Please use a PC Browser to access Register-Tadawul

Jack Abraham Board Role Links Hims And Hers To Research Frontline

Hims & Hers Health, Inc. Class A HIMS | 24.40 | -4.46% |

- Jack Abraham, founder of Atomic and co founder of Hims & Hers Health (NYSE:HIMS), has been elected to the governing board of Cold Spring Harbor Laboratory.

- The appointment links Hims & Hers Health to a long established biomedical research institution with influence across genetics, neuroscience, and cancer research.

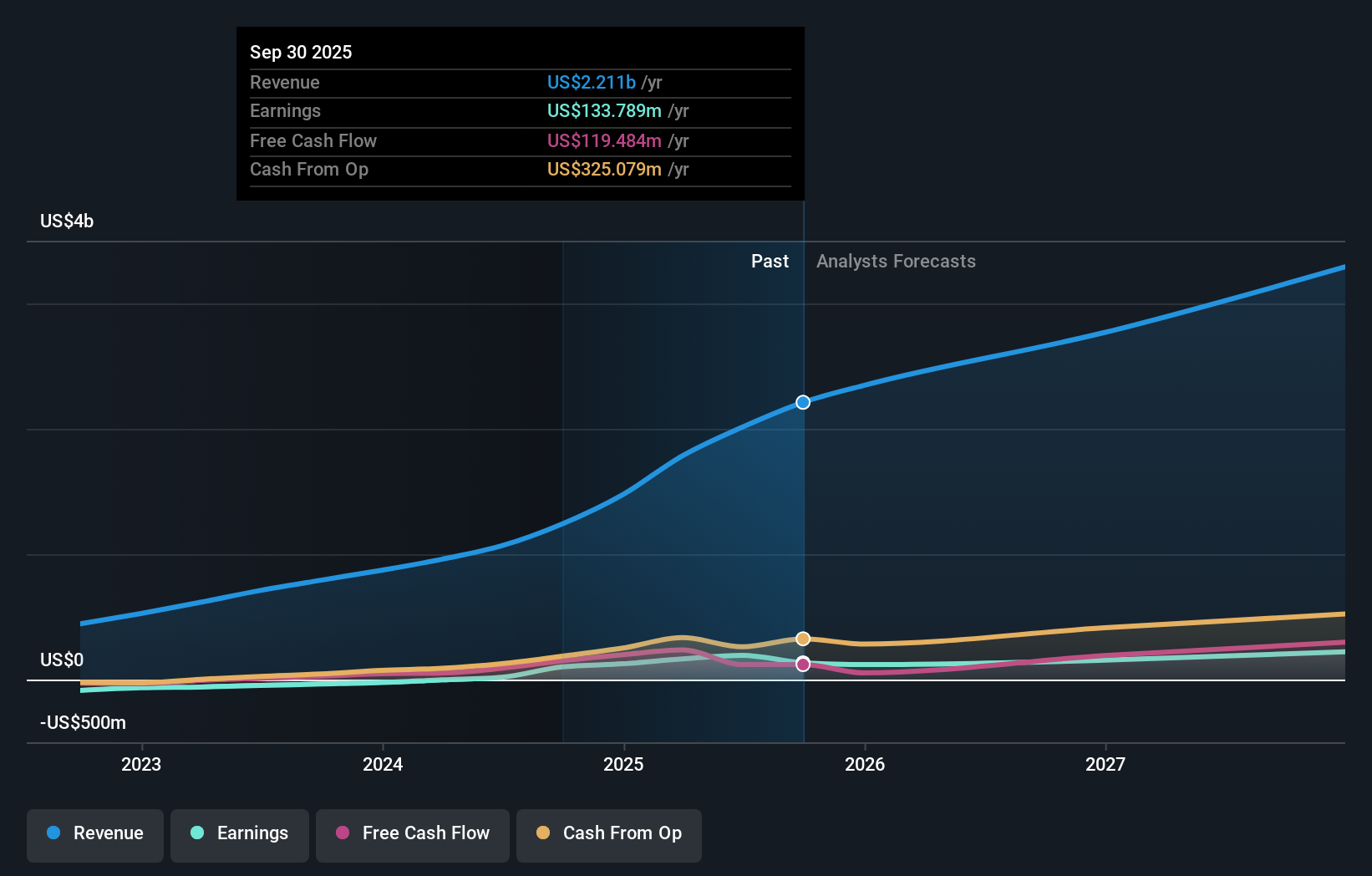

For Hims & Hers Health, which closed at $29.68, this governance role gives a co founder closer proximity to scientific networks that sit at the core of modern healthcare and biotechnology. Over the past 3 years, NYSE:HIMS has delivered a very large return, while its 1 year return of 5.9% and 5 year return of 48.3% provide additional context for how the market has treated the stock across different time frames.

Investors watching NYSE:HIMS may treat Abraham's new position as another indication of how the company wants to be connected to research intensive segments of healthcare. The appointment may influence how some shareholders view the company's long term relationships, potential partnerships, and access to emerging science around conditions that matter for its current and future product offerings.

Stay updated on the most important news stories for Hims & Hers Health by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Hims & Hers Health.

Jack Abraham joining the Cold Spring Harbor Laboratory board gives Hims & Hers a direct line into a long-established research hub in genetics, neuroscience, and oncology, which sits close to areas like mental health, weight management, and hormonal care that the company already targets. For a telehealth platform competing with players such as Teladoc Health and Ro, that kind of proximity to early scientific work could influence how quickly it spots new treatment categories or refines its clinical approach.

How this fits the Hims & Hers Health narrative

This board role fits neatly with the long-term vision of Hims & Hers as a broad, personalised-health platform rather than a single-pill business, where diagnostics, treatment, and prevention sit on one stack. Investors who buy into that narrative may see the CSHL connection as another data point that the company is trying to stay close to the front edge of science across areas like hormonal health, weight loss and longevity-focused care.

Risks and rewards to keep in mind

- Potential for earlier insight into emerging therapies that could support new long-term product lines across mental health, metabolic and hormonal categories.

- Added credibility with clinicians and partners if Hims & Hers can point to governance links with a respected research institution.

- Execution risk if management attention is spread across too many initiatives while the core business is already dealing with regulatory scrutiny and earnings estimate pressure.

- No direct revenue tie from this appointment, so investors may need to treat it as a qualitative signal rather than a clear financial catalyst.

What to watch next

From here, it is worth watching whether Hims & Hers references CSHL-related work when it talks about new service lines, clinical protocols, or potential partnerships, especially in categories where competition with firms like Teladoc and Ro is intense. If you want to see how this kind of development fits into the broader long-term story, check community narratives on the company’s profile and see how other investors are framing the next chapter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.