Please use a PC Browser to access Register-Tadawul

Ivanhoe Electric Links Chile Copper Search With US Supply Chain Plans

Ivanhoe Electric Inc. IE | 14.92 | -2.86% |

- Ivanhoe Electric (NYSEAM:IE) signed a collaboration and exploration agreement with Chilean miner SQM to search for copper across more than 2,000 km2 in northern Chile.

- The company is using its geophysical technologies in this program, which could lead to joint venture opportunities on any future deposits that are identified.

- Ivanhoe Electric took part in a White House event launching a US$12b US minerals stockpile initiative that includes a US$825m Export Import Bank letter of interest for its Santa Cruz Copper Project.

For you as an investor, this connects Ivanhoe Electric’s copper exploration business directly with both Chilean resource potential and US minerals policy. The company focuses on finding and developing copper and other critical minerals. The Chile exploration area and the Santa Cruz Copper Project are part of a broader push by governments to secure long-term supply chains.

These developments show how NYSEAM:IE is positioning its projects within large public and private capital programs related to critical minerals. Key points to monitor include exploration results in Chile and any progress in the US Export Import Bank discussions toward more detailed funding terms.

Stay updated on the most important news stories for Ivanhoe Electric by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Ivanhoe Electric.

The SQM agreement gives Ivanhoe Electric access to 2,002 km2 of copper targets in northern Chile with SQM funding the first US$9m of work, while the US Project Vault involvement links its Arizona Santa Cruz Copper Project to a US$12b minerals stockpile program. For you, the key takeaway is that Ivanhoe Electric is trying to pair its exploration-technology model with large balance sheet partners and policy-driven capital, which can be important in a capital intensive industry that includes peers like Freeport McMoRan and BHP.

How this fits into the Ivanhoe Electric narrative

Ivanhoe Electric is positioning itself as both a copper explorer using proprietary geophysical tools and a potential supplier into US-focused supply chains, and this news ties those two threads together. The Chile JV framework and the US Export Import Bank letter of interest for US$825m of project debt indicate that the company is looking to move from pure exploration towards larger project-level partnerships without shouldering all early stage funding alone.

Risks and rewards to keep in mind

- SQM carries the initial US$9m exploration spend, which limits upfront cash outlay for Ivanhoe Electric while still giving it an option on large scale discoveries.

- The option to form a 50/50 joint venture on any qualifying deposit and the potential US Export Import Bank project debt could broaden funding sources beyond equity.

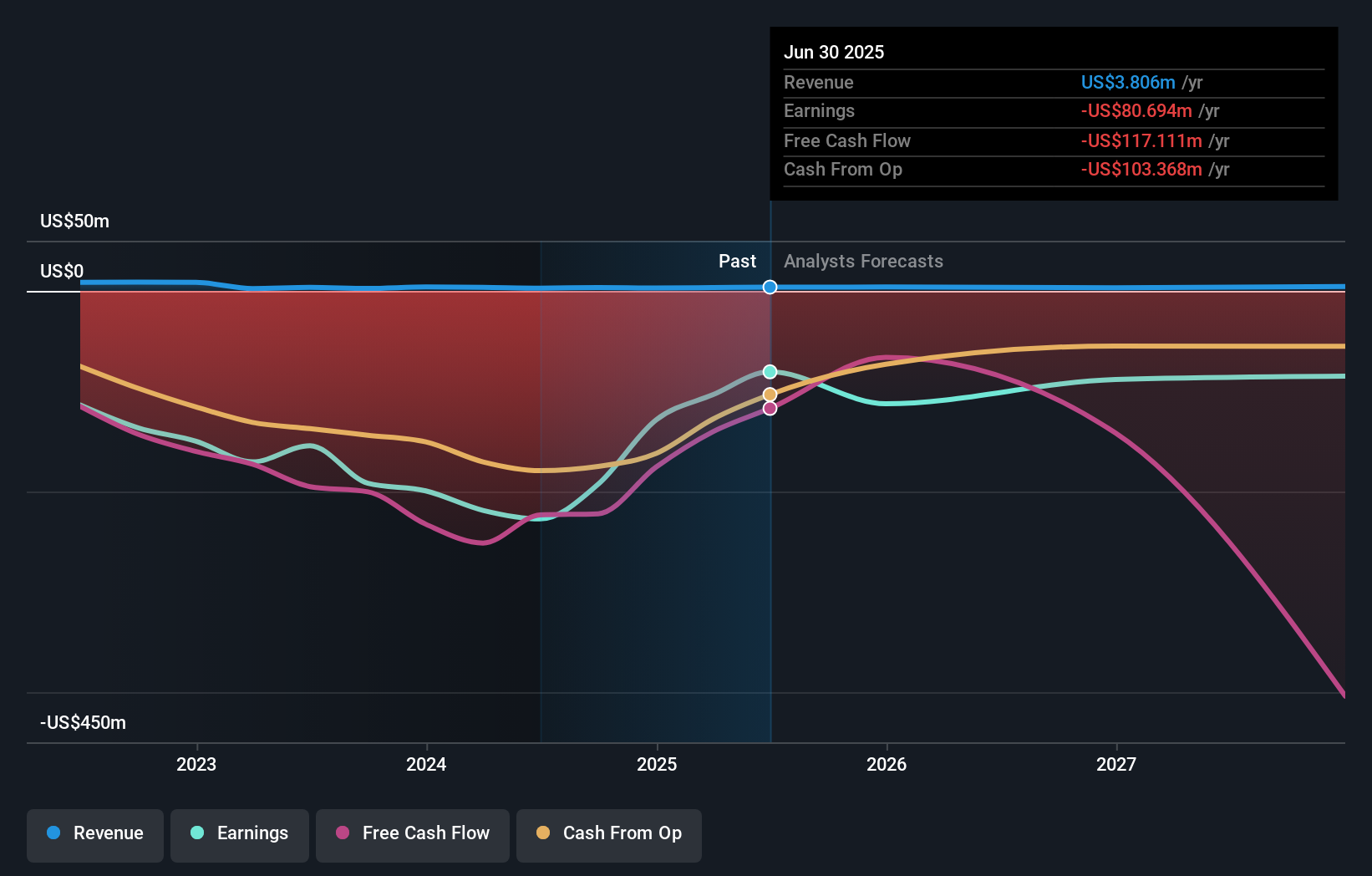

- The company is currently unprofitable, has limited revenue and analysts have flagged 5 key risks, including past shareholder dilution and share price volatility.

- The Santa Cruz Copper Project and any Chilean deposit still face typical mining sector uncertainties such as permitting, construction execution and long timelines before potential production.

What to watch from here

From here, the practical checkpoints are whether Typhoon surveys in Chile outline any qualifying deposits, how quickly the JV terms are exercised if that happens, and whether the US Export Import Bank interest in Santa Cruz moves into binding loan agreements. If you want to see how other investors are thinking about these developments and how they fit into a longer term thesis, take a look at the community views on Ivanhoe Electric narratives here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.