Please use a PC Browser to access Register-Tadawul

KBR (KBR): Valuation Opportunities After Contract Termination and Class Action Investigation

KBR, Inc. KBR | 44.12 44.12 | +1.45% 0.00% Post |

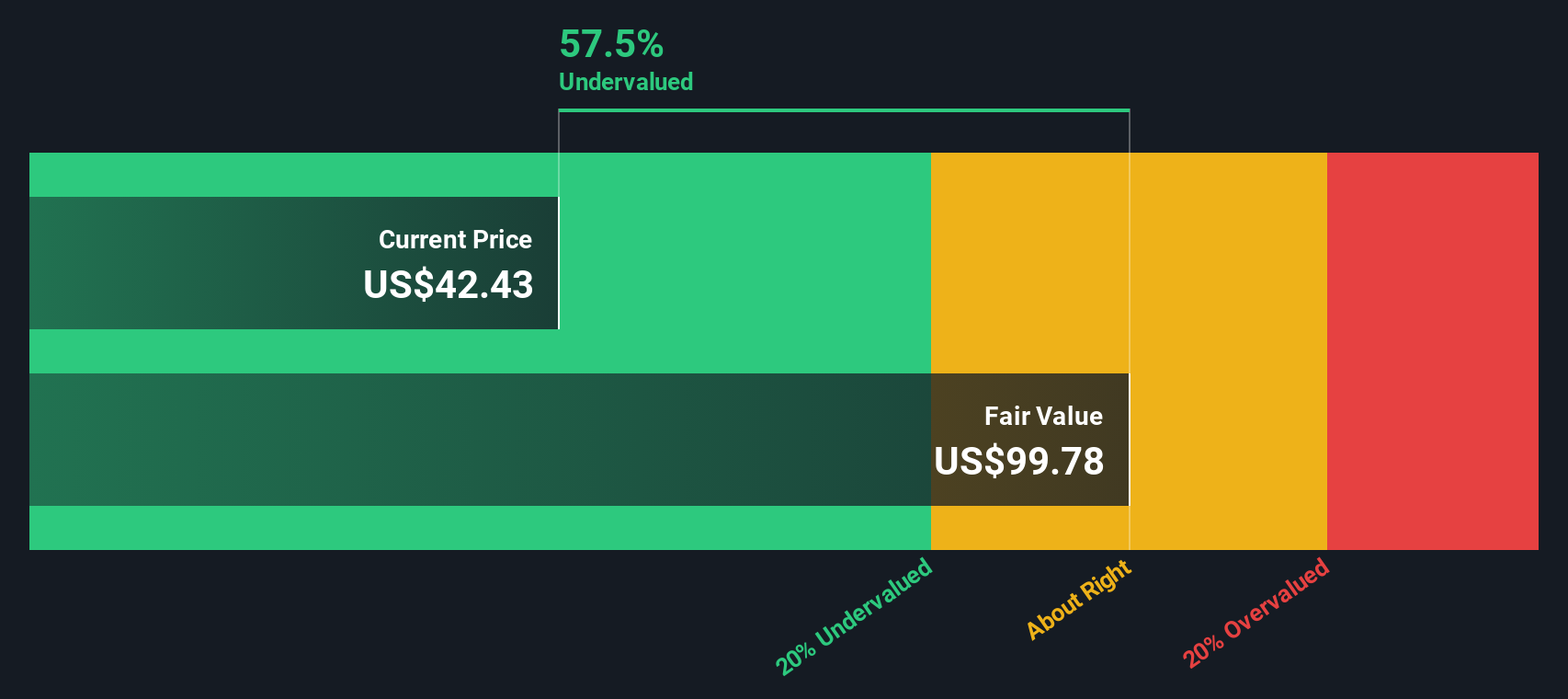

Most Popular Narrative: 18.2% Undervalued

According to the most widely followed narrative, KBR is currently trading well below its estimated fair value, with analysts projecting a meaningful upside if the company's earnings growth and margin expansion targets are achieved.

The passage of the U.S. Reconciliation Act is unlocking over $1 trillion in national security and defense spending through 2026. KBR is well-positioned to capture incremental funding due to its established positions in mission tech, advanced defense technologies, and intelligence contracts, supporting potential revenue and earnings growth.

Is KBR’s future priced for liftoff or caution? The narrative leans heavily on a fresh growth engine, one built on bold forecasts for earnings, sales momentum, and expanding margins. But how steep are these assumptions, and what could they mean for investors seeking a full swing in valuation? Dig deeper to discover the financial leaps that make this 18% undervaluation so compelling and decide for yourself which catalyst could reshape KBR’s story.

Result: Fair Value of $60.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected contract losses or continued government budget delays could derail KBR's turnaround. This would challenge the bullish outlook and highlight ongoing volatility.

Find out about the key risks to this KBR narrative.Another View: Sizing Up the Value

Looking at things from a different angle, our DCF model also finds KBR undervalued. This method leans more on future cash flow forecasts and less on what analysts expect. Which lens will prove most accurate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KBR Narrative

If the consensus leaves you unconvinced or you want to dig deeper with your own perspective, you can shape your narrative in just a few minutes. Do it your way

A great starting point for your KBR research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next great investment slip through the cracks. Seize the moment and use these powerful stock ideas from our screener tool to target big potential winners before the crowd catches on.

- Grow your savings by targeting high-yield picks, and get started with dividend stocks with yields > 3% that pay more while you hold.

- Jump ahead of the curve by searching for promising healthcare innovators shaping tomorrow’s medicine with healthcare AI stocks.

- Unlock hidden bargains by zeroing in on undervalued opportunities, revealed by our expert undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.