Please use a PC Browser to access Register-Tadawul

Is Wendy’s (WEN) Chicken Tender Launch Signaling a New Approach to Menu Innovation?

Wendy's Company WEN | 8.02 | -0.25% |

- Wendy’s recently launched its new Chicken Tenders, called “Tendys,” across the U.S., accompanied by six new dipping sauces and packaging designed for easier dipping, with some restaurants in select cities temporarily rebranded as “Tendy’s” for the promotion.

- This move marks a significant effort to strengthen Wendy’s position in the competitive quick-service chicken segment and capture consumer attention with both product innovation and creative in-store marketing.

- To understand the potential impact of this nationwide chicken tender launch, we’ll explore how this menu update fits into Wendy’s broader growth and innovation plans.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Wendy's Investment Narrative Recap

Being a shareholder in Wendy’s means believing in the company’s ability to grow through menu innovation, digital investments, and international expansion, while navigating the challenges of a fiercely competitive U.S. market and margin pressures. The nationwide “Tendys” chicken tender launch is a clear bid to boost U.S. sales, but given recent soft same-store sales and persistent margin risks, its material impact as a short-term catalyst remains to be seen and is not yet evident in financial results.

Among recent announcements, Wendy’s Q2 earnings update is most relevant to this menu addition, with data showing U.S. sales down and international operations offsetting declines but not reversing overall softness. Connecting these results back to catalysts, continued menu innovation could support higher sales and average check size, critical factors given the negative trends flagged in recent financial releases.

However, investors should also keep an eye on how competitive pressure and price-focused promotions could affect Wendy’s ability to hold market share and profitability, especially if...

Wendy's narrative projects $2.3 billion revenue and $210.4 million earnings by 2028. This requires 1.2% yearly revenue growth and an $18.3 million earnings increase from $192.1 million.

Uncover how Wendy's forecasts yield a $11.86 fair value, a 24% upside to its current price.

Exploring Other Perspectives

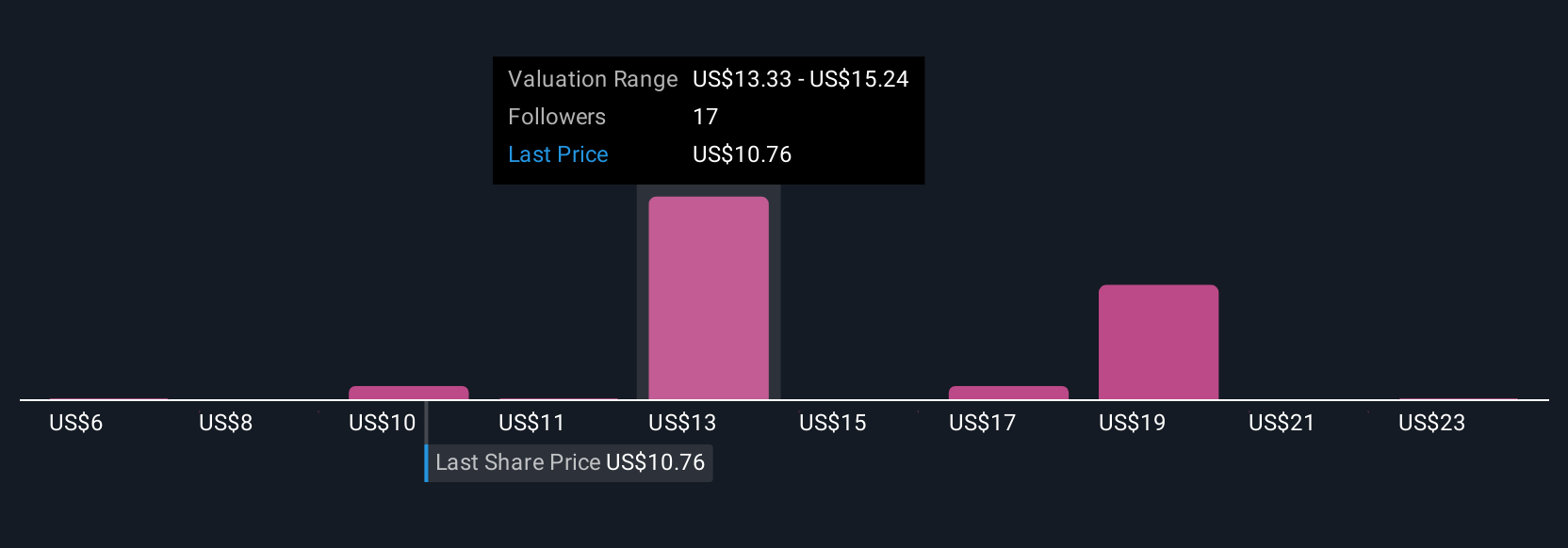

Simply Wall St Community members provided 10 distinct fair value estimates for Wendy’s, ranging from US$10 to US$24.79 per share. Given ongoing U.S. sales declines and tough competition, these varied views highlight the importance of considering multiple perspectives when evaluating the company's potential and risks.

Explore 10 other fair value estimates on Wendy's - why the stock might be worth over 2x more than the current price!

Build Your Own Wendy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wendy's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wendy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wendy's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.