Please use a PC Browser to access Register-Tadawul

Is VEEV’s Surging Global Shipments Changing the Investment Case for Philip Morris International (PM)?

Philip Morris International Inc. PM | 153.65 | +1.79% |

- In the second quarter of 2025, Philip Morris International’s e-vapor brand VEEV reported shipment volumes that more than doubled year over year, with the company launching VEEV inPRIME in the Czech Republic and expanding into markets such as Indonesia, Canada, and Colombia.

- This rapid growth in VEEV highlights Philip Morris International’s ongoing transition toward a broader smoke-free product strategy, aiming to capture new consumer segments and strengthen its premium positioning globally.

- With VEEV's shipment surge emerging as a key growth driver, we'll explore how this development influences Philip Morris International’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

Philip Morris International Investment Narrative Recap

Owning shares of Philip Morris International really means believing in the long-term shift from traditional cigarettes to newer, smoke-free products as the core engine for future growth. The recent surge in VEEV shipment volumes supports this direction, but the most important short-term catalyst, sustainable smoke-free product expansion, faces the ongoing risk that these alternatives may not grow fast enough to offset declining cigarette sales and mounting regulatory threats. At this stage, the VEEV news strengthens the catalyst, though regulatory and illicit trade pressures remain front of mind.

Among recent announcements, PMI’s plan for a US$600 million manufacturing facility in Colorado to boost ZYN nicotine pouch production is an extension of its multi-category smoke-free shift. This move ties directly to the catalyst of accelerated reduced-risk product volume growth, tapping demand among new consumer segments and helping to anchor future revenues and margins, even as competition and regulation persist.

In contrast, it’s important for investors to consider the impact of shifting regulatory policies on reduced-risk products and how these can affect growth, especially...

Philip Morris International's outlook anticipates $49.3 billion in revenue and $14.3 billion in earnings by 2028. To achieve this, the company would need to deliver 8.1% annual revenue growth and a $6.1 billion increase in earnings from the current $8.2 billion.

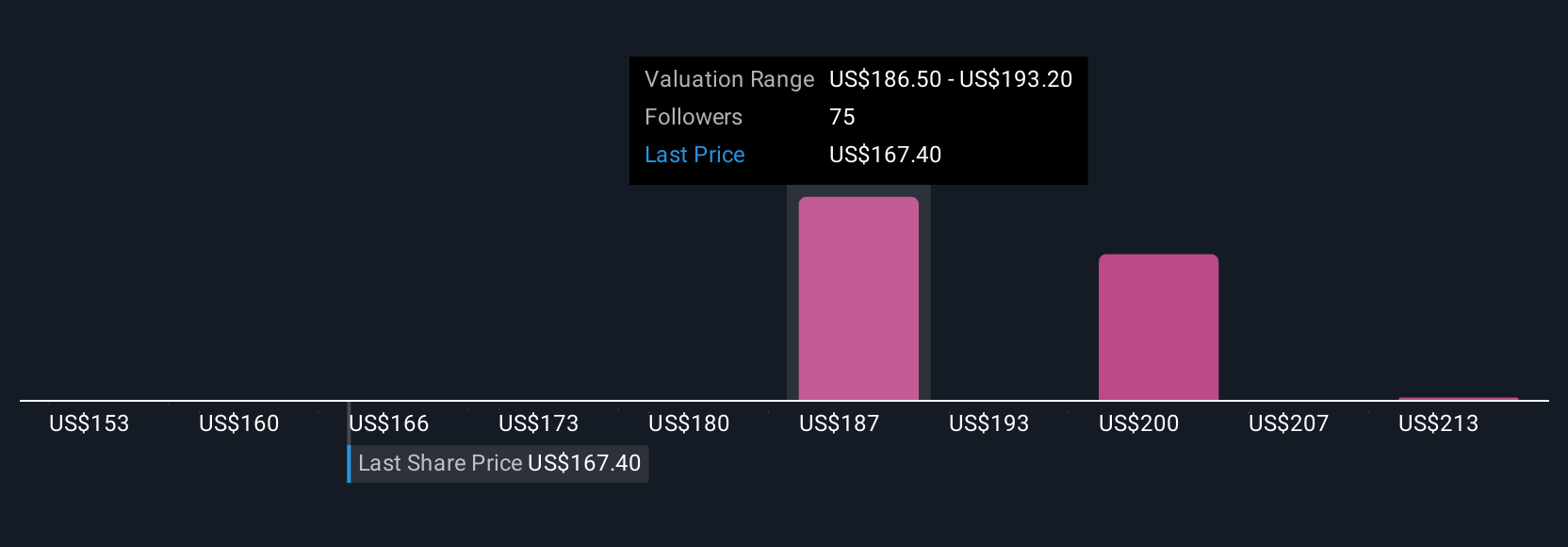

Uncover how Philip Morris International's forecasts yield a $186.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts see even greater opportunity, projecting earnings could hit US$15.4 billion by 2028 if growth accelerates in emerging markets. While pre-news estimates reflected confidence in PMI’s smoke-free push, your outlook might shift as you compare these bullish forecasts with today’s rapid developments in VEEV and potential regulatory risks. The debate isn’t settled, so exploring these different viewpoints can prepare you for what comes next.

Explore 9 other fair value estimates on Philip Morris International - why the stock might be worth 6% less than the current price!

Build Your Own Philip Morris International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Philip Morris International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Philip Morris International's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.