Please use a PC Browser to access Register-Tadawul

Is There Still Room In RenaissanceRe (RNR) After Strong Multi Year Share Price Gains?

RenaissanceRe Holdings Ltd. RNR | 269.92 269.92 | -0.72% 0.00% Pre |

- If you are wondering whether RenaissanceRe Holdings is still good value at around US$270.10 per share, this breakdown is designed to help you make sense of the current price.

- The stock’s moves have been relatively muted recently, with a 0.7% decline over the last week, a 0.8% decline over the past month and year to date, and an 8.2% return over one year and 76.5% over five years.

- Recent attention on RenaissanceRe has centered on how the company is positioned within the insurance and reinsurance space, including its underwriting discipline, capital position and exposure to major catastrophe risks. These talking points help frame why the share price has held its ground in the short term while still showing stronger multi year results.

- On our checks, RenaissanceRe earns a valuation score of 5 out of 6. We will unpack this using several valuation methods before finishing with a broader way to think about what this number really means for long term investors.

Approach 1: RenaissanceRe Holdings Excess Returns Analysis

The Excess Returns model looks at how much profit a company is expected to earn over and above the return that shareholders require, and then capitalizes those extra profits into an intrinsic value per share.

For RenaissanceRe Holdings, the model starts with a Book Value of $231.23 per share and a Stable Book Value estimate of $291.02 per share, based on forecasts from 7 analysts. On this equity base, analysts see Stable EPS of $41.55 per share, drawn from future return on equity estimates from 8 analysts. This implies an Average Return on Equity of 14.28%.

The required return for shareholders, or Cost of Equity, is put at $20.24 per share. The difference between what the company is expected to earn and this required return is the Excess Return, calculated at $21.31 per share. These ongoing excess returns are then used to estimate an intrinsic value of about $867.57 per share.

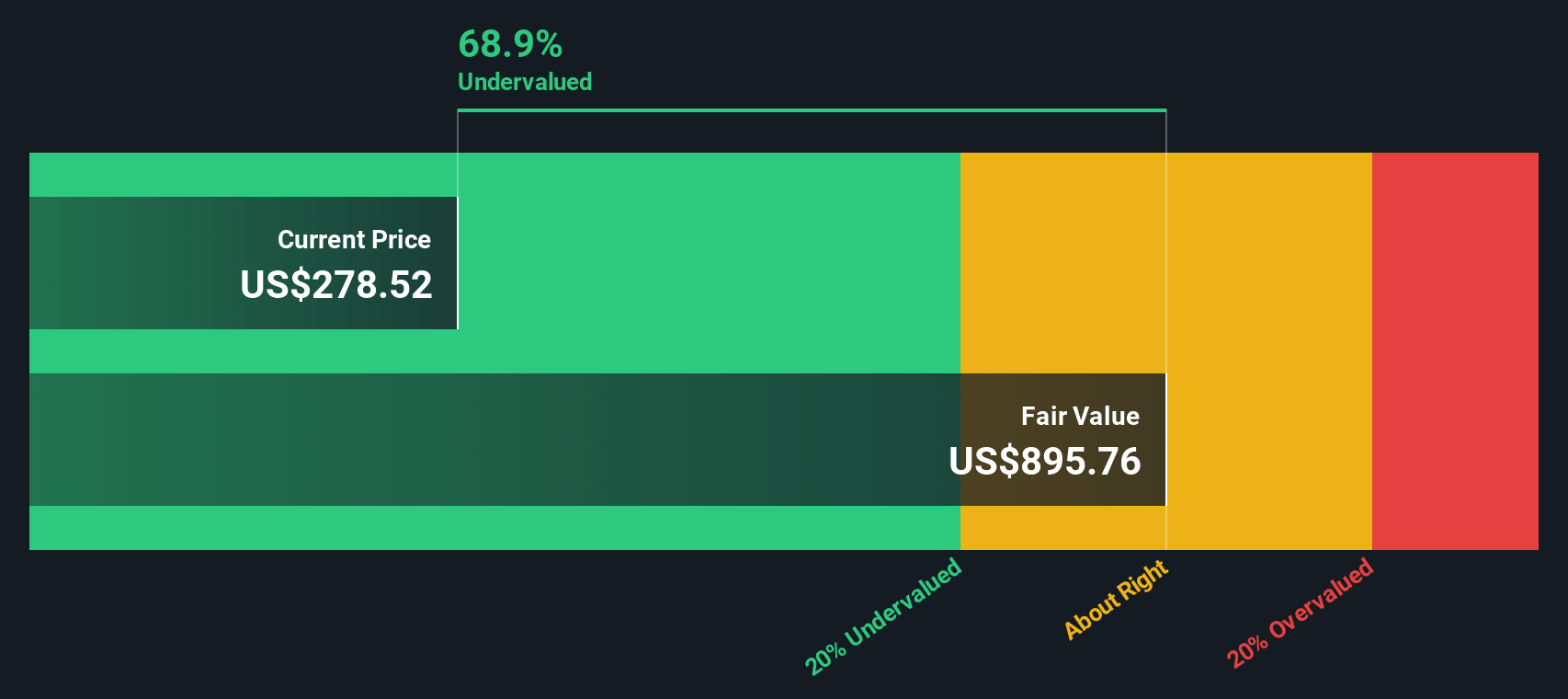

Compared with the current share price of around $270.10, the Excess Returns model suggests RenaissanceRe is about 68.9% undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests RenaissanceRe Holdings is undervalued by 68.9%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: RenaissanceRe Holdings Price vs Earnings

The P/E ratio is a common way to value profitable companies because it links what you pay for each share to the earnings that business is currently generating. In general, higher expected earnings growth and lower perceived risk tend to justify a higher P/E, while slower growth and higher risk usually point to a lower, more cautious P/E being considered normal.

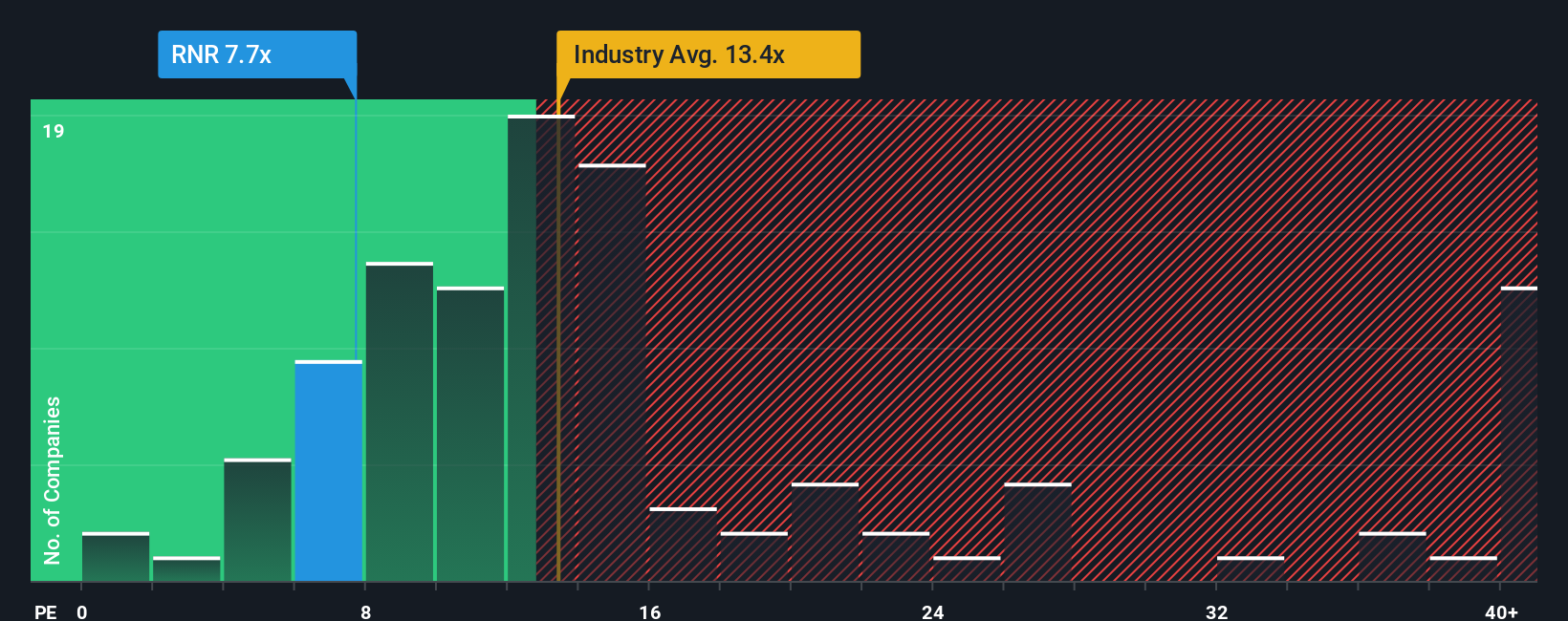

RenaissanceRe currently trades on a P/E of 7.46x. That sits below the Insurance industry average of 12.55x and also below the peer group average of 15.79x. Simply Wall St goes a step further with its Fair Ratio, which estimates what a more tailored P/E might look like once factors such as earnings growth, profit margins, industry, market cap and risk profile are taken into account. This is designed to be more specific to the company than a simple comparison with broad industry or peer averages.

For RenaissanceRe, the Fair Ratio is 11.22x, higher than the current 7.46x P/E. On this metric, the shares appear to be trading below what Simply Wall St’s model suggests as a more fitting multiple.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your RenaissanceRe Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simply your story about a company, linked directly to your assumptions for future revenue, earnings, margins and a fair value estimate. On Simply Wall St’s Community page you can use them to compare that fair value with the current price, see how other investors are thinking, and watch those views update automatically as new news or earnings come through. For RenaissanceRe Holdings, one investor might build a Narrative around the higher analyst price target of US$422.00 with relatively supportive assumptions on future earnings and P/E. Another might lean toward the lower US$237.00 target with more cautious expectations. You can decide which story you find more reasonable and whether the gap between your fair value and the current share price suggests it is closer to a buy, hold, or sell decision for your own portfolio.

Do you think there's more to the story for RenaissanceRe Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.