Please use a PC Browser to access Register-Tadawul

J&J Snack Foods (JJSF): Reassessing Valuation After a Recent Share Price Bounce

J & J Snack Foods Corp. JJSF | 92.44 | -2.03% |

J&J Snack Foods (JJSF) has quietly bounced about 13% over the past month, even as its longer term returns and revenue trend remain weak. That kind of divergence usually makes investors ask what the market is starting to price in.

That recent 12.6% 1 month share price return looks more like a short term reset than a full trend change, given the roughly 40% year to date share price decline and weak multi year total shareholder returns.

If that reversal has you rethinking where to look for the next opportunity, now could be a good time to explore fast growing stocks with high insider ownership.

So with J&J Snack Foods trading well below its recent highs but still at a modest discount to analyst targets, are investors looking at a bargain in a temporarily pressured business, or is the market already pricing in a rebound?

Most Popular Narrative: 15.6% Undervalued

With J&J Snack Foods last closing at $92.79 versus a narrative fair value of $110, the current price implies the market is discounting that upside.

Operational improvements through supply chain optimization, automation, and facility consolidation (for example, shifting handhelds production to a more efficient plant and reducing distribution/freight costs) are expected to drive higher net margins and earnings over time.

Ongoing product innovation and the expansion of better-for-you offerings, such as high-protein and whole-grain items, clean label novelties, and the removal of artificial colors, expands the accessible market and aligns with evolving consumer preferences, paving the way for sustained top-line growth.

Curious how modest revenue growth, fatter margins, and a richer future earnings multiple can still produce this upside gap, and why analysts think it holds?

Result: Fair Value of $110 (UNDERVALUED)

However, several risks could derail that upside, including sustained ingredient cost inflation and weaker retail demand for legacy frozen novelties and handhelds.

Another Angle on Value

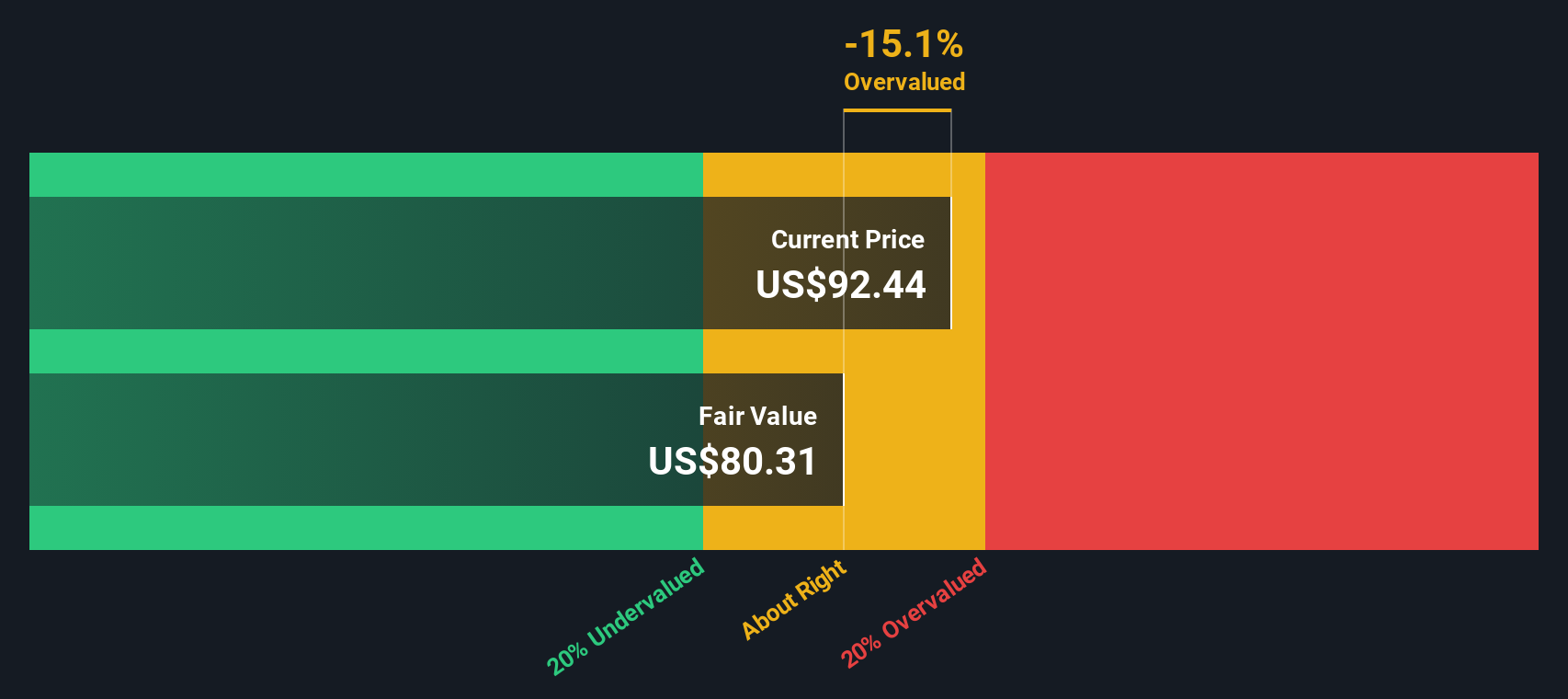

Our SWS DCF model paints a cooler picture, putting fair value closer to $80 than $110, which makes the current $92.79 share price look overvalued rather than cheap. If cash flows are right and the multiple view is wrong, how much upside is really left?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out J&J Snack Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own J&J Snack Foods Narrative

If you are not fully aligned with these views or want to dig into the numbers yourself, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your J&J Snack Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single stock when you can scan the market for fresh ideas, uncover new angles, and position yourself ahead of the next big shift.

- Capture potential income and stability by targeting companies in these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Ride structural growth trends by zeroing in on innovators behind these 25 AI penny stocks shaping the future of intelligent technology.

- Seize mispriced opportunities by focusing on these 909 undervalued stocks based on cash flows that the market has yet to fully recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.