Please use a PC Browser to access Register-Tadawul

Is Zevra Therapeutics (ZVRA) Using J.P. Morgan Spotlight To Reframe Its Rare-Disease Investment Story?

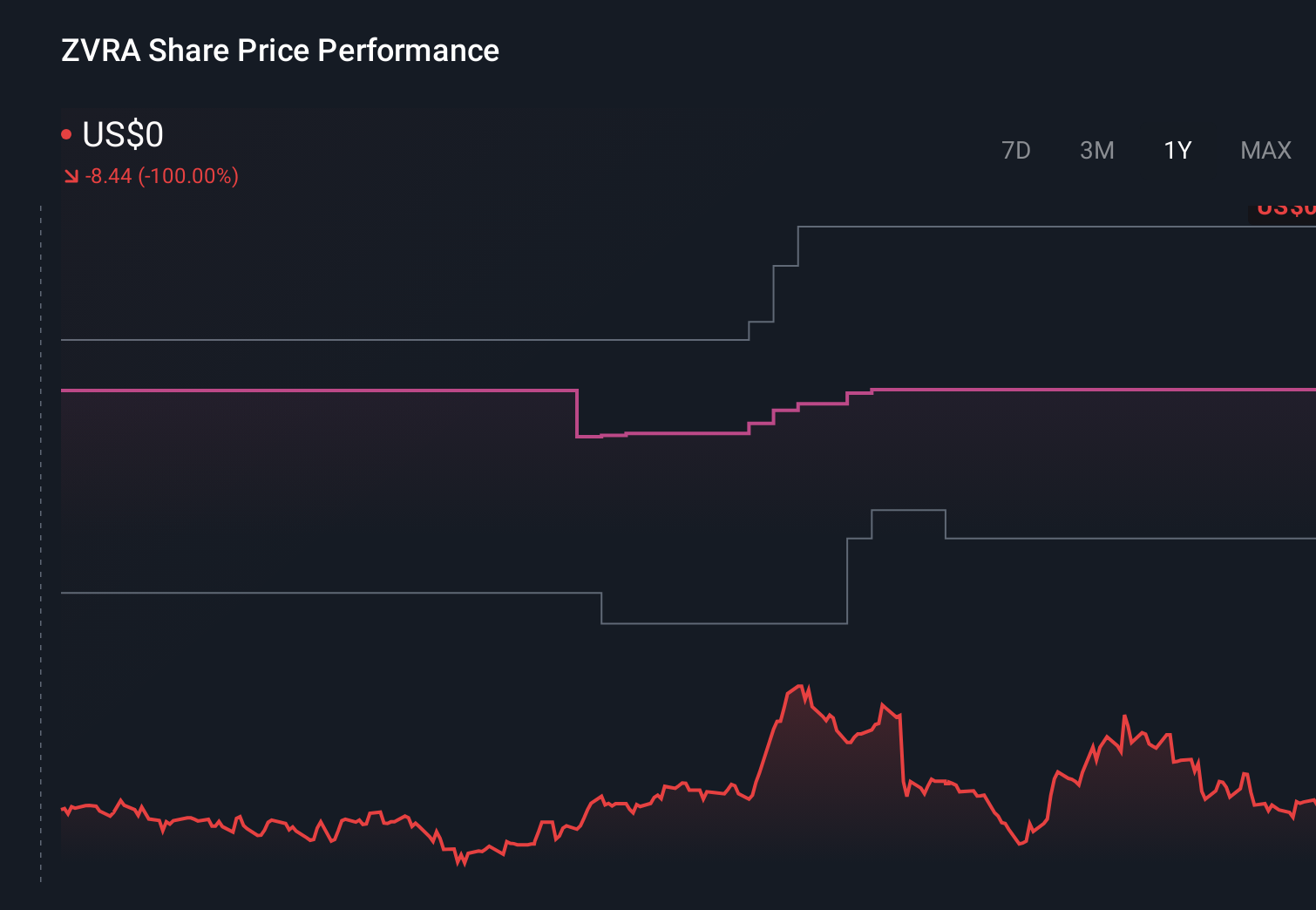

Zevra Therapeutics, Inc. ZVRA | 8.80 | -1.01% |

- Zevra Therapeutics, Inc. presented at the 44th Annual J.P. Morgan Healthcare Conference on January 15, 2026, at The Westin St. Francis Hotel’s 111 Minna Gallery in San Francisco.

- This high-profile conference appearance gave Zevra a platform to highlight its rare disease focus and pipeline priorities to a concentrated audience of healthcare investors and industry partners.

- We’ll now examine how Zevra’s high-visibility J.P. Morgan Healthcare Conference presentation may influence its rare-disease-focused investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Zevra Therapeutics Investment Narrative Recap

To own Zevra, you need to believe its focused rare disease portfolio, led by MIPLYFFA and supported by OLPRUVA and pipeline assets, can justify today’s risk profile. The J.P. Morgan appearance mainly boosts visibility and relationships, but does not materially change the near term balance between the key catalyst of broader MIPLYFFA uptake and the ongoing risk from OLPRUVA’s slow adoption and past impairment.

In this context, Zevra’s 2025 EMA submission for MIPLYFFA in Niemann Pick disease type C stands out, as it directly ties into the conference story: management now has a high profile forum to frame European reimbursement ambitions, regulatory progress and remaining hurdles alongside its U.S. commercial effort, all central to how the market views its rare disease thesis.

However, investors should also be aware that OLPRUVA’s prior US$58.7 million impairment and US$11.7 million inventory write down highlight...

Zevra Therapeutics' narrative projects $296.5 million revenue and $151.4 million earnings by 2028.

Uncover how Zevra Therapeutics' forecasts yield a $23.22 fair value, a 153% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer 11 fair value views on Zevra, ranging from US$18 to about US$103, underscoring how far opinions can stretch. Against this wide spread, the continuing pressure around OLPRUVA’s slow uptake and prior impairment keeps execution risk front of mind and encourages you to compare several different rare disease theses before forming your own view.

Explore 11 other fair value estimates on Zevra Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Zevra Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.