Please use a PC Browser to access Register-Tadawul

Is WEC Energy Group Properly Priced After 20% Jump and Solid Dividend Growth in 2025?

WEC Energy Group Inc WEC | 105.50 | -0.05% |

If you are considering what to do with WEC Energy Group stock right now, you are definitely not alone. With a closing price at $113.29, it is not surprising given that the stock has caught the attention of many investors lately. Over the past week, WEC’s share price nudged up by 0.4%, but it is the longer-term gains that really stand out, with a 5.1% rise over the past month and an impressive 20.5% advance since the start of the year. Going back farther, WEC Energy Group has rewarded patient shareholders with returns of 22.8% over the last year, 47.6% over three years, and 34.4% across five years. This track record may have some investors rethinking their expectations for this utility player.

Behind the scenes, much of this movement can be traced to shifting market sentiment. Recent sector trends have increased demand for relatively stable, income-generating stocks like WEC as investors continue to value reliable utility businesses in uncertain times. However, when it comes to whether now is a smart time to buy, hold, or sell, valuation has never been more critical.

By the numbers, WEC Energy Group scores 1 out of 6 on a valuation checklist. This means it appears undervalued in just one key area based on standard methods. In the next section, we will break down each of these checks and what they mean for WEC’s potential, while also exploring whether traditional valuation tools are enough, or if there is an even smarter way to think about what this stock is really worth.

WEC Energy Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: WEC Energy Group Dividend Discount Model (DDM) Analysis

The Dividend Discount Model, or DDM, estimates a stock’s intrinsic value by projecting future dividend payments and discounting them back to their present value. This approach is especially relevant for stable, dividend-paying utility companies like WEC Energy Group, since their dividends are a key part of their long-term investment appeal.

According to the latest data, WEC currently pays a dividend per share of $3.95. The company's return on equity stands at 11.84%, and its payout ratio is a solid 69.2%, indicating that the bulk of earnings are being returned to shareholders. The model applies a projected dividend growth rate of 3.08% per year, which has been capped based on recent trends and sector averages.

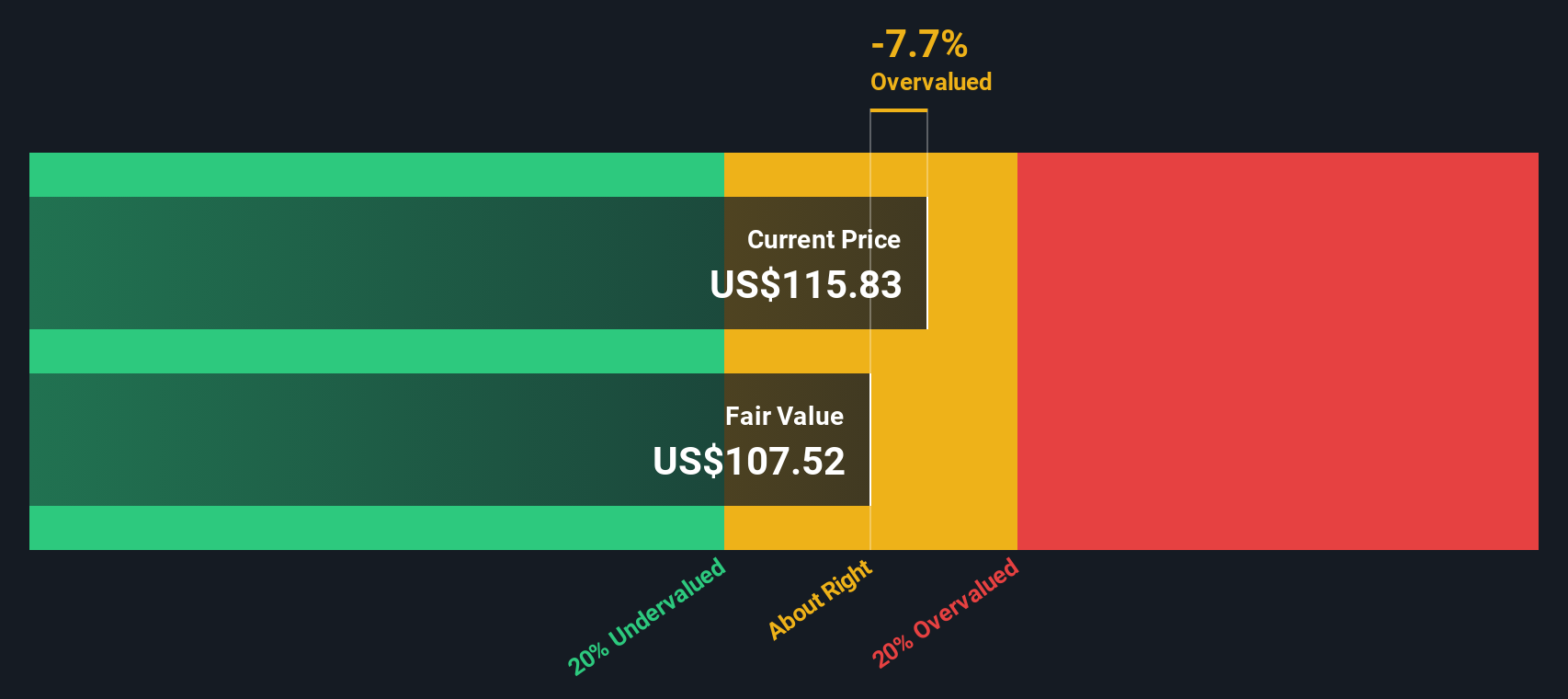

Applying these figures, the DDM calculates an intrinsic value for WEC stock of $107.00 per share. Given that the current market price is $113.29, this implies the stock is about 5.9% above its fair value based on this single method. While not a dramatic gap, it does suggest a modest premium is being paid for WEC's reliable income stream.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out WEC Energy Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: WEC Energy Group Price vs Earnings

The price-to-earnings (PE) ratio is a popular and practical way to value profitable companies like WEC Energy Group. Since PE ties the company’s market price to its per-share earnings, it helps investors measure how much they are paying for each dollar of profit today. A suitable PE ratio takes into account a company’s growth prospects and risk profile, as faster-growing or less risky businesses usually command higher multiples.

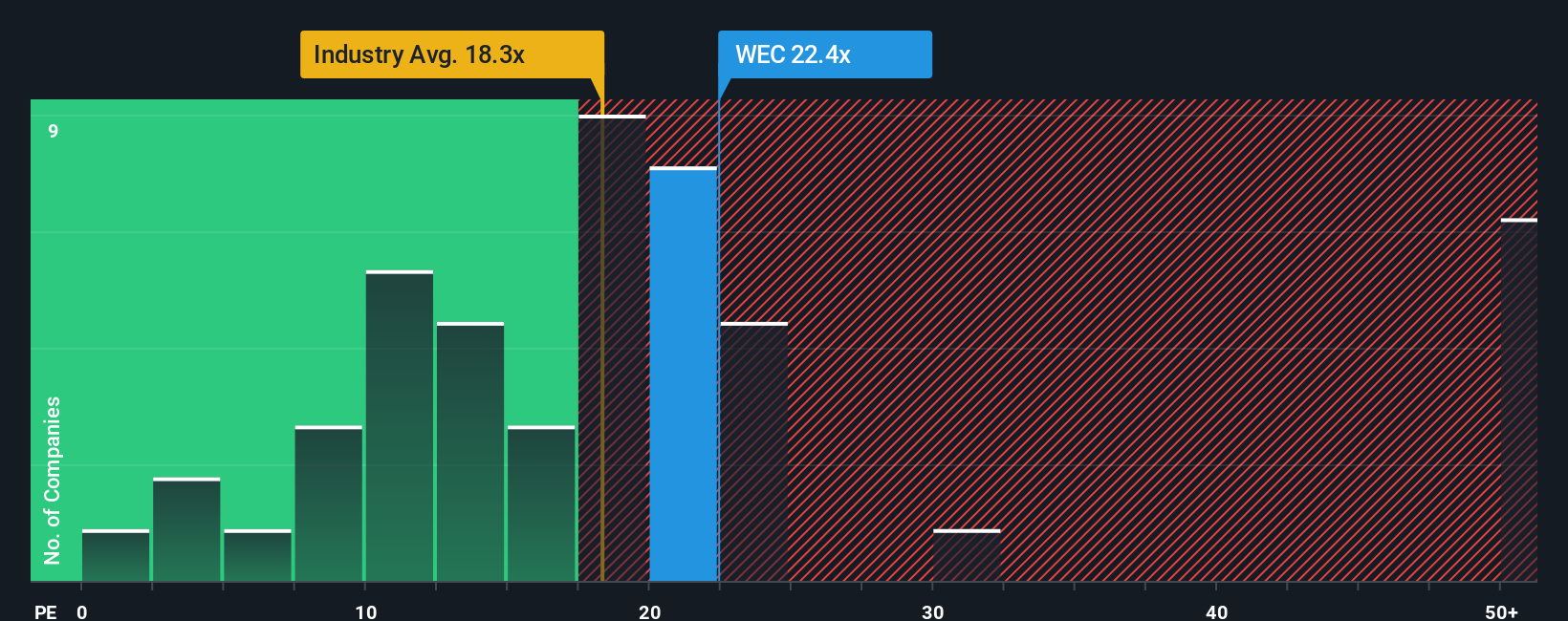

Currently, WEC trades at a PE ratio of 21.9x. For context, the average PE for the integrated utilities industry is 18.3x, and WEC’s peer group averages 22.3x. At first glance, WEC appears to be trading at a modest premium versus the broader industry, but in line with its peers.

However, comparing with industry or peer averages does not always tell the full story. That is why Simply Wall St’s proprietary Fair Ratio steps in. It adjusts for nuances like WEC’s earnings growth, profit margin, size and specific risk factors, offering a refined “should-be” multiple. WEC’s Fair Ratio stands at 20.7x, very close to the company’s current 21.9x. This close alignment suggests the market is pricing WEC’s stock almost exactly in line with what would be expected, given its unique characteristics and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your WEC Energy Group Narrative

Earlier, we mentioned there might be a better way to understand a stock’s true value. Let’s introduce you to Narratives, a dynamic and user-friendly approach that empowers you to connect WEC Energy Group’s story with its financial forecast and fair value in just a few clicks.

A Narrative is your own personalized outlook for a company, blending your perspective on its future (such as assumptions for revenue growth, margins, or fair value) with the company’s real business drivers and risks. Instead of just relying on ratios and historical trends, you shape the story behind the numbers by deciding what you believe will influence WEC’s future and then seeing the expected value based on your assumptions.

Narratives are accessible directly on Simply Wall St’s Community page, making it simple for any investor to visualize their view, update their thesis as new information arrives, and compare their Fair Value against WEC’s latest share price to inform smarter buy or sell decisions. The best part is that Narratives automatically update with the latest data or news, so your outlook always stays relevant.

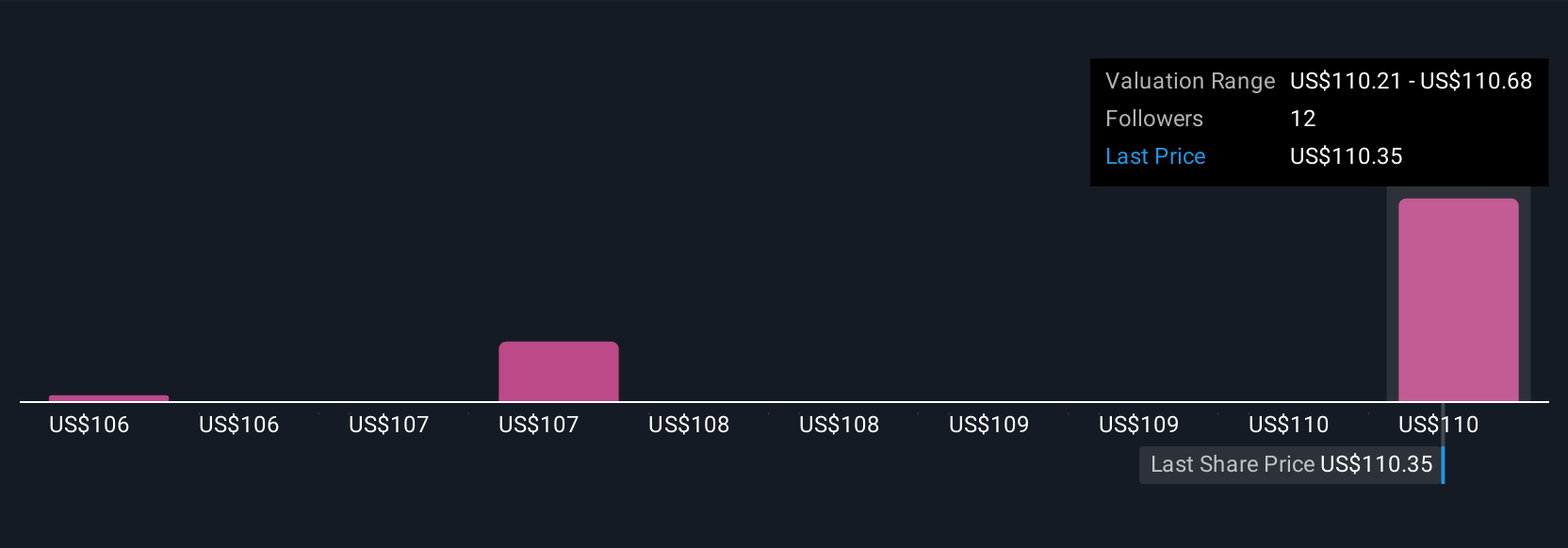

For example, one Narrative might expect surging demand from data centers and grid upgrades to drive WEC’s growth, projecting a fair value of $113 per share. Another may worry about regulatory risks and rising costs, setting fair value near $107. This demonstrates how your story shapes your valuation and action.

Do you think there's more to the story for WEC Energy Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.