Please use a PC Browser to access Register-Tadawul

Is Westlake (WLK) Quietly Tilting From Chemicals Toward Building Products With Its ACI Deal?

Westlake Corporation WLK | 94.40 | -0.69% |

- Westlake Royal Building Products, part of Westlake, recently showcased roofing brands and installation clinics at the 2026 International Roofing Expo, while Westlake completed its purchase of ACI/Perplastic Group’s global compounding solutions businesses across Portugal, Romania and Tunisia.

- This acquisition broadens Westlake’s Housing & Infrastructure Products reach in Europe and North Africa, potentially reshaping how investors view the balance between its building-products and commodity-chemicals exposure.

- We’ll now examine how Westlake’s ACI/Perplastic acquisition could influence its investment narrative and longer-term positioning in housing and infrastructure.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Westlake Investment Narrative Recap

To own Westlake, you need to believe in its shift toward more resilient Housing & Infrastructure Products while it works through chemical-cycle headwinds and recent losses. The ACI/Perplastic deal extends that housing and infrastructure footprint into Europe and North Africa, but it does not change the key near term swing factor, which remains how quickly oversupplied commodity chains and weak manufacturing demand can stabilize relative to ongoing cost and restructuring pressures.

The most relevant development here is Westlake’s completion of the ACI/Perplastic compounding acquisition, which slots neatly into its Housing & Infrastructure Products growth focus. Against a backdrop of global chlorovinyl capacity closures and cost cutting in the Performance and Essential Materials segment, this kind of downstream expansion helps clarify the evolving mix between higher value building products and more cyclical chemicals exposure, which is central to how investors may weigh the company’s future earnings quality and volatility.

Yet while this shift toward building products is encouraging, investors should also be aware of the risk that prolonged global chemical oversupply could still...

Westlake's narrative projects $13.0 billion revenue and $893.8 million earnings by 2028. This requires 3.5% yearly revenue growth and a $960.8 million earnings increase from $-67.0 million.

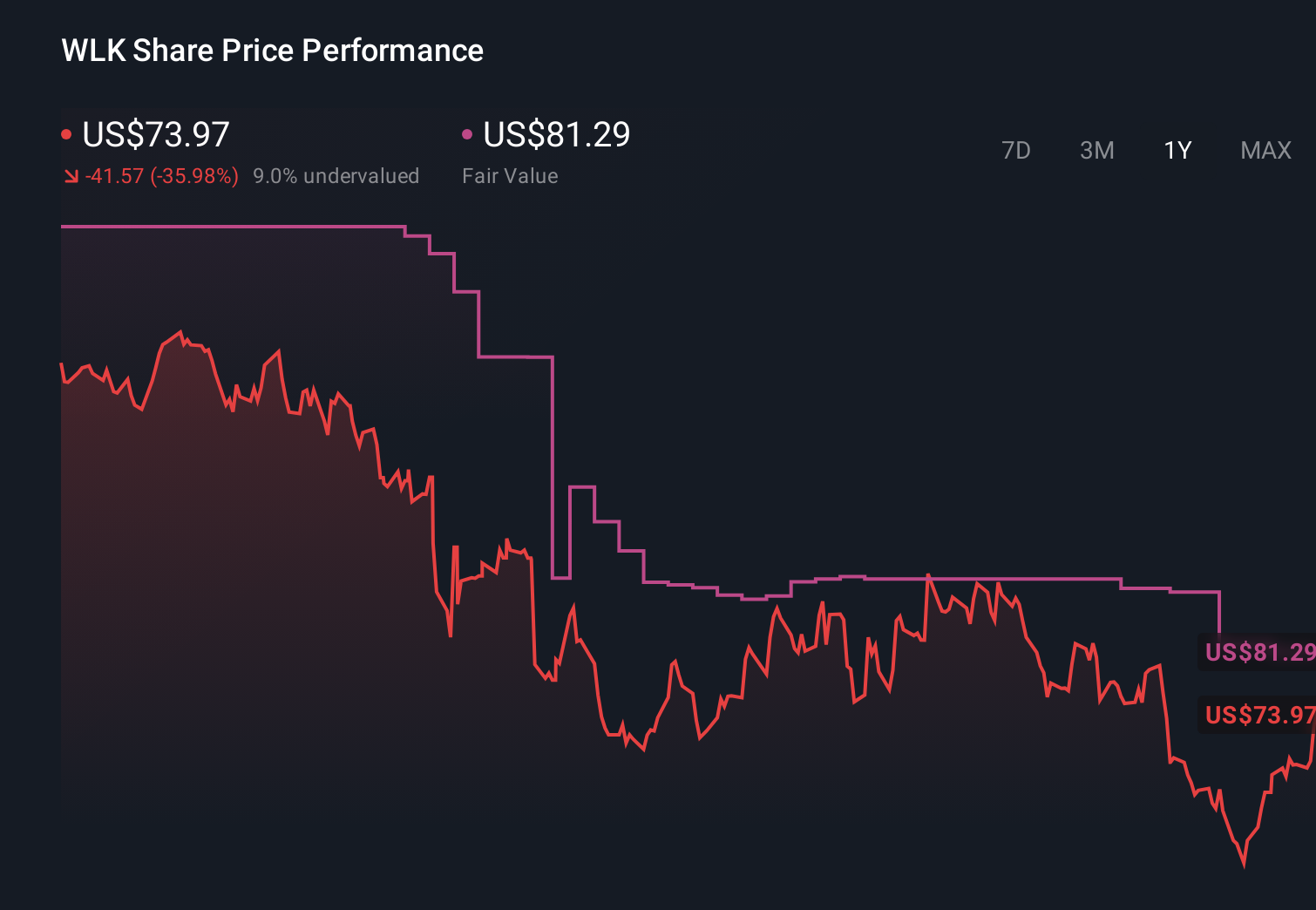

Uncover how Westlake's forecasts yield a $82.00 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently see fair value for Westlake between US$77.86 and US$82.00, underscoring how differently individual investors can read the same numbers. When you set those views against the risk of persistent global oversupply in key chemical chains, it becomes even more important to compare several perspectives before deciding how Westlake might fit into your portfolio.

Explore 2 other fair value estimates on Westlake - why the stock might be worth 11% less than the current price!

Build Your Own Westlake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westlake research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Westlake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westlake's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.