Please use a PC Browser to access Register-Tadawul

Is There Still Upside for Coupang After Strong 2025 Rally?

Coupang, Inc. Class A CPNG | 25.63 25.63 | -0.89% 0.00% Pre |

Thinking about what to do with Coupang stock? You are not alone, and you are definitely asking the right questions. With Coupang’s strong recent run, up a remarkable 41.5% so far this year and a hefty 90.7% over three years, plenty of investors are wondering whether this e-commerce player is still running ahead of itself or if there’s real value left on the table. Even with a slight dip of -1.9% in the past week and a -5.8% pullback over the last month, Coupang’s story has been one of persistent forward momentum, driven by confidence in its market position and the expansion of online retail in South Korea and beyond.

All this movement in the stock price, combined with a value score of 4 out of 6 on our undervaluation scale, suggests there’s more to the narrative than meets the eye. That score means Coupang checks the “undervalued” box in four of the standard six valuation checks, which is a standout sign, especially for a company with Coupang’s growth profile and international ambitions. But before jumping to conclusions, let’s dig into how these valuation checks work, what they show about Coupang, and, crucially, whether there’s an even smarter way to decide if this stock is truly a bargain. Stick around, because we’ll be exploring classic techniques first, but saving the most insightful approach for the very end.

Approach 1: Coupang Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and discounting them back to today’s dollars. This approach is widely trusted for its focus on the most fundamental driver of a business’s value: actual cash generation.

For Coupang, the most recent Free Cash Flow (FCF) stands at $833 million. Analysts forecast strong growth, projecting FCF to reach $2.8 billion by the end of 2027. Looking further out, Simply Wall St extrapolates that annual FCF could grow to nearly $6.7 billion by 2035. These projections combine both analyst estimates for the next few years and longer-term trends for future years.

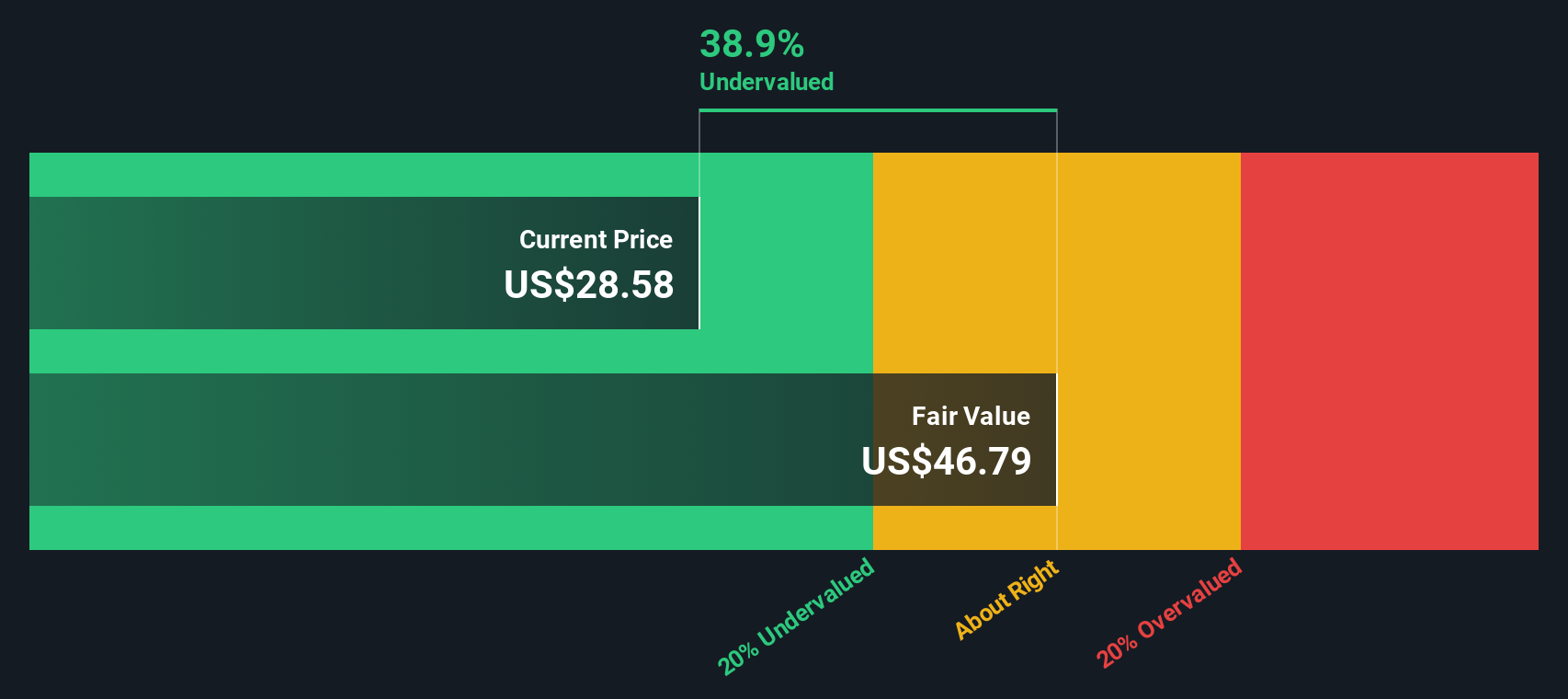

Based on these cash flow forecasts, the DCF model calculates an intrinsic value for Coupang at $47.79 per share. Compared to the current share price, this implies the company is trading at a 34% discount, which suggests the stock is potentially significantly undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coupang is undervalued by 34.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Coupang Price vs Sales

For companies in rapid growth phases like Coupang, the Price-to-Sales (P/S) ratio is often a useful valuation measure. It lets investors assess whether the market is fairly valuing every dollar of revenue, which is especially relevant for companies that are still reinvesting aggressively and may not yet show robust profits. When companies are not showing significant earnings yet, or are channeling margins back into growth, sales can give a clearer picture of value than earnings alone.

The P/S ratio reflects both growth prospects and the risk profile a company carries. Generally, higher growth expectations or a safer business model justify a higher ratio, while riskier or slower-growing businesses trade at lower multiples. These benchmarks are usually compared to peer companies or the industry average to calibrate expectations.

Coupang’s current P/S ratio stands at 1.78x. The broader Multiline Retail industry averages about 1.42x, while Coupang’s peer group commands a higher average, around 3.38x. Just comparing ratios may suggest Coupang is somewhere in the middle of the pack. To provide a more tailored view, Simply Wall St uses its “Fair Ratio” for Coupang, which is 2.14x. This “Fair Ratio” weighs growth momentum, profitability, risk, market cap and industry against one another. This proprietary approach is considered more insightful than a straightforward industry comparison because it tailors the multiple to Coupang’s unique position and potential rather than relying on generic groupings.

With a Fair Ratio of 2.14x and an actual P/S of 1.78x, Coupang’s shares appear to be undervalued relative to what would be considered reasonable given its growth, margins and risk factors.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coupang Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. This is a clear, dynamic approach that goes beyond the numbers to help you make smarter, more personalized investment decisions. A Narrative is your story about a company: you lay out your expectations for Coupang’s future, such as growth rates, profit margins, and fair value, and back it with your reasoning, all in one place.

Narratives bridge the gap between a company’s business outlook and its financial forecasts, linking the “why” behind your confidence or caution to real, data-driven valuation. On Simply Wall St’s Community page, investors can easily create and follow Narratives, making this interactive tool accessible for anyone interested in seeing what others are thinking or tracking how their own view compares over time.

The real advantage of Narratives is how they help you decide when to act. By comparing your Fair Value estimate with the current price, you can spot exactly when a stock looks appealing or overpriced. Plus, because Narratives refresh with every major update, from new earnings reports to breaking news, your perspective and fair value calculation stay current without extra effort.

For Coupang, for example, Narratives range from bullish investors seeing a $39 per share fair value based on outsized revenue and margin expansion, to conservative estimates around $26.20 that account for slower growth or margin risk. This helps each investor see clearly how different outlooks drive contrasting investment choices.

For Coupang, here are previews of two leading Coupang Narratives:

- 🐂 Coupang Bull Case

Fair Value: $34.52

Current closing price is approximately 8.6% below this estimate.

Forecast annual revenue growth: 14%

- Analyst consensus expects technology-led efficiency, new market expansion, and increasing spend per customer to drive long-term earnings and margins higher.

- Rapid growth in Taiwan and across new e-commerce verticals is broadening Coupang’s market opportunities, with revenue and profit margin expansion anticipated.

- Key risks include persistent scaling inefficiencies, cost pressures in new ventures, and continued heavy reliance on the South Korean market for core profits.

- 🐻 Coupang Bear Case

Fair Value: $27.25

Current closing price is approximately 15.8% above this estimate.

Forecast annual revenue growth: 12.05%

- Despite strong revenue growth and a dominant market position, Coupang struggles to achieve consistent profitability, limiting near-term investment appeal.

- Significant risks come from intensifying competition (particularly from large global entrants like Alibaba’s joint venture), and operational setbacks such as integration of Farfetch and regulatory scrutiny.

- While the long-term outlook is positive for high-growth investors, the near-term is likely to remain volatile due to margin pressures, expansion risks, and economic headwinds.

Do you think there's more to the story for Coupang? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.