Please use a PC Browser to access Register-Tadawul

Is United Bankshares’ (UBSI) Strong Q2 Earnings and Upgraded Outlook Reshaping Its Investment Case?

United Bankshares, Inc. UBSI | 39.50 | -0.40% |

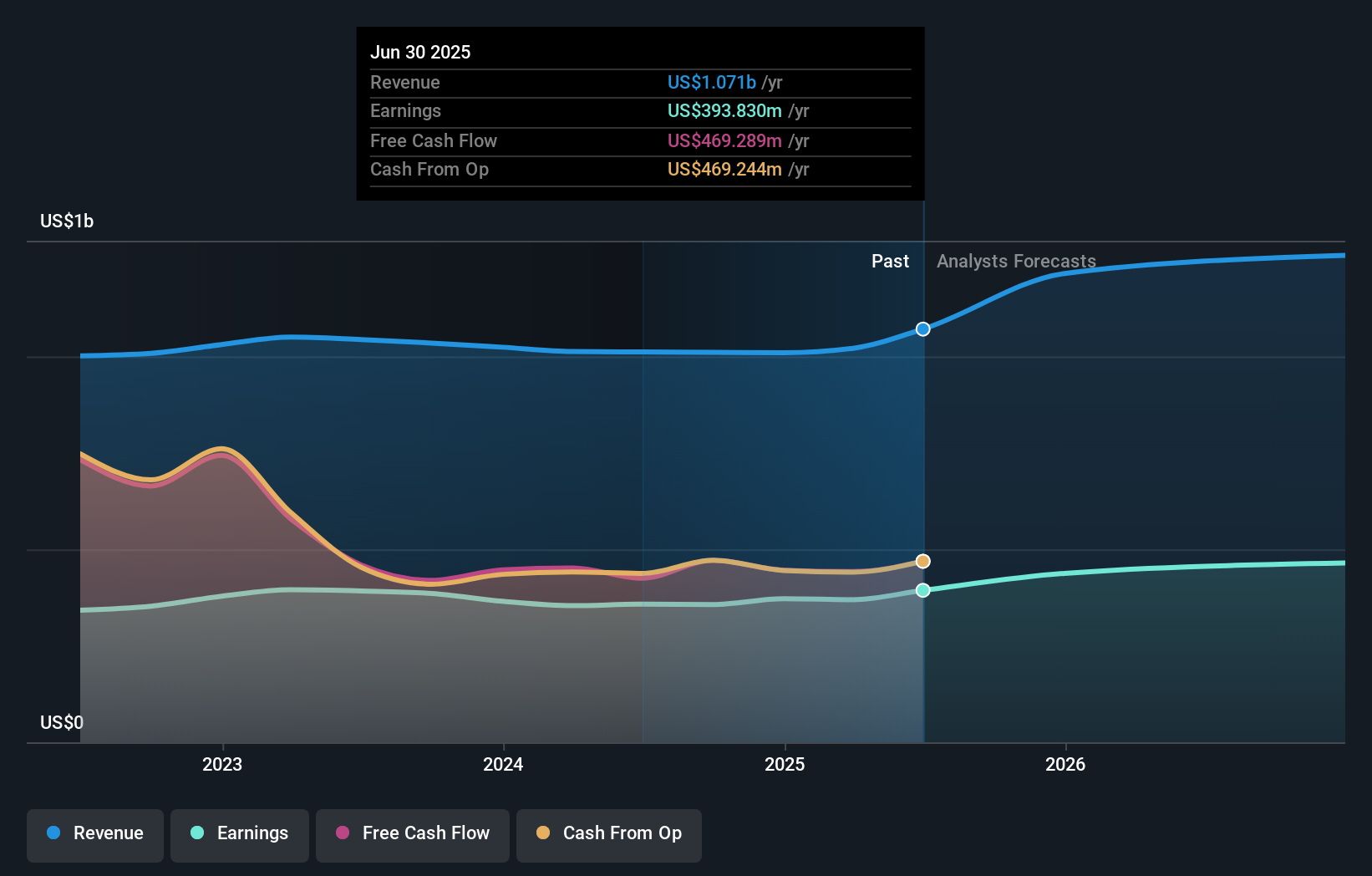

- United Bankshares, Inc. recently posted second-quarter 2025 results, delivering net income of US$120.72 million compared to US$96.51 million the year before, with revenues and earnings per share both surpassing analyst forecasts.

- Analysts raised their revenue and earnings expectations for 2025, and the company's projected growth now outpaces the broader US banking sector.

- We'll explore how this strong earnings beat and the improved growth forecast refine United Bankshares' investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is United Bankshares' Investment Narrative?

For someone considering United Bankshares, the core story remains steady, with the bank’s recent quarter exceeding Wall Street’s forecasts and updated analyst models now projecting faster top-line and bottom-line growth than the broader US banking sector. This stronger earnings beat and improved revenue outlook reinforce confidence in management’s steady approach, highlighted by consistent dividends and recent buybacks. The uptick in net charge-offs, from 0.02% to 0.14%, catches the eye, but as the market reaction was relatively muted and price targets held steady, it appears short-term views on risk or upside haven’t shifted dramatically. While rising credit losses bear watching, especially as forecasts now capture higher growth, most catalysts and risks remain as they were: stable growth, value compared to peers, and monitoring for further credit quality changes as lending conditions evolve. On the flipside, heightened charge-offs could signal brewing credit headwinds investors should note.

Despite retreating, United Bankshares' shares might still be trading 40% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on United Bankshares - why the stock might be worth just $39.67!

Build Your Own United Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Bankshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Bankshares' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.