Please use a PC Browser to access Register-Tadawul

Is Verisk’s New GenAI Underwriting Assistant Shaping a Smarter Long-Term Outlook for VRSK?

Verisk Analytics Inc VRSK | 217.14 | +0.39% |

- In September 2025, Verisk announced the launch of its Commercial GenAI Underwriting Assistant, a cloud-based generative AI solution designed to streamline and modernize commercial property underwriting for insurers by automating workflows, delivering real-time risk insights, and supporting expert judgment through a human-in-the-loop design.

- This launch addresses key industry pain points such as rising costs, workforce shortages, and demand for digital transformation, while integrating advanced AI with established Verisk products in a modular suite to enhance insurers' operational efficiency and profitability.

- With intelligent automation at the core of this solution, we'll review how Verisk's new AI platform influences its long-term investment narrative and growth prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Verisk Analytics Investment Narrative Recap

Owning Verisk Analytics often appeals to investors who believe in the insurance sector’s long-term digital transformation and trust in Verisk’s ability to deliver essential analytics and automation to clients. The recent launch of the Commercial GenAI Underwriting Assistant advances Verisk’s innovation agenda, but its overall near-term effect on profitability is expected to be modest compared to the more immediate challenge of cost pressures within the insurance industry.

Among recent announcements, the Carbon Trust Assured Model for Property Claims is especially relevant, as it highlights Verisk’s focus on scalable, compliance-driven solutions that complement its AI-powered underwriting products. Both initiatives contribute in different ways to strengthening customer reliance on Verisk’s suite of modular, integrated offerings.

Yet, against these innovation tailwinds, investors should not overlook the risk of tighter client spending if insurance industry costs or economic pressures escalate...

Verisk Analytics' outlook anticipates $3.9 billion in revenue and $1.2 billion in earnings by 2028. This implies a 9.1% annual revenue growth rate and a $290.7 million increase in earnings from the current $909.3 million level.

Uncover how Verisk Analytics' forecasts yield a $307.31 fair value, a 26% upside to its current price.

Exploring Other Perspectives

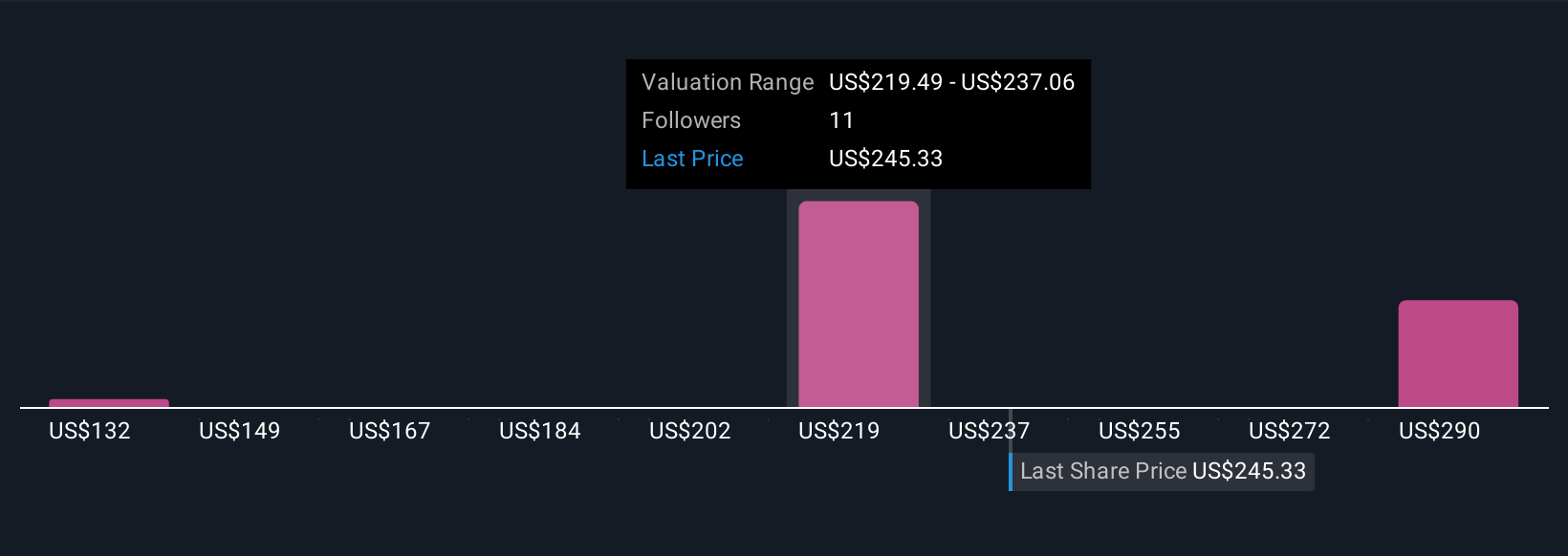

Simply Wall St Community fair value estimates for Verisk range from US$131.67 to US$307.31, across four unique analyses. This variety of perspectives stands out as insurance sector cost challenges may affect future spending on analytics, so consider multiple angles as you form your view.

Explore 4 other fair value estimates on Verisk Analytics - why the stock might be worth 46% less than the current price!

Build Your Own Verisk Analytics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verisk Analytics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verisk Analytics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verisk Analytics' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.