Please use a PC Browser to access Register-Tadawul

IZEA Worldwide, Inc. (NASDAQ:IZEA) Stock Rockets 46% But Many Are Still Ignoring The Company

IZEA, Inc. IZEA | 4.88 | -2.59% |

IZEA Worldwide, Inc. (NASDAQ:IZEA) shares have had a really impressive month, gaining 46% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

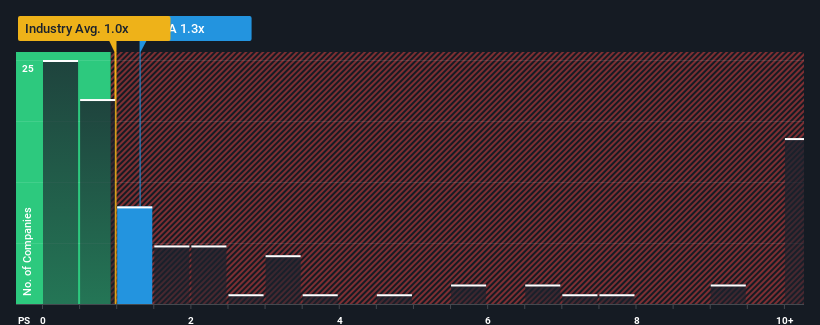

Even after such a large jump in price, it's still not a stretch to say that IZEA Worldwide's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Interactive Media and Services industry in the United States, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We've discovered 1 warning sign about IZEA Worldwide. View them for free.

What Does IZEA Worldwide's P/S Mean For Shareholders?

IZEA Worldwide could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think IZEA Worldwide's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For IZEA Worldwide?

In order to justify its P/S ratio, IZEA Worldwide would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.2% last year. The solid recent performance means it was also able to grow revenue by 11% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 15% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

With this in consideration, we find it intriguing that IZEA Worldwide's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On IZEA Worldwide's P/S

IZEA Worldwide appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at IZEA Worldwide's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.