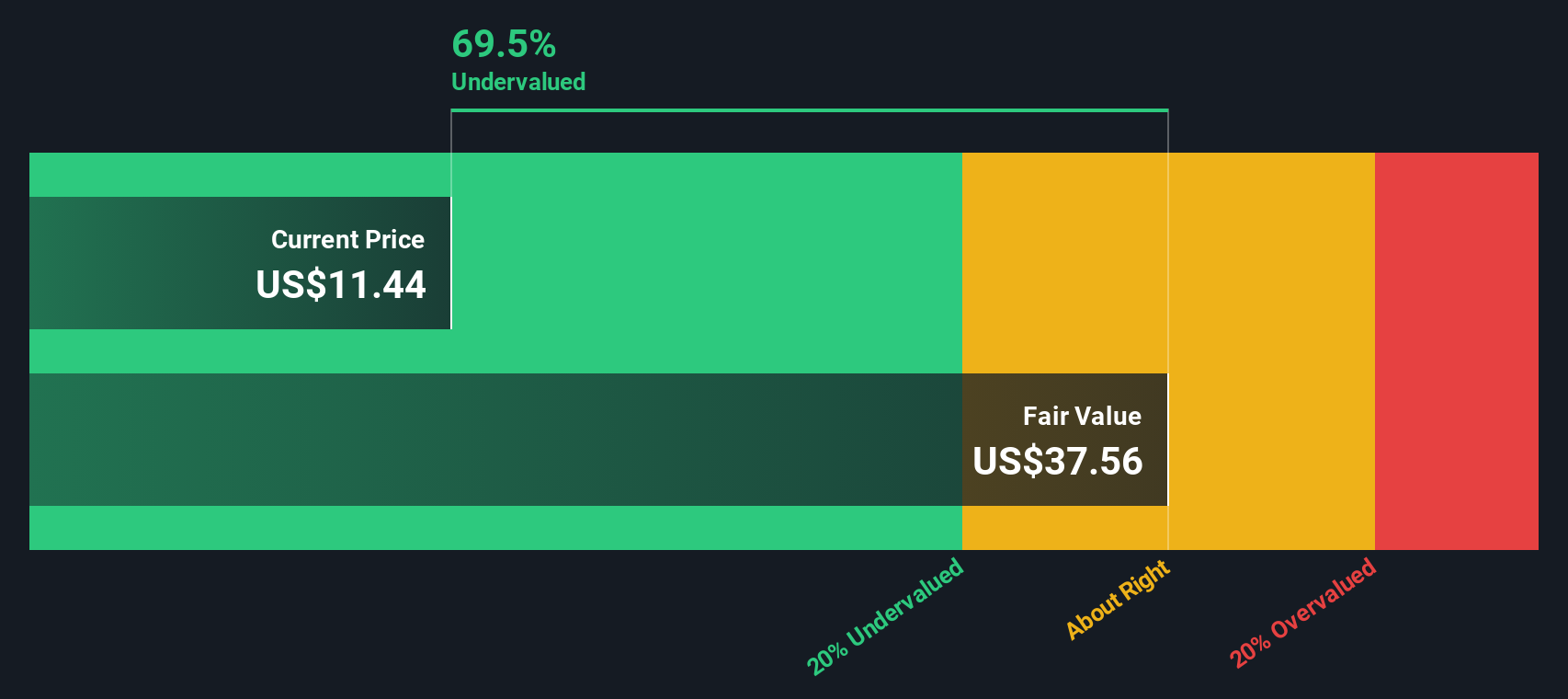

When it comes to valuation, Costamare looks especially interesting right now. By a variety of standard measures, it's currently undervalued in 5 out of 6 key checks, earning a strong value score of 5. That kind of track record deserves a closer look. Let's dive into the major valuation methods and see where Costamare really stands. As we go, I'll introduce an even sharper way to tell if the stock is truly a bargain at today's price.

Approach 1: Costamare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s dollars. This approach is designed to capture the full long-term earnings power of Costamare by using both recent financial performance and forward-looking growth estimates.

Currently, Costamare generates $217.5 million in Free Cash Flow. Analysts forecast this number to grow steadily, projecting Free Cash Flow of $470 million by 2026 and $458 million by 2027. From there, future cash flows are extrapolated, arriving at an estimated $518.9 million in 2035. All cash flows are considered in US dollars. The DCF model used is a 2 Stage Free Cash Flow to Equity approach, which balances near-term analyst forecasts with longer-term estimates from Simply Wall St.

Based on these calculations, the estimated intrinsic value per share is $38.34. This figure is 68.9 percent above Costamare’s current stock price, implying that shares are significantly undervalued on a fundamental, cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Costamare is undervalued by 68.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

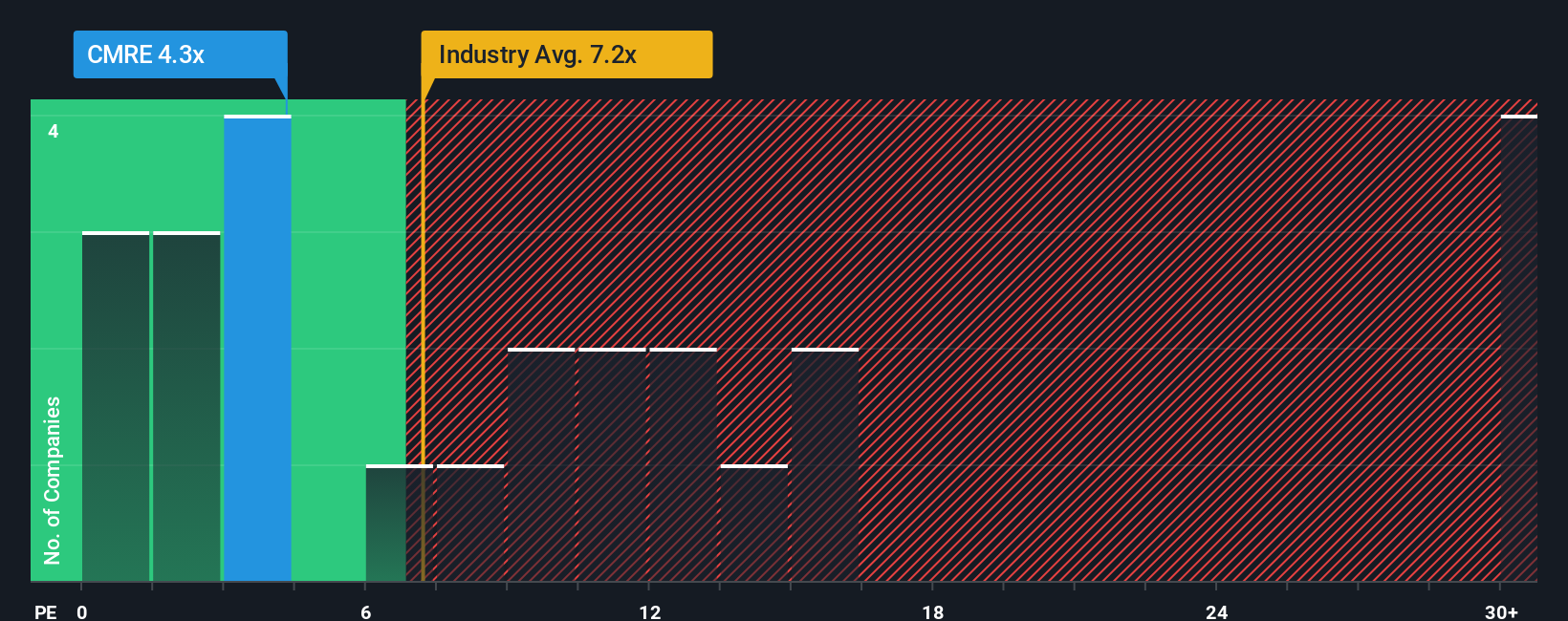

Approach 2: Costamare Price vs Earnings

The price-to-earnings (PE) ratio is a time-tested metric for valuing profitable companies like Costamare. It helps investors assess how much they're paying for each dollar of current earnings. For companies that consistently generate solid profits, the PE ratio offers a clear snapshot of perceived value and is one of the most widely used multiples in equity analysis.

What makes a PE ratio “fair” is shaped by expectations for future growth and risks. Higher growth potential usually justifies a higher PE, while increased risks or weaker earnings prospects result in a lower ratio. Therefore, it is crucial to look at Costamare’s PE in the context of its peers and the industry, as well as its unique business fundamentals.

Costamare’s current PE is 4.55x, which is below the average for shipping peers (5.87x) and also lower than the broader industry average of 6.40x. At first glance, this might suggest the stock is undervalued compared to its sector, but a simple comparison can miss important nuances.

This is where the proprietary Fair Ratio comes in. Rather than just comparing Costamare’s PE to a list of averages, the Fair Ratio incorporates dynamic factors such as the company’s earnings growth, profit margins, industry outlook, market capitalization, and risk profile. In Costamare’s case, the Fair Ratio stands at 7.21x and captures a fuller picture of what the stock deserves based on its strengths and challenges.

Comparing today’s PE of 4.55x to a Fair Ratio of 7.21x may signal significant undervaluation, even after accounting for all the relevant factors that a smart investor would consider. This deeper analysis goes a step beyond simple peer or industry averages and provides a more tailored view of Costamare’s value opportunity.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

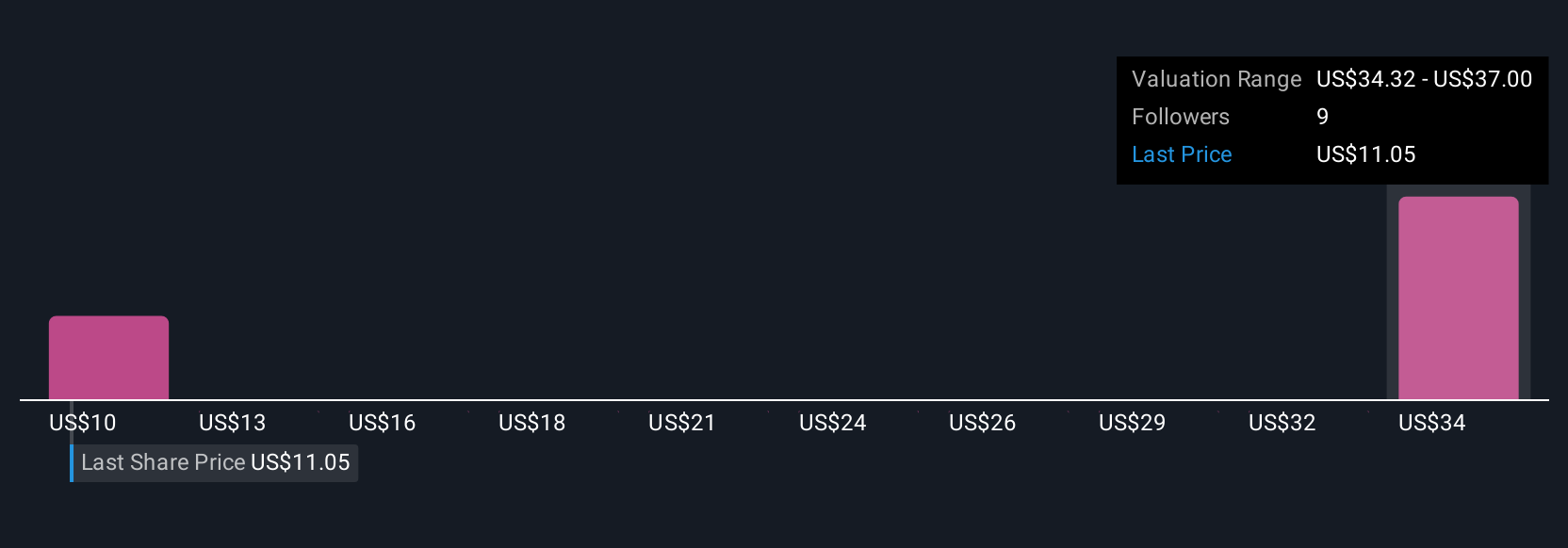

Upgrade Your Decision Making: Choose your Costamare Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an innovative, story-driven approach that empowers you to interpret a company’s future beyond just the numbers. A Narrative combines your perspective on Costamare’s business story, your outlook on its revenue, earnings, and margins, with a financial forecast to generate your own Fair Value estimate. Think of it as connecting the 'why' behind a company with the 'how much,' all in a single, accessible tool that is available to millions of investors on Simply Wall St's Community page.

Narratives help you decide if it might be time to buy or sell by illuminating whether your Fair Value is above or below the current Price. Best of all, Narratives are updated dynamically with every new company announcement, news report, or earnings release, so your investment scenario evolves as soon as the facts do.

For example, two investors exploring Costamare could craft vastly different Narratives. One might estimate a Fair Value of $10.15 based on concerns that Suez Canal disruptions will hurt future growth, while another projects a much higher Fair Value by betting on robust charter markets and sustained earnings. This means no matter your outlook, Narratives give you the tools and transparency to make sharper, more personalized decisions.

Do you think there's more to the story for Costamare? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.