Please use a PC Browser to access Register-Tadawul

Is Zevra Therapeutics (ZVRA) Using Expanded Access To Quietly Recast Its Rare-Disease Growth Story?

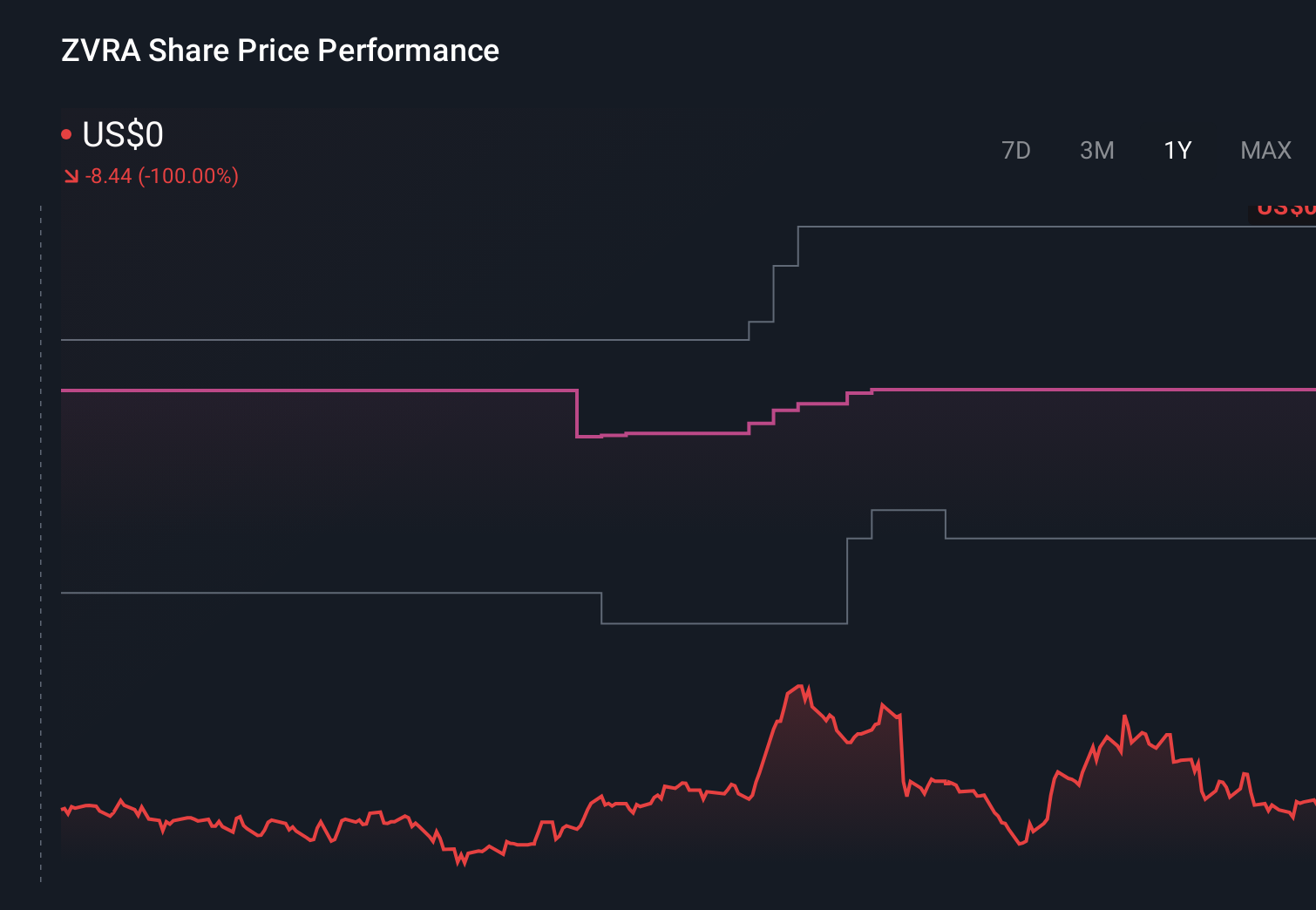

Zevra Therapeutics, Inc. ZVRA | 9.17 9.17 | +2.80% 0.00% Pre |

- Zevra Therapeutics recently announced an exclusive expanded access distribution agreement with Ireland-based Uniphar, enabling Niemann-Pick Disease Type C patients in selected territories outside Europe to obtain reimbursed named-patient supply of MIPLYFFA (arimoclomol), which is already approved and commercially available in the US.

- The deal effectively extends MIPLYFFA’s reach beyond its current US and European early-access footprint, potentially broadening treatment availability for an ultra-rare, life-limiting disease where MIPLYFFA used with miglustat is reported to halt progression and maintain benefits over more than five years.

- We’ll now examine how this expanded access deal for MIPLYFFA with Uniphar could reshape Zevra’s rare-disease growth narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Zevra Therapeutics Investment Narrative Recap

To own Zevra, you need to believe MIPLYFFA can anchor a sustainable rare-disease franchise despite a tiny NPC patient pool and OLPRUVA’s weak traction. The Uniphar expanded access deal modestly supports that thesis by widening reimbursed reach outside Europe, but the key near term catalyst remains European regulatory and reimbursement progress, while heavy reliance on a single ultra-orphan asset and past OLPRUVA impairments still frame the main risks.

The recent Marketing Authorisation Application for arimoclomol under EMA review is the announcement most closely tied to this Uniphar agreement, since both target growth beyond the US. Together, they highlight Zevra’s push to convert clinical data and early access into a broader international footprint, while the timing and outcome of country-by-country reimbursement decisions could materially influence how much value that footprint ultimately creates.

Yet, investors should also think carefully about how OLPRUVA’s large impairment and slow adoption might affect...

Zevra Therapeutics' narrative projects $296.5 million revenue and $151.4 million earnings by 2028. This requires 68.5% yearly revenue growth and an earnings increase of about $155.3 million from -$3.9 million today.

Uncover how Zevra Therapeutics' forecasts yield a $23.22 fair value, a 178% upside to its current price.

Exploring Other Perspectives

Eleven members of the Simply Wall St Community see Zevra’s fair value anywhere between US$18 and about US$103, underlining very different expectations. Set that against the company’s reliance on a single ultra-orphan drug and the uncertainties around European access, and it becomes clear why you may want to compare several views before forming your own.

Explore 11 other fair value estimates on Zevra Therapeutics - why the stock might be worth just $18.00!

Build Your Own Zevra Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.