Please use a PC Browser to access Register-Tadawul

Johnson & Johnson (JNJ): Neutral Valuation Insights as Shares Show a Steady Climb

Johnson & Johnson JNJ | 209.29 | -2.28% |

Johnson & Johnson (JNJ) has been on investors’ radar recently, not because of a headline-grabbing event, but due to a steady movement in its share price that could prompt a closer look. Sometimes, the absence of big news can be just as telling for shareholders trying to decide what happens next. Are these gradual shifts the market’s way of reflecting hidden strengths, emerging risks, or simply business as usual?

If we take a step back, Johnson & Johnson’s stock has posted double-digit gains over the past year and has picked up momentum in recent months. While recent earnings and business updates have not set off fireworks, the stock’s 23% year-to-date climb signals increasing market interest. Short-term declines seem to have had little impact on the longer upward trend, suggesting resilience even amid a few bumps this year.

With this performance in mind, investors have to ask whether JNJ is offering good value or if the stock is already reflecting expectations of more steady growth ahead.

Most Popular Narrative: 2.6% Overvalued

The most widely discussed narrative at present suggests Johnson & Johnson may be trading slightly above its calculated intrinsic value, with signals from recent performance and future expectations playing a major role in shaping this view.

I am maintaining my 6% annual revenue growth estimate and extending it to 2029, resulting in around $120B of sales in 2029. I believe that extrapolating the past 1.45% CAGR growth of the past 10 years is a misconception because JNJ will be focused on a higher return business, particularly since the Kenvue spinoff.

How do these bullish projections compare to Johnson & Johnson’s current share price? This narrative relies on an ambitious revenue roadmap and margin assumptions that set a much higher bar for future performance. Explore which new business mix metrics are contributing to this fair value debate and discover the financial levers influencing the narrative’s outlook.

Result: Fair Value of $173.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, lingering patent expirations and ongoing litigation remain key risks that could quickly challenge the optimistic outlook underlying Johnson & Johnson’s current valuation.

Find out about the key risks to this Johnson & Johnson narrative.Another View: What Does the SWS DCF Model Say?

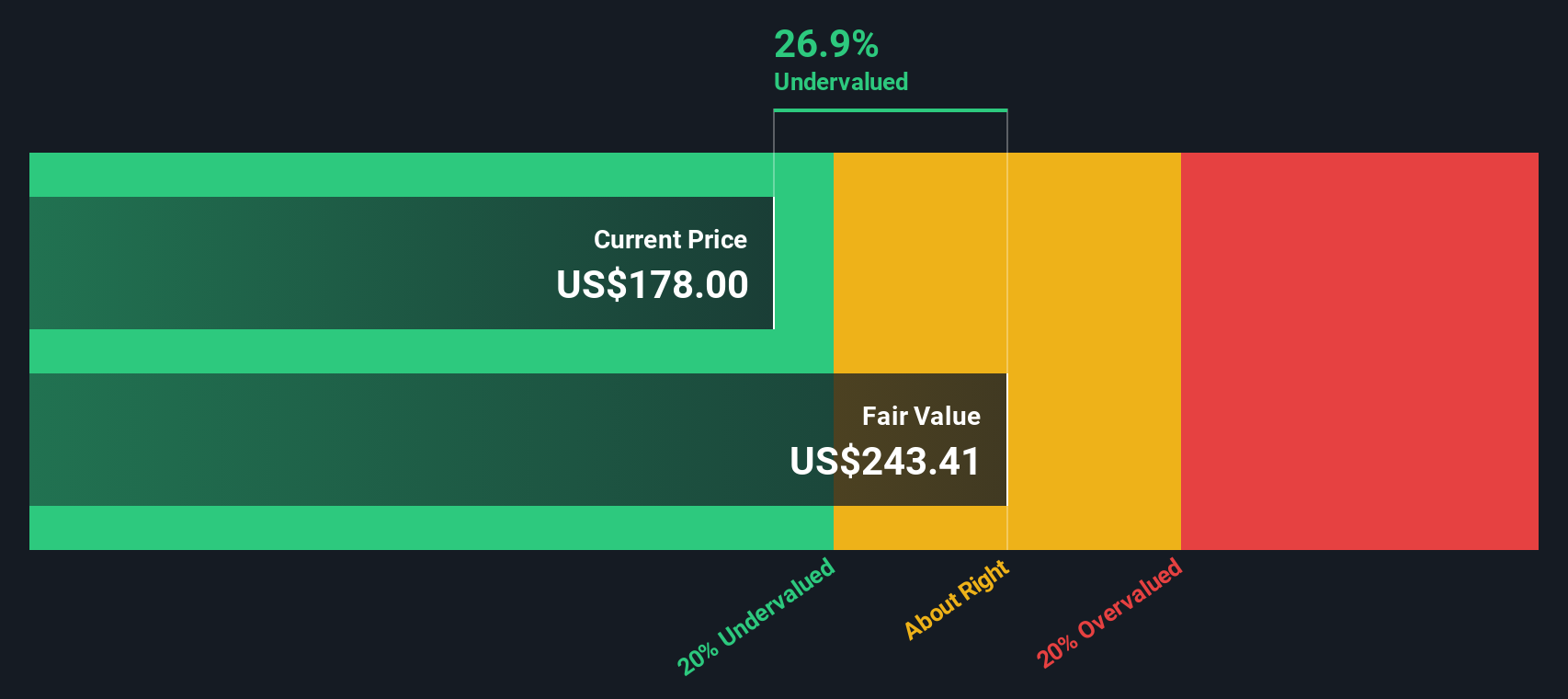

While the fair value estimate suggests Johnson & Johnson is slightly overpriced, our SWS DCF model challenges that perspective. It indicates the stock trades at a discount to its underlying cash flows. Could this signal an opportunity that most are missing?

Build Your Own Johnson & Johnson Narrative

If you are curious or have a different perspective, take a few minutes to explore the underlying numbers and develop your own view. Do it your way.

A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

The market is full of exciting possibilities. Get ahead of the curve and broaden your portfolio by tapping into unique opportunities shaped by today’s most powerful trends.

- Supercharge your portfolio with next-level technology leaders and spot tomorrow’s breakthroughs by using AI penny stocks.

- Access strong income potential and stability as you scan for winning picks through dividend stocks with yields > 3%.

- Unlock value gems trading below their worth and seize opportunities with undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.