Please use a PC Browser to access Register-Tadawul

Jacobs Solutions (J) Wins Major Port of Long Beach Rail Project Is Backlog Growth Set to Accelerate?

JACOBS ENGINEERING GROUP INC J | 135.72 | -0.74% |

- In recent days, Jacobs Solutions was awarded a contract to provide construction management for the Port of Long Beach's Pier B On-Dock Rail Support Facility, part of a US$2.2 billion program to double the facility's size and more than triple rail capacity at the port.

- This project is expected to reduce truck traffic, lower emissions, create over 1,000 local jobs, and support Jacobs’ growing presence in large-scale, sustainability-focused infrastructure initiatives.

- We'll explore how this major infrastructure contract win enhances Jacobs Solutions' investment narrative, especially regarding its backlog growth and sector leadership.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Jacobs Solutions Investment Narrative Recap

To be a shareholder in Jacobs Solutions, you need confidence that secular tailwinds in infrastructure modernization, sustainability, and digital transformation will continue fueling record backlog growth and strong multi-year revenue visibility. While the recent Long Beach Pier B contract further reinforces Jacobs’ backlog and sector leadership, it does not materially alter the biggest immediate catalyst, sustaining robust public- and private-sector infrastructure spending, or the largest risk: potential funding disruptions or policy changes impacting project pipelines.

Among Jacobs’ announcements, the company’s new contract wins in water and transportation operations and maintenance are especially relevant, as they closely align with the Pier B Rail project’s focus on efficiency, sustainability, and recurring revenue streams. These wins also support the view that recurring and multi-year projects, underpinning backlog growth, remain a critical catalyst for investor confidence.

Yet, it’s important to keep in mind that, by contrast, government or public funding shifts remain a risk investors should be aware of...

Jacobs Solutions' outlook forecasts $14.4 billion in revenue and $973.6 million in earnings by 2028. This implies an 11.1% annual revenue growth rate and a $564.6 million earnings increase from current earnings of $409.0 million.

Uncover how Jacobs Solutions' forecasts yield a $148.74 fair value, in line with its current price.

Exploring Other Perspectives

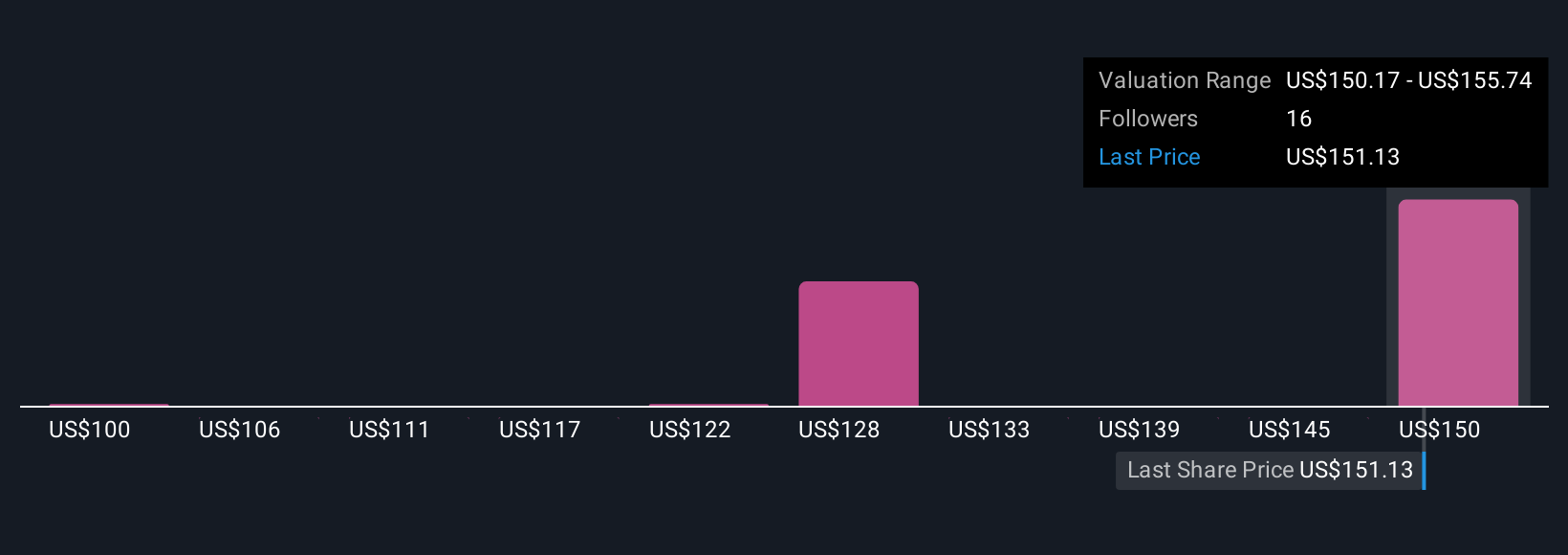

Simply Wall St Community members have shared fair value estimates for Jacobs Solutions ranging from US$100 to US$148.74, based on three unique approaches. With this breadth of opinion, keep in mind that sustained infrastructure spending is a vital catalyst shaping the outlook for future profitability.

Explore 3 other fair value estimates on Jacobs Solutions - why the stock might be worth 33% less than the current price!

Build Your Own Jacobs Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jacobs Solutions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Jacobs Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jacobs Solutions' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.