Please use a PC Browser to access Register-Tadawul

Kenvue (KVUE): Exploring Valuation After Autism Litigation Headlines Stir Investor Concerns

Kenvue Inc. KVUE | 17.33 | +0.06% |

If you have been watching Kenvue (NYSE:KVUE), this week’s headlines probably raised your eyebrows. President Trump and administration health officials went public with statements suggesting that acetaminophen, the ingredient at the heart of Kenvue’s Tylenol, may be linked to autism. It is a controversial claim that has stirred debate among doctors, who largely reject any scientific basis and warn of the risks of spreading misinformation. Unsurprisingly, Kenvue quickly pushed back, defending Tylenol’s safety record and stressing the absence of credible clinical evidence.

Market reaction was swift and sharp. Fresh litigation fears, along with media attention and political pressure, dragged shares down to a record low, only to see a partial rebound as the news cycle evolved. Over the past year, Kenvue’s stock price has drifted nearly 24% lower, underperforming both peers and the market as the company faces legal headwinds and shifting consumer sentiment. It is a clear sign that recent momentum is firmly to the downside, even as Kenvue’s revenue and net income have notched modest growth in that time.

With the share price already under pressure, is this legal risk priced in or is there untapped growth worth a closer look?

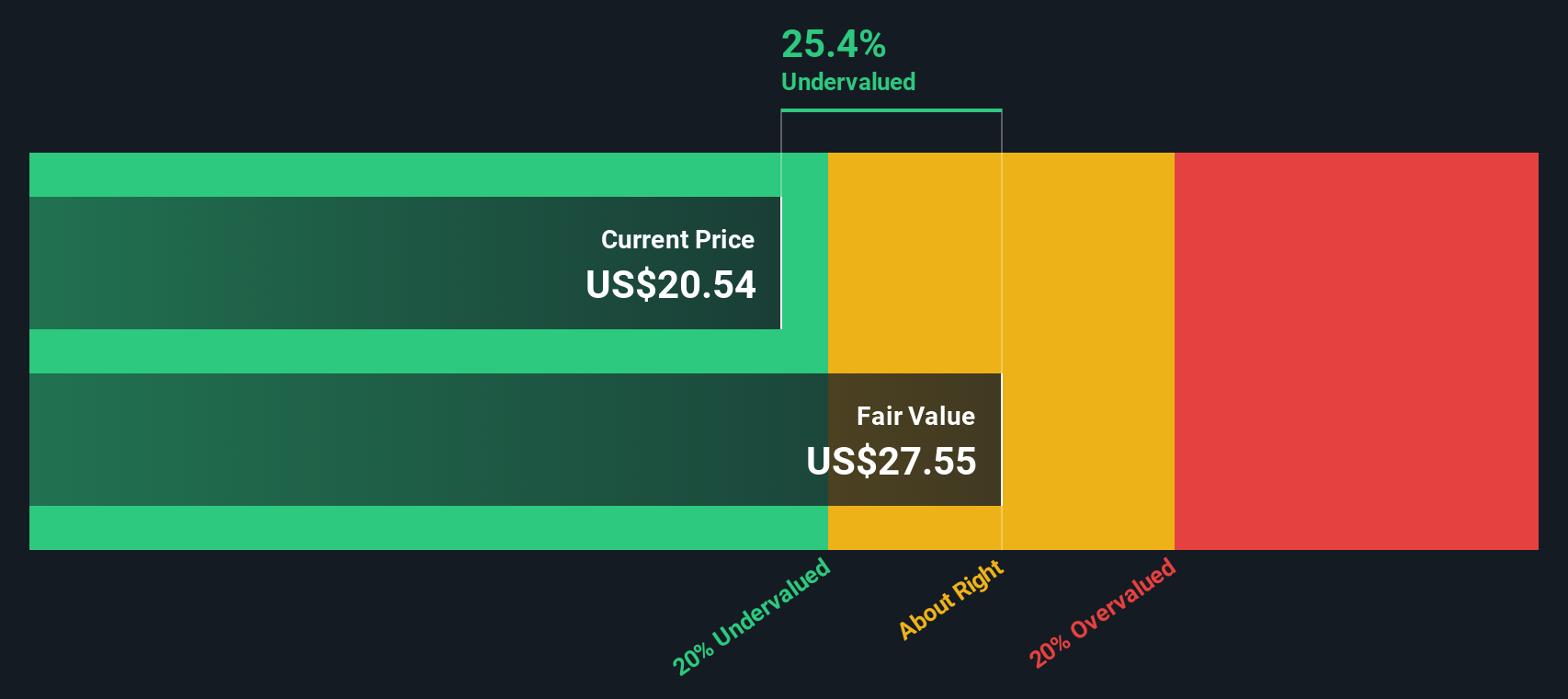

Most Popular Narrative: 32% Undervalued

According to the most popular narrative, Kenvue’s current share price represents a significant discount to its calculated fair value. The stock is viewed as undervalued, with future profits and growth drivers potentially overlooked by the market at current levels.

With autonomy from its former parent, Kenvue can allocate resources to best fit its needs and grow the business. Macro drivers such as an aging population and premiumization of health care may act as tailwinds for all of Kenvue’s brands.

Want to know the growth blueprint behind this eye-catching valuation? The narrative’s bold assumptions hinge on a profit margin that rivals sector leaders and a growth outlook that breaks with the company’s recent past. Curious about which key metrics are driving such optimism? Delve into the full narrative to uncover what is powering this fair value target.

Result: Fair Value of $25.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising input costs and increasing competition from niche brands could challenge Kenvue’s ability to maintain its current margins and market share.

Find out about the key risks to this Kenvue narrative.Another View: Is the Market Missing Something?

Looking through the lens of our SWS DCF model, the story still leans toward undervaluation. This result is consistent with findings from the first method. But can the future really play out as models predict, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kenvue Narrative

If you are keen to interpret the numbers differently or want to dig into the data yourself, it takes just minutes to craft your own perspective. Do it your way.

A great starting point for your Kenvue research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why settle for just one opportunity? If you want your portfolio working harder, check out these powerful strategies and tap into fresh ways to grow your wealth.

- Grow your income with stocks built for generous yields by starting your search among dividend stocks with yields > 3%.

- Seize market-beating bargains and see which companies may be trading far below their real worth using undervalued stocks based on cash flows.

- Catch the next wave of innovation fueling intelligent healthcare solutions with the help of our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.