Please use a PC Browser to access Register-Tadawul

July 2025's Top Penny Stocks To Watch

MONY Group Inc. MNY | 1.33 | +2.31% |

In the last week, the market has been flat, but it is up 12% over the past year with earnings expected to grow by 15% per annum over the next few years. Penny stocks, often smaller or newer companies, can offer a unique blend of affordability and growth potential when backed by strong financials. This article will explore several penny stocks that stand out for their financial strength and potential for long-term success in today's evolving market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.45 | $517.18M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.32 | $252.76M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.946 | $153.53M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.30 | $240.36M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.42M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.05 | $410.26M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.82788 | $5.93M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.45 | $102.66M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.76 | $44.48M | ✅ 2 ⚠️ 2 View Analysis > |

Let's review some notable picks from our screened stocks.

Blade Air Mobility (BLDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blade Air Mobility, Inc. offers air transportation and logistics services primarily for hospitals both in the United States and internationally, with a market cap of $334.60 million.

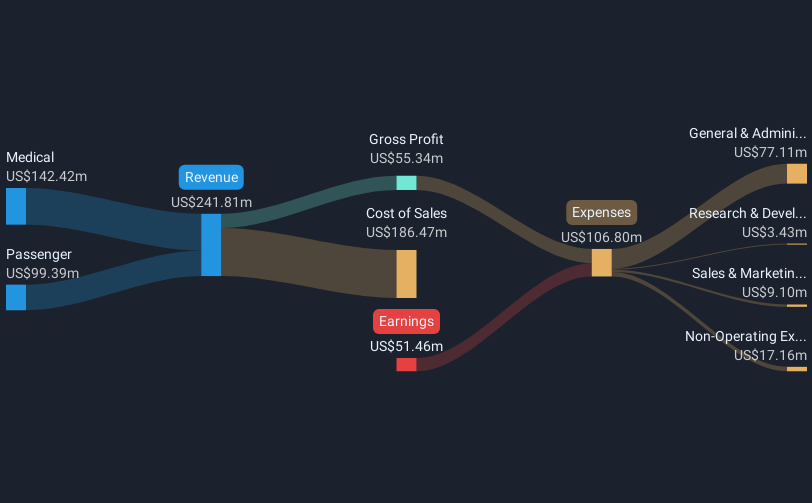

Operations: The company generates revenue from two main segments: Medical services, contributing $146.74 million, and Passenger services, accounting for $104.75 million.

Market Cap: $334.6M

Blade Air Mobility, Inc., with a market cap of US$334.60 million, operates in the air transportation and logistics sector, generating significant revenue from medical (US$146.74 million) and passenger services (US$104.75 million). Despite being unprofitable with increasing losses over the past five years, Blade remains debt-free and has a cash runway exceeding three years based on current free cash flow. The company's short-term assets comfortably cover both short- and long-term liabilities. Recent earnings reports show improved sales of US$54.31 million for Q1 2025 compared to the previous year, alongside a reduced net loss of US$3.49 million.

MoneyHero (MNY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MoneyHero Limited operates a personal finance aggregation and comparison platform for banking, insurance, and other financial products, with a market cap of $53.14 million.

Operations: The company's revenue is primarily generated from its operations in Hong Kong ($29.12 million), Singapore ($27.03 million), the Philippines ($10.64 million), and Taiwan ($4.79 million).

Market Cap: $53.14M

MoneyHero Limited, with a market cap of US$53.14 million, operates a personal finance platform across Asia. Despite being unprofitable and experiencing increased losses over the past five years, the company remains debt-free and has sufficient short-term assets to cover liabilities. Recent earnings reports show a decrease in sales to US$14.31 million for Q1 2025 from US$22.18 million the previous year, but net losses have narrowed significantly. A strategic partnership with RCBC Bankard Services Corporation aims to enhance its credit card offerings in the Philippines, potentially bolstering its position in digital financial services within the region.

Offerpad Solutions (OPAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Offerpad Solutions Inc., along with its subsidiaries, offers technology-driven solutions for the U.S. residential real estate market and has a market cap of $47.38 million.

Operations: The company generates revenue primarily through its Cash Offer segment, which accounted for $770.72 million.

Market Cap: $47.38M

Offerpad Solutions Inc., with a market cap of US$47.38 million, is navigating challenges in the U.S. residential real estate market. Despite generating significant revenue through its Cash Offer segment, recent earnings showed a decline to US$160.7 million in Q1 2025 from US$285.36 million the previous year, with net losses narrowing slightly. The company has been dropped from multiple Russell indexes as of June 2025, reflecting potential investor concerns about its financial stability and growth prospects. However, Offerpad's strategic initiatives like HomePro and partnerships aim to enhance customer engagement and expand its service offerings despite ongoing unprofitability challenges.

Where To Now?

- Unlock more gems! Our US Penny Stocks screener has unearthed 417 more companies for you to explore.Click here to unveil our expertly curated list of 420 US Penny Stocks.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.