Please use a PC Browser to access Register-Tadawul

ITT Acquisition Of SPX FLOW Puts Growth And Valuation In Focus

ITT, Inc. ITT | 206.47 | +1.05% |

- ITT Inc. (NYSE:ITT) plans to acquire SPX FLOW, with the deal expected to close in March.

- The acquisition is described as a meaningful step for ITT's growth profile and profit margins.

- Management expects the transaction to contribute to earnings per share in the coming year.

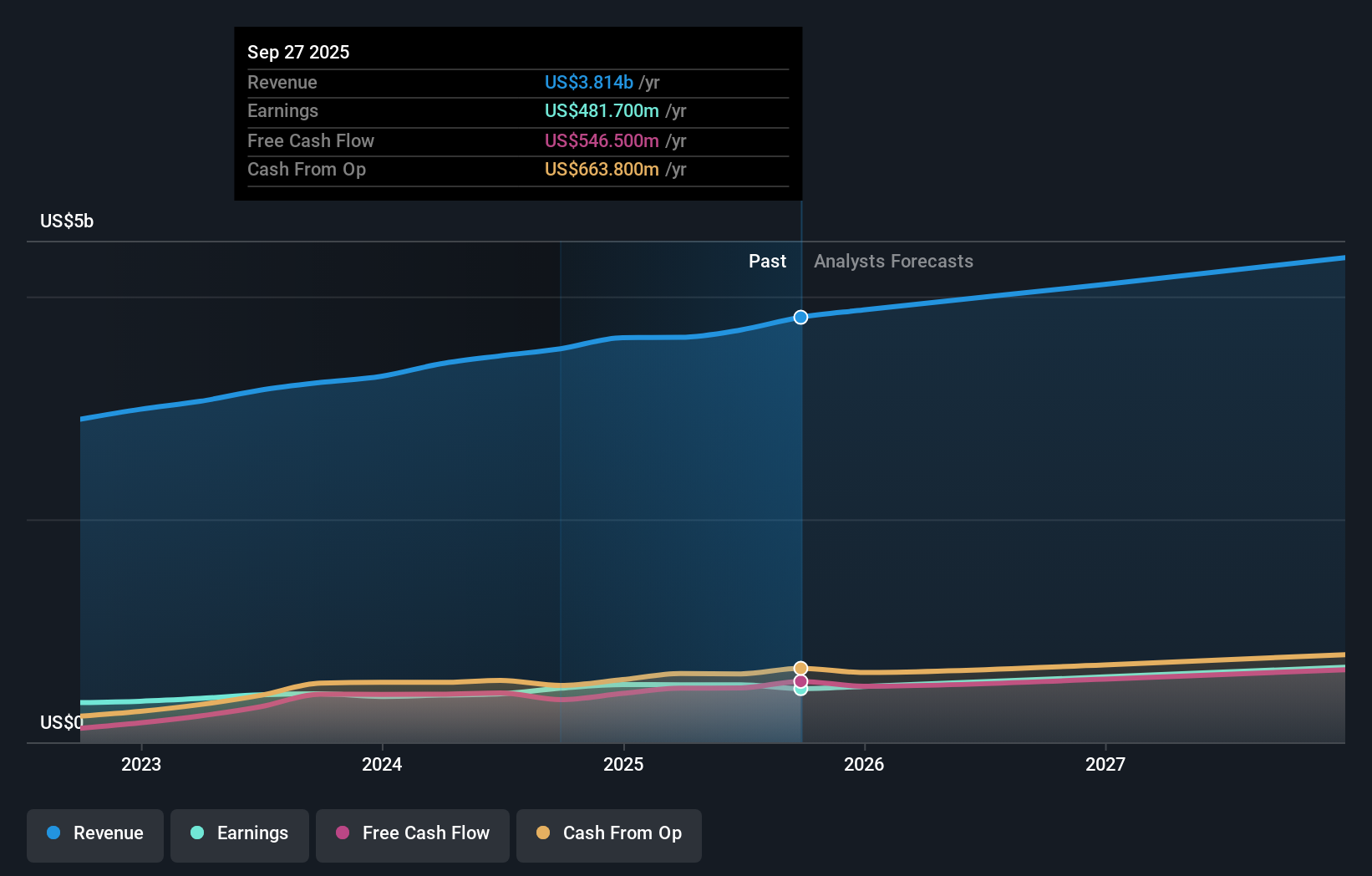

ITT Inc. operates across industrial markets, supplying critical components and systems for sectors such as fluid handling, motion technologies and industrial processes. The planned addition of SPX FLOW fits into this broader industrial equipment theme, where companies are focusing on scale, product breadth and service capabilities. For investors, the deal sits alongside ITT's recent earnings results as a key update on how the business is evolving.

Looking ahead, the closing of the SPX FLOW transaction and subsequent integration will be central to how ITT's growth profile, margins and earnings mix develop. Investors may want to watch how management executes on cost efficiency, cross selling and capital allocation once the acquisition is completed, as these elements often shape the long term value of large transactions.

Stay updated on the most important news stories for ITT by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on ITT.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$202.05 versus a US$213.00 consensus target, ITT is about 5% below analyst expectations.

- ⚖️ Simply Wall St Valuation: Shares are described as trading close to estimated fair value, so there is no strong value signal either way.

- ✅ Recent Momentum: A 30 day return of 12.26% shows solid short term positive momentum ahead of the SPX FLOW deal.

Check out Simply Wall St's in depth valuation analysis for ITT.

Key Considerations

- 📊 The SPX FLOW acquisition is framed as a key driver for ITT's future growth profile and margins, so your thesis may hinge on how well that story plays out.

- 📊 Watch the P/E of 36.1 against the Machinery industry average of 27.9, earnings per share delivery after close, and any margin commentary tied directly to the new assets.

- ⚠️ Integration execution risk is front and center, including how management handles costs, cross selling and capital allocation once SPX FLOW is on the books.

Dig Deeper

For the full picture including more risks and rewards, check out the complete ITT analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.