Please use a PC Browser to access Register-Tadawul

KBR (KBR) Is Down 5.9% After DoD Contract Termination and Onset of Securities Lawsuits – What's Changed

KBR, Inc. KBR | 43.49 | +3.30% |

- Earlier this year, KBR faced significant legal and business challenges after the U.S. Department of Defense's Transportation Command terminated a major military contract with its joint venture, HomeSafe Alliance, triggering a series of securities class-action lawsuits alleging misleading statements about the contract's status and operational issues.

- This development not only introduced substantial legal and operational risks for KBR, but also raised questions among stakeholders about the company's reliance on large, complex government contracts and the impact on its long-term strategic direction.

- We'll now explore how these legal and operational setbacks could influence KBR's investment narrative, especially regarding its dependence on large government contracts.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

KBR Investment Narrative Recap

To own shares in KBR, investors need confidence in the company's ability to withstand volatility tied to large government contracts while capitalizing on demand for technology-driven solutions in defense, energy transition, and infrastructure. The recent termination of a significant military contract and ensuing class-action lawsuits sharply raised the company’s risk profile and could dampen the near-term outlook for new contract awards until these matters are resolved.

In response to these challenges, KBR’s board announced plans to spin off its Mission Technology Solutions business, creating two independent, publicly traded companies by late 2026. This move signals a potential shift in strategic focus and operational structure, directly relating to issues around execution risk in its current contract portfolio and possible impacts on future growth opportunities.

Yet investors should also be aware that, in contrast to prior stability, the sudden legal and contract setbacks reveal...

KBR's outlook anticipates $9.4 billion in revenue and $664.3 million in earnings by 2028. This reflects a 5.4% annual revenue growth rate and a $264.3 million increase in earnings from the current $400.0 million.

Uncover how KBR's forecasts yield a $60.71 fair value, a 38% upside to its current price.

Exploring Other Perspectives

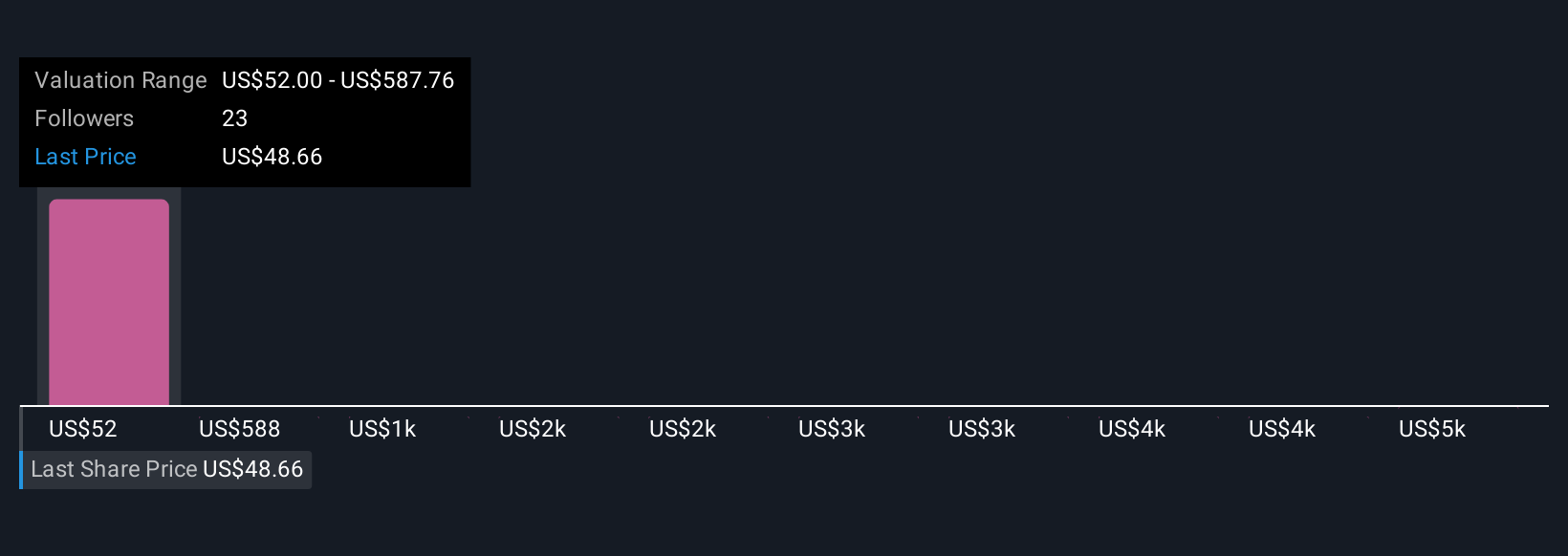

Nine individual fair value estimates from the Simply Wall St Community range from US$40 to over US$5,400, showing very different views on KBR’s potential. While these opinions vary greatly, unresolved contract terminations and ongoing legal risks highlight why many market participants may be cautious about the company’s near-term prospects.

Explore 9 other fair value estimates on KBR - why the stock might be worth 9% less than the current price!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.