Please use a PC Browser to access Register-Tadawul

Is Webull’s (BULL) European Launch Redefining Its Access to Retail Investors?

Bull Run Corp BULL | 6.01 | +2.39% |

- Earlier this month, Webull Corporation announced its expansion into the European market by launching brokerage services in the Netherlands through its newly authorised Amsterdam-based subsidiary, Webull Securities (Europe) B.V.

- This gives Dutch retail investors access to European and U.S.-listed equities, fractional shares, options, ETFs, and advanced trading tools, with plans for further EU launches in the near future.

- We'll examine how Webull's entry into the Netherlands shapes its investment narrative through anticipated broader access to European retail investors.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Webull Investment Narrative Recap

Webull’s move into the Netherlands signals continued intent to build a global retail investor base, a narrative underpinned by the belief that expanding into new regions can drive faster customer and revenue growth. This European expansion could become a near-term catalyst if it accelerates international user acquisition, but regulatory risk remains the biggest challenge, as approval processes and oversight can impact both the timing and scope of these rollouts.

Among recent company updates, the relaunch of cryptocurrency trading for U.S. users is a particularly relevant complement, showing Webull’s focus on broadening its product offerings as it enters new markets. These actions reinforce the company’s catalyst of diversifying revenue streams and enhancing trading activity, especially as it seeks growth beyond its current core geographies.

Yet, in contrast to the promise of new markets, investors should be aware that increasing regulatory scrutiny in each region may...

Webull's narrative projects $920.2 million revenue and $233.4 million earnings by 2028. This requires 26.1% yearly revenue growth and a $158.5 million earnings increase from $74.9 million today.

Uncover how Webull's forecasts yield a $18.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives

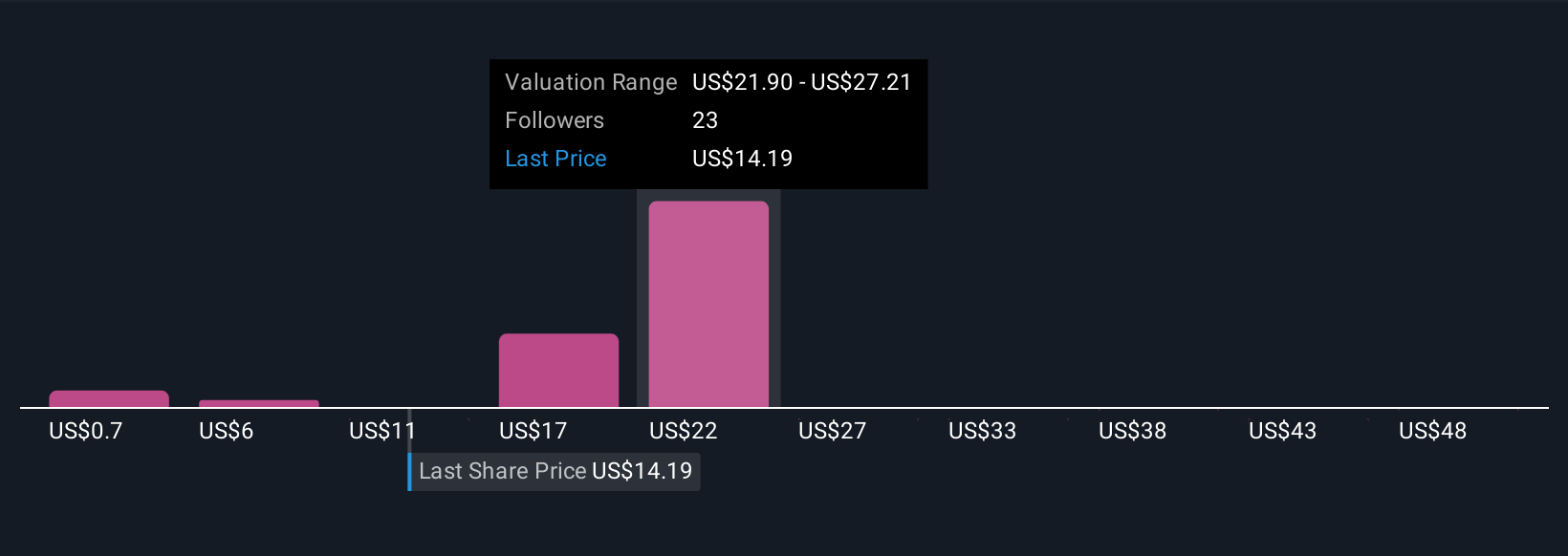

Sixteen fair value estimates from the Simply Wall St Community range from US$0.69 to over US$1,459. If global expansion drives stronger revenue growth, as highlighted by many, opinions on Webull’s performance are likely to continue to diverge.

Explore 16 other fair value estimates on Webull - why the stock might be a potential multi-bagger!

Build Your Own Webull Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Webull research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Webull research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Webull's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.