Please use a PC Browser to access Register-Tadawul

July 2025's Top Growth Companies With Strong Insider Ownership

Capital Bancorp, Inc. CBNK | 29.97 29.97 | +1.15% 0.00% Pre |

As the U.S. stock market hovers near all-time highs, buoyed by strong earnings reports and investor optimism, growth companies with substantial insider ownership are drawing increased attention. In this environment, stocks that combine robust growth potential with significant insider stakes can offer unique insights into company confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Eagle Financial Services (EFSI) | 15.8% | 82.8% |

| Credo Technology Group Holding (CRDO) | 11.8% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 12.9% | 44.4% |

Let's explore several standout options from the results in the screener.

Clearfield (CLFD)

Simply Wall St Growth Rating: ★★★★☆☆

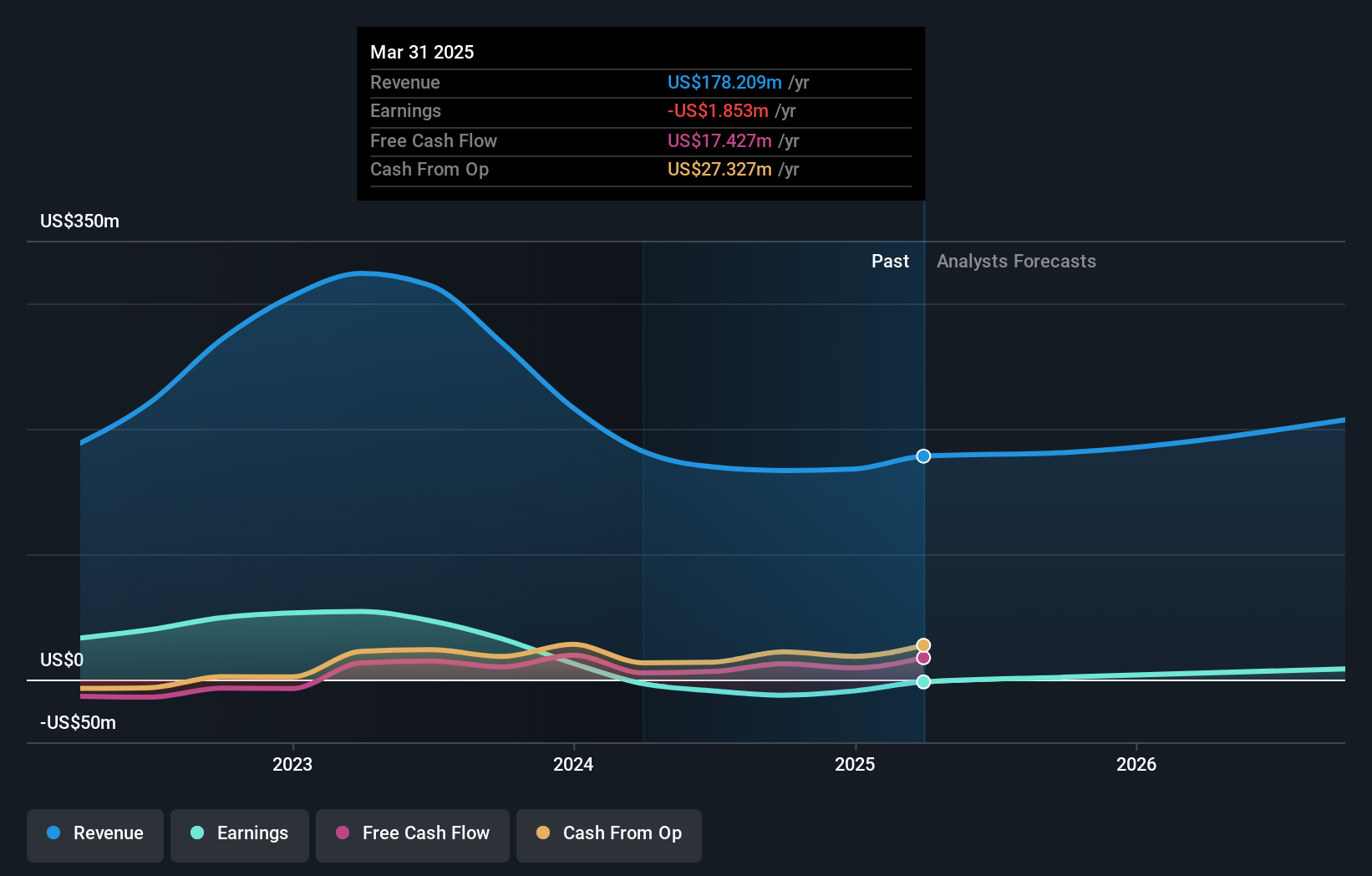

Overview: Clearfield, Inc. manufactures and sells various fiber connectivity products both in the United States and internationally, with a market cap of approximately $571.77 million.

Operations: The company generates revenue from its fiber connectivity products, with Clearfield contributing $140.25 million and Nestor Cables adding $40.16 million.

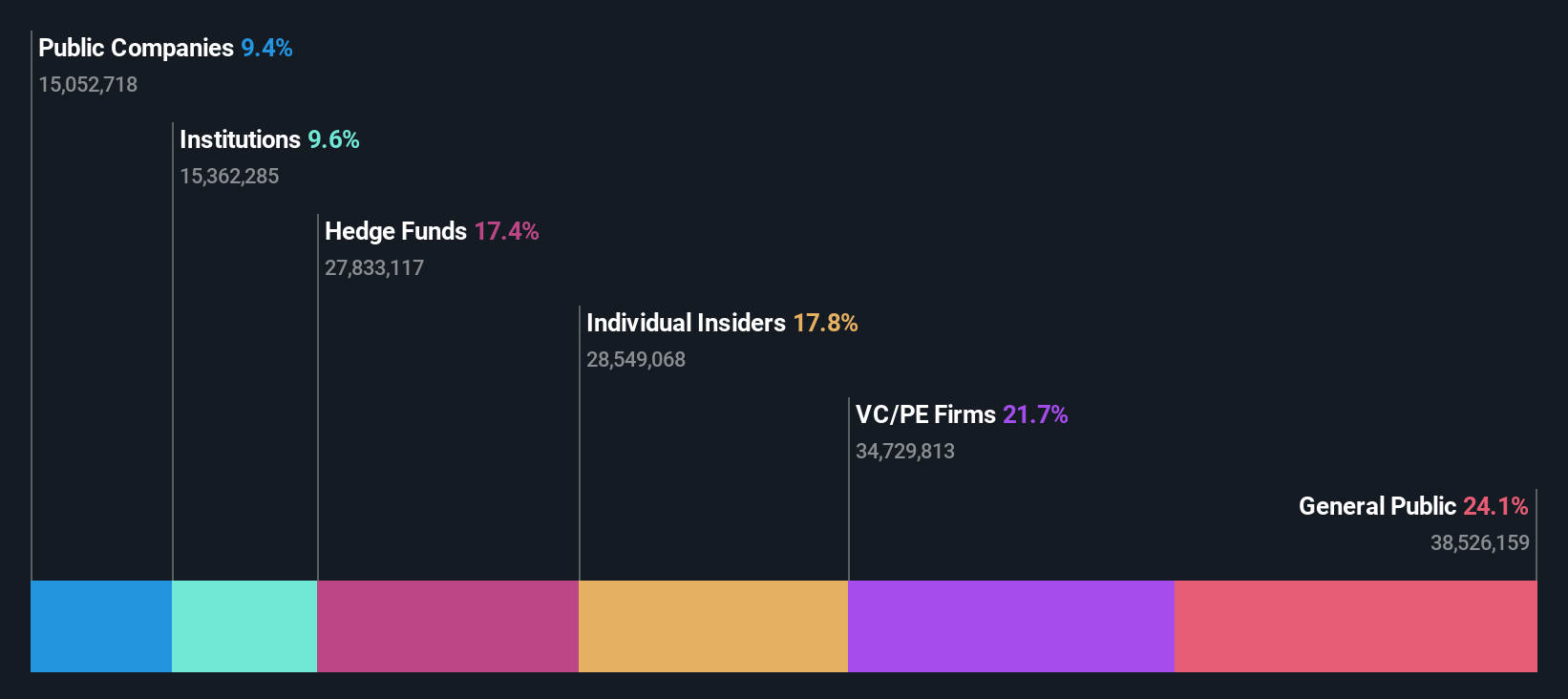

Insider Ownership: 17.2%

Earnings Growth Forecast: 167.3% p.a.

Clearfield, Inc. has been added to multiple Russell Growth Indexes, highlighting its growth potential. The company launched the TetherSmart Multi-Fiber Terminal, enhancing its product portfolio for fiber networks. Recent earnings revealed a significant turnaround with US$47.17 million in sales and a net income of US$1.33 million for Q2 2025, compared to losses previously. Although revenue growth is forecasted at 10.7% annually—faster than the market—profitability remains a future goal within three years.

Capital Bancorp (CBNK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capital Bancorp, Inc. is the bank holding company for Capital Bank, N.A., with a market cap of $571.80 million.

Operations: Capital Bancorp's revenue is primarily derived from its Commercial Bank segment at $99.97 million, followed by Opensky at $69.68 million, and Capital Bank Home Loans (CBHL) contributing $7.32 million.

Insider Ownership: 32.1%

Earnings Growth Forecast: 23% p.a.

Capital Bancorp has been added to several Russell Growth Indexes, underscoring its growth trajectory. Recent earnings show robust performance with net income nearly doubling to US$13.93 million for Q1 2025. Revenue is projected to grow at 18% annually, outpacing the broader market. Insider activity indicates more buying than selling recently, although not in substantial volumes. The company trades significantly below estimated fair value and anticipates strong earnings growth of 23% per year ahead of market averages.

ZKH Group (ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for MRO products, including spare parts and office supplies, in China with a market cap of approximately $490.63 million.

Operations: The company generates revenue primarily from its business-to-business trading and services of industrial products, amounting to CN¥8.84 billion.

Insider Ownership: 17.9%

Earnings Growth Forecast: 108.7% p.a.

ZKH Group's strategic initiatives include a US$50 million share repurchase program and the commissioning of a smart manufacturing base in Taicang, enhancing R&D capabilities. Despite reporting a net loss of CNY 66.72 million for Q1 2025, earnings are expected to grow substantially at 108.66% annually, with revenue growth forecasted at 9.9% per year, outpacing the US market average. The stock trades significantly below its estimated fair value with positive analyst sentiment for future price appreciation.

Key Takeaways

- Click this link to deep-dive into the 194 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.