Please use a PC Browser to access Register-Tadawul

Is TTMI’s Pause on Buybacks a Strategic Shift Toward Advanced Manufacturing and Value-Added Growth?

TTM Technologies, Inc. TTMI | 98.58 | +6.48% |

- TTM Technologies recently reported that from July 1, 2025 to September 29, 2025, it did not repurchase any shares under its buyback program announced in May 2025, while management outlined expansion plans for advanced PCB manufacturing in China and a renewed focus on higher value-added segments during a non-deal roadshow.

- This renewed operational focus aligns with growing investor interest in value-oriented technology companies, particularly as industry caution mounts regarding high-valuation segments in tech and artificial intelligence.

- We'll explore how TTM Technologies' manufacturing expansion and market positioning highlight important shifts in its long-term growth narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TTM Technologies Investment Narrative Recap

To consider investing in TTM Technologies, you need to believe in the company’s ability to capture growth from advanced PCB manufacturing and a shift toward higher value segments like data center computing and aerospace. The recent update that no shares were repurchased under the new buyback program is not a material near-term catalyst or risk; instead, TTM’s operational execution and demand growth remain the main factors to watch.

Among recent announcements, the expansion of advanced PCB manufacturing capacity in China stands out as most relevant. This move directly supports TTM’s focus on higher-margin segments and aligns with expectations for ongoing demand from data center and AI infrastructure, which are crucial short-term catalysts for the company’s outlook.

However, investors should be aware that, in contrast, supply chain disruption or cost inflation driven by U.S.–China geopolitical tensions could quickly change the picture for...

TTM Technologies' outlook projects $3.2 billion in revenue and $251.1 million in earnings by 2028. This assumes a 6.4% annual revenue growth rate and an earnings increase of $157.9 million from current earnings of $93.2 million.

Uncover how TTM Technologies' forecasts yield a $75.50 fair value, a 20% upside to its current price.

Exploring Other Perspectives

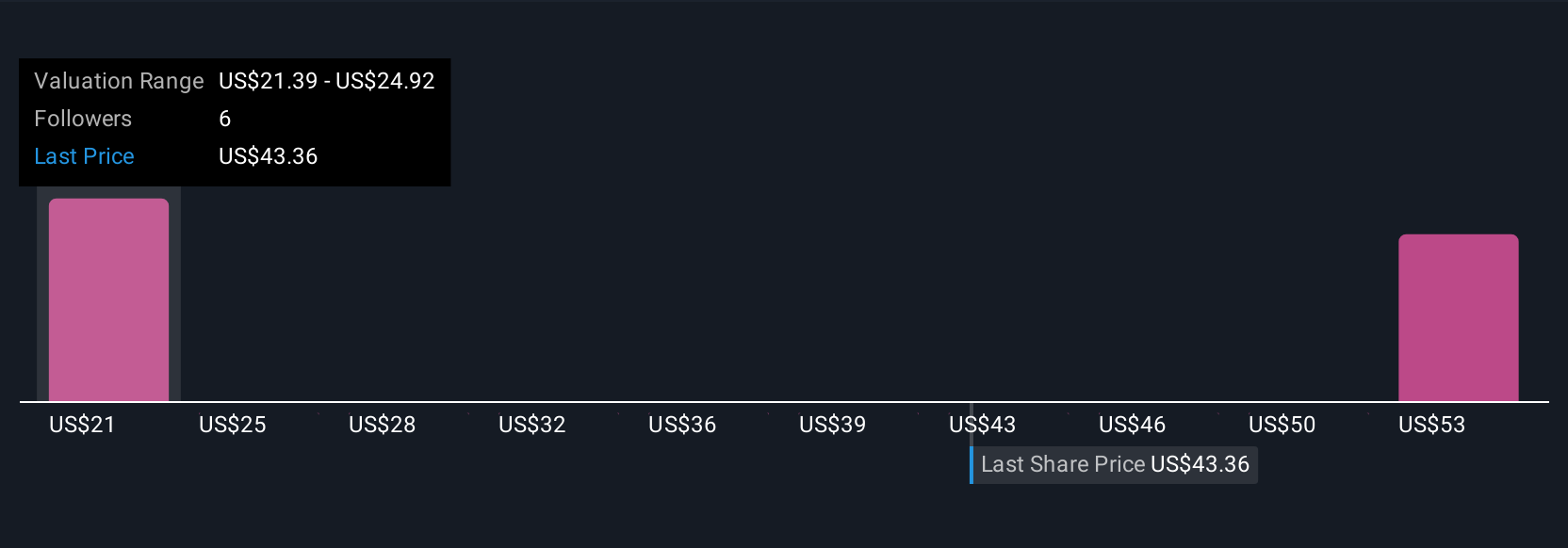

Fair value estimates from three Simply Wall St Community members span a wide range, from US$28.39 to US$75.50 per share. While opinions vary significantly, keep in mind that growing U.S. and NATO defense spending has also been cited as a catalyst that could impact TTM’s long-term results.

Explore 3 other fair value estimates on TTM Technologies - why the stock might be worth as much as 20% more than the current price!

Build Your Own TTM Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TTM Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TTM Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TTM Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.