Please use a PC Browser to access Register-Tadawul

Is Wayfair's (W) Way Day Push a Turning Point for Its Omnichannel Strategy?

Wayfair, Inc. Class A W | 81.43 | +2.34% |

- Wayfair has announced the return of its annual Way Day event, which ran from October 26 to 29, featuring deep discounts of up to 80% across all home categories, daily flash deals, doorbusters, and free shipping both online and in select physical stores.

- This event also provided exclusive promotions for Wayfair Rewards and Wayfair Professional members, further highlighting Wayfair’s focus on driving customer engagement through both digital and in-store experiences.

- We’ll now examine how Way Day’s expansive promotions and expanded in-store experiences may influence Wayfair’s broader investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wayfair Investment Narrative Recap

To be a Wayfair shareholder, one needs to believe in the company’s ability to drive growth through deep customer engagement, both online and in stores, while executing its retail and operational expansions effectively. The return of Way Day may support near-term revenue momentum and boost customer interaction, but the toughest short-term catalyst remains macro headwinds like consumer sentiment and discretionary spending; the current announcement does not materially alter these risks or their relevance for investors.

Of Wayfair’s recent news, the company’s ongoing retail expansion stands out, such as the upcoming Denver, Colorado store opening in late 2026, reinforcing the narrative that physical locations could amplify online sales and brand loyalty, particularly in the context of large-scale promotional periods like Way Day, which drive foot traffic and omnichannel engagement.

By contrast, investors should also be aware of continuing risks tied to inflation and a challenging housing market, as these factors...

Wayfair's narrative projects $13.9 billion in revenue and $124.7 million in earnings by 2028. This requires 4.9% yearly revenue growth and a $424.7 million increase in earnings from -$300.0 million today.

Uncover how Wayfair's forecasts yield a $83.17 fair value, in line with its current price.

Exploring Other Perspectives

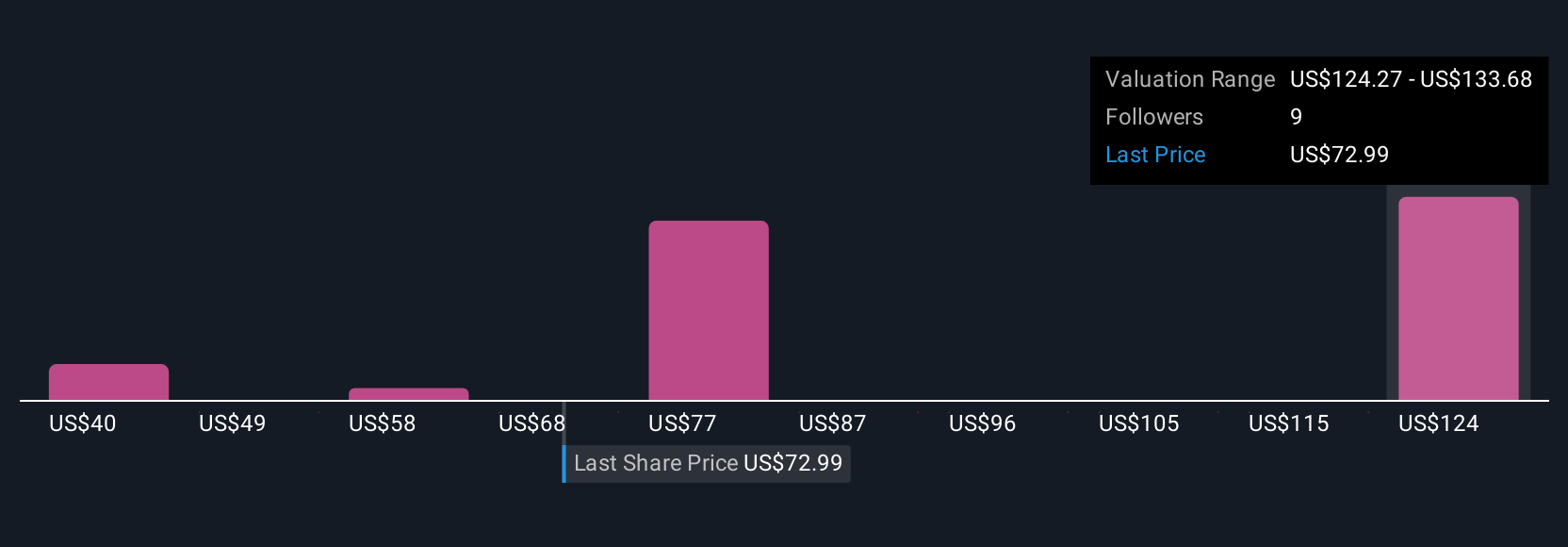

Five fair value estimates from the Simply Wall St Community range from US$39.54 to US$157.69. While many see upside tied to Wayfair’s logistics and store rollouts, individual expectations can differ widely, encouraging you to explore several alternative viewpoints.

Explore 5 other fair value estimates on Wayfair - why the stock might be worth less than half the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

No Opportunity In Wayfair?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.