Please use a PC Browser to access Register-Tadawul

KB Home's (KBH) Push Into High-Demand Markets: A New Phase for Its Customization Strategy?

KB Home KBH | 63.33 | -1.34% |

- In October 2025, KB Home announced the grand opening of new residential communities in Bothell, Washington, and Roseville, California, each designed with modern features and community amenities aimed at appealing to families and homebuyers seeking personalization.

- The launch of these communities highlights KB Home's focus on expanding its presence in high-demand regions while emphasizing customization, customer satisfaction, and energy-efficient living spaces.

- Let's explore how the company's continued expansion into sought-after markets with customizable homes influences its broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

KB Home Investment Narrative Recap

To own KB Home stock, an investor needs confidence in the company’s ability to execute community expansions in high-demand regions while mitigating the impact of uneven housing demand. The recent openings in Bothell, WA, and Roseville, CA, reinforce KB Home's focus on customizable homes and capturing share in desirable markets, but these launches do not materially shift the immediate risk: short-term demand volatility amid macroeconomic uncertainty remains the biggest challenge for the business.

Among KB Home’s latest announcements, the updated earnings guidance for Q4 2025 stands out as particularly relevant. The company expects housing revenues of US$1.6 billion to US$1.7 billion and a full-year average selling price near US$483,000, reinforcing that future performance hinges on stabilizing homebuyer confidence and timely home deliveries.

However, the flipside that investors should be aware of is the risk that consumer confidence could...

KB Home's narrative projects $6.8 billion in revenue and $496.4 million in earnings by 2028. This requires a 0.2% annual revenue decline and a $125.1 million decrease in earnings from the current $621.5 million.

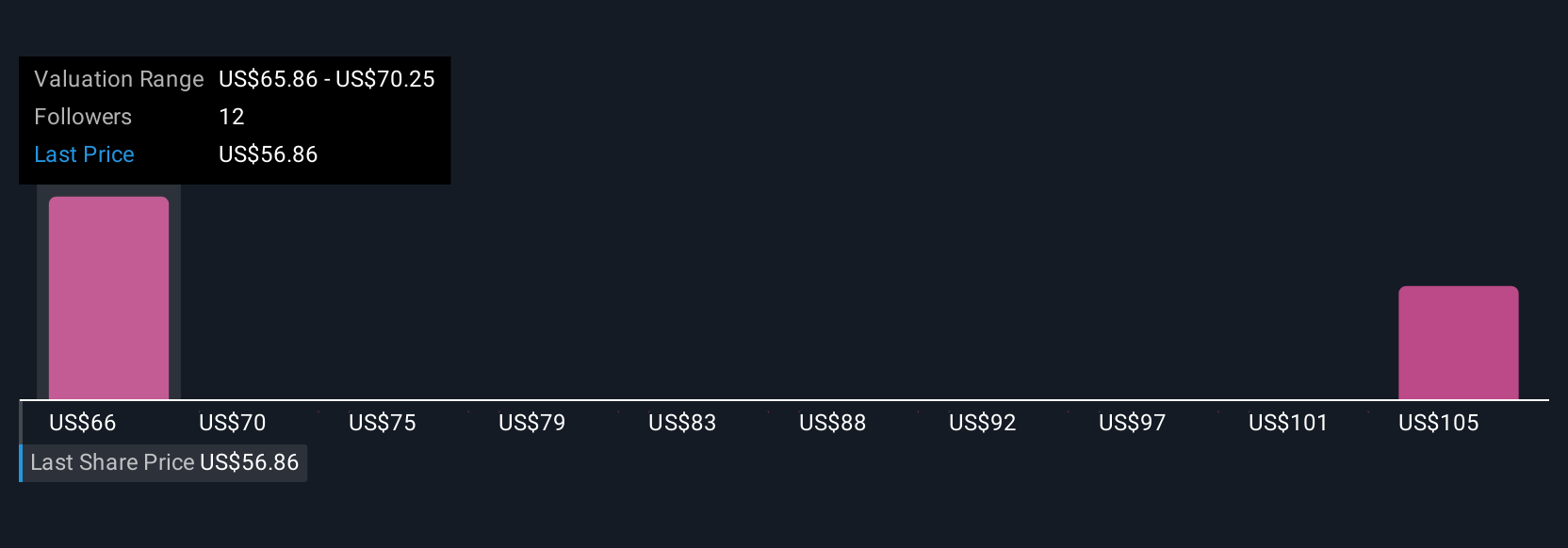

Uncover how KB Home's forecasts yield a $66.00 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from four Simply Wall St Community members range widely from US$58 to over US$172,746 per share. While some see opportunity, others remain cautious, especially as short-term demand volatility continues to influence KB Home’s near-term revenue outlook.

Explore 4 other fair value estimates on KB Home - why the stock might be a potential multi-bagger!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.