Please use a PC Browser to access Register-Tadawul

Jack Henry & Associates (JKHY): Evaluating Valuation After New Embedded Finance Partnership with Bits of Stock

Jack Henry & Associates, Inc. JKHY | 187.50 | +0.17% |

If you’re watching Jack Henry & Associates (JKHY) closely, the recent announcement might pique your curiosity. The company unveiled a strategic partnership with Bits of Stock, letting banks and credit unions offer fractional stock rewards to customers directly through their digital accounts. This move signals a broader effort to modernize traditional banking and entice a new generation of depositors, tapping into the embedded finance trend that is reshaping the industry.

Jack Henry’s shares have slipped almost 8% in the past year and are down about 11% over the past 3 months, reflecting dampened momentum compared to previous years. Still, management has not slowed on innovation. In addition to launching seamless Buy Now Pay Later integrations and expanding fintech partnerships, this latest alliance is designed to deepen client engagement and open up more avenues for fee income. While share performance has lagged, the company continues to report stable revenue and net income growth year over year.

After a year of underperformance but meaningful product innovation, is Jack Henry now undervalued, or is the market pricing in the potential of embedded finance growth ahead?

Most Popular Narrative: 13.5% Undervalued

According to the most widely followed narrative, Jack Henry & Associates is currently undervalued by 13.5% compared to its estimated fair value. This perspective is built on expectations of solid, though not breakneck, future earnings growth and increasing margins thanks to the company’s accelerating adoption of cloud solutions and digital banking products.

The company is experiencing accelerated adoption of its cloud-native platforms and SaaS offerings, which is expected to drive higher recurring revenue, improved margins, and higher free cash flow conversion as legacy on-premise contracts decline. Jack Henry's strong momentum in serving larger financial institutions is evident in recent new core client wins in the $1B+ and $5-10B asset ranges. The total assets of new core clients have nearly tripled over three years, supporting longer-term revenue and earnings growth. Larger institutions typically have stickier, higher-value contracts and longer implementation cycles that ramp up over subsequent fiscal periods.

Eager to know what fuels this upbeat analyst outlook? There is a bold quantitative road map behind that double-digit discount, featuring projections on rapid digital adoption, rising margins, and a future profit multiple that outpaces the rest of the sector. Want the full story on the specific profit and revenue milestones that could justify this valuation leap? Find out what drives the consensus and whether those financial targets can really be met.

Result: Fair Value of $185.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent bank mergers and mounting pricing pressure on contract renewals could limit Jack Henry’s margin gains and slow the anticipated growth trajectory.

Find out about the key risks to this Jack Henry & Associates narrative.Another View: A Look Through the Lens of Market Comparisons

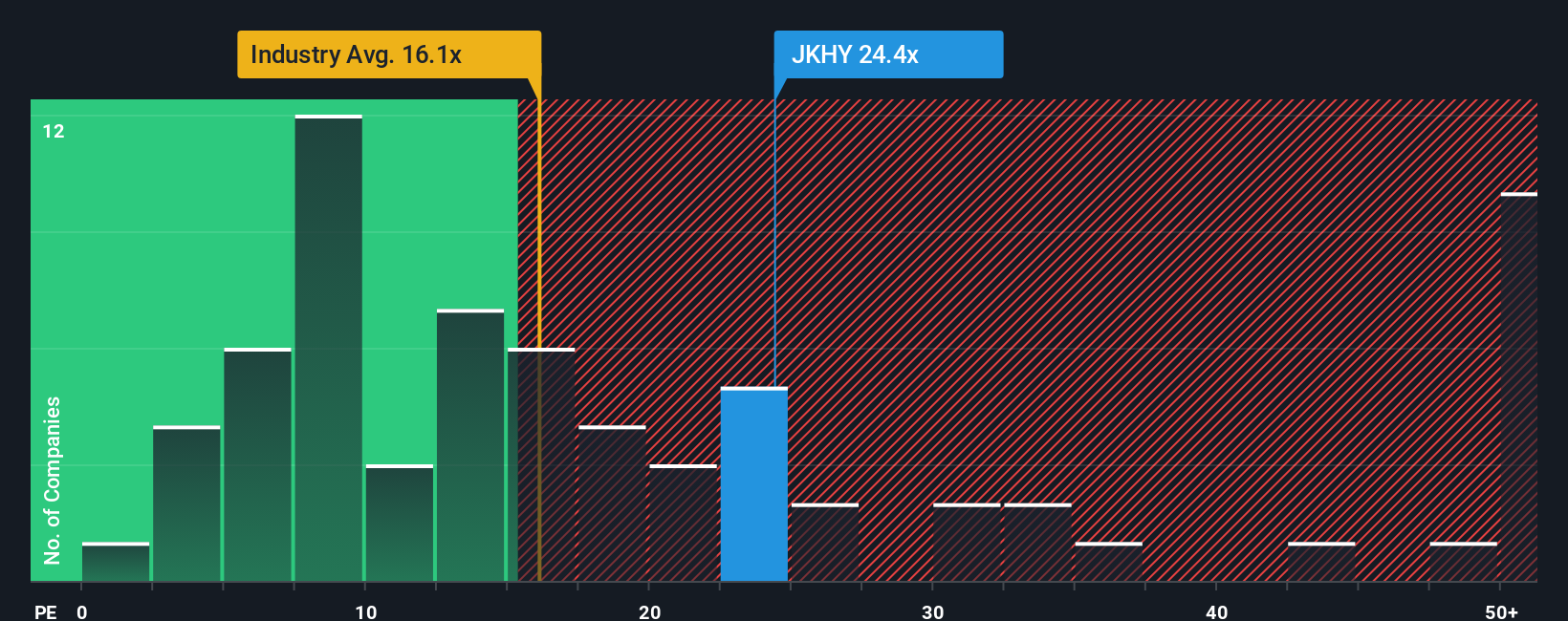

While analyst forecasts suggest Jack Henry may be undervalued, comparing the company's current earnings multiple to the broader industry presents a pricier picture. Is the market banking on growth that is not fully reflected in the fundamentals yet?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jack Henry & Associates Narrative

If you see things differently or want to investigate the numbers yourself, you can craft a personalized narrative that fits your own analysis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Jack Henry & Associates.

Looking for more investment ideas?

Unleash your investing strategy with unique opportunities you might be missing elsewhere. These hand-picked screens could help spark your next winning idea.

- Spot tomorrow’s market movers by browsing penny stocks with robust financials through penny stocks with strong financials. See which under-the-radar names are catching momentum.

- Pursue consistent income streams by checking out companies focused on reliable yields and strong dividends via dividend stocks with yields > 3%.

- Jump ahead of the curve and identify emerging potential in the world of artificial intelligence by exploring AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.