Please use a PC Browser to access Register-Tadawul

JPMorgan Chase (NYSE:JPM) Unveils Fixed-Income Offerings With 4.90 Percent and Zero Coupon Notes

JPMorgan Chase & Co. JPM | 318.52 | +0.36% |

JPMorgan Chase (NYSE:JPM) recently announced multiple fixed-income offerings, including 4.9% and zero-coupon notes, reflecting a strategic focus on fixed-income markets. These offerings came amidst strong financial performance, as demonstrated in the company's fourth quarter results, where net income rose to $14 billion, up from $9 billion year-over-year. Leadership changes, including the retirement of COO Daniel Pinto and the appointment of Jennifer Piepszak, have also added to the corporate dynamics. Meanwhile, the broader market dynamics showed a mixed picture with the Dow Jones falling 1.5% after record highs in the S&P 500. Amidst these market shifts and corporate milestones, JPM's stock price increased by 14% last quarter. The company's continued branch expansion into states like Alabama, alongside these financial moves, suggests a robust growth posture contributing to investor confidence and shareholder return.

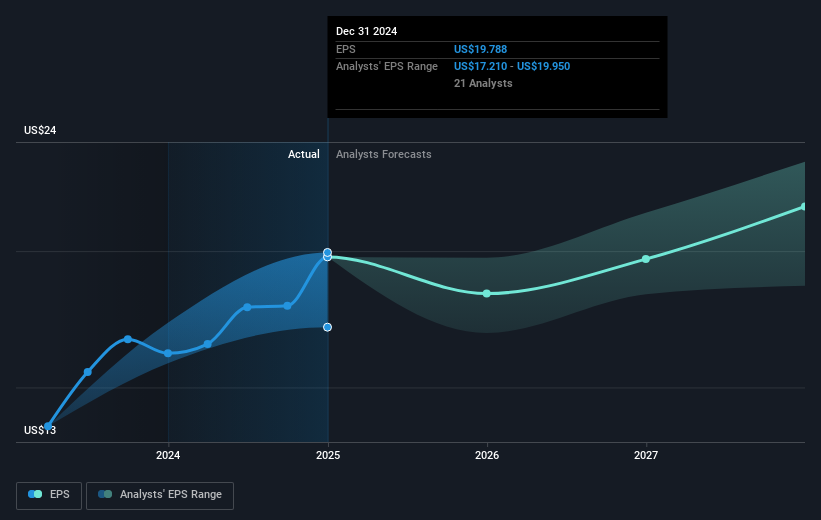

Over the past five years, JPMorgan Chase shareholders have seen total returns of 154.47%. This impressive performance can be linked to several key developments. The company's aggressive expansion strategies, such as its plans to triple branches in Alabama by 2030, reflect its commitment to long-term growth. Furthermore, JPMorgan's fixed-income offerings, including substantial senior notes, have reinforced its position in the financial markets. Despite higher valuations compared to industry peers, its long-term growth trajectory and consistent earnings growth averaging 12.2% per year have bolstered investor confidence.

JPMorgan Chase has also outperformed both the US market, which returned 23.7%, and the US Banks industry, which returned 41.7% over the past year. Enhanced earnings for 2024, with net income reaching a very large US$58.47 billion, along with substantial share repurchases, have further attracted investors, maintaining robust shareholder returns amidst various market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.