Please use a PC Browser to access Register-Tadawul

Kimco Realty (KIM): Evaluating Valuation After Groundbreaking of The Chester at Westlake Mixed-Use Project

Kimco Realty Corporation KIM | 20.08 | -2.05% |

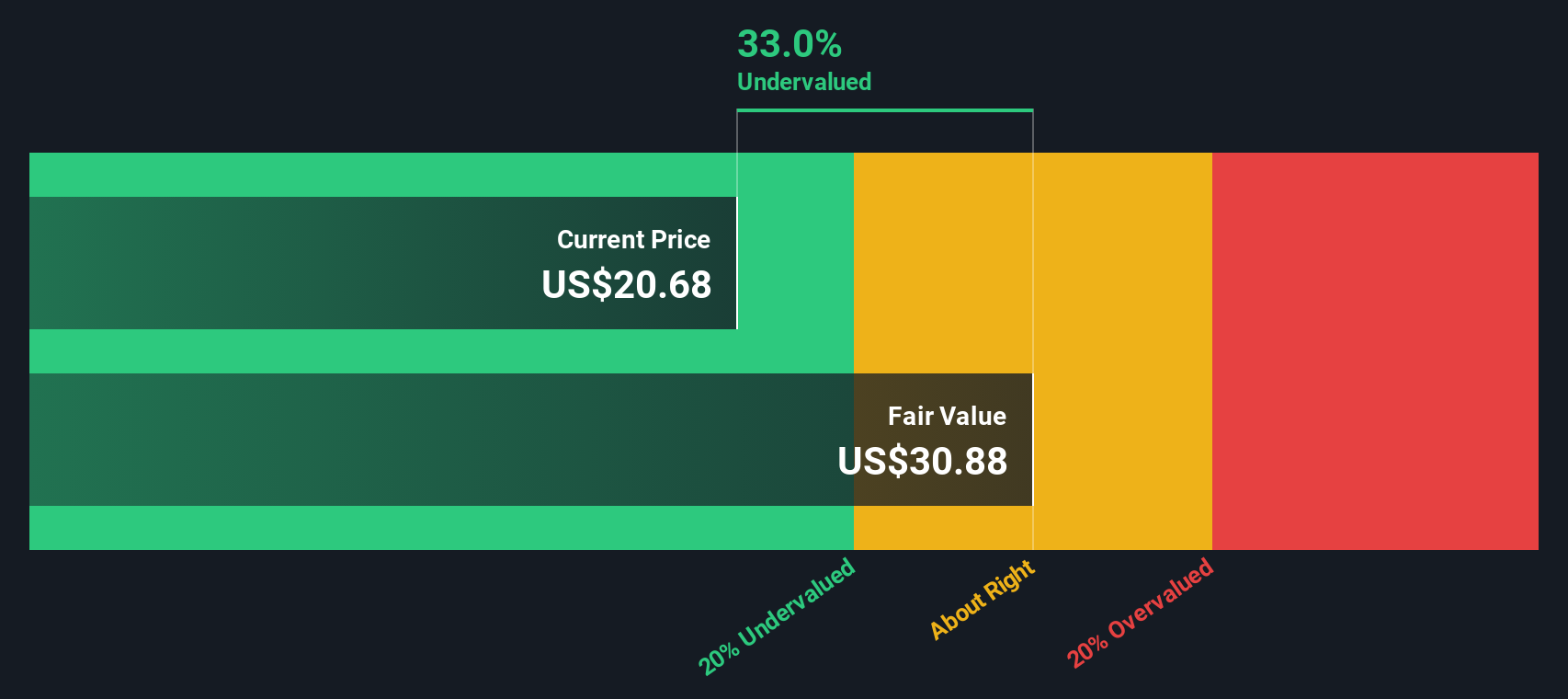

Most Popular Narrative: 8.7% Undervalued

According to the widely followed narrative, Kimco Realty’s shares are currently trading at a notable discount to their assessed fair value. This suggests underlying optimism about the company’s earnings power and future prospects, even as growth forecasts remain moderate.

“Strategic recycling of capital from low-growth assets into higher-yielding grocery-anchored properties, combined with an active structured investment program providing a pipeline of future acquisitions, positions Kimco to enhance EBITDA and net margins, especially if cost of capital improves. Deployment of AI and operational innovations is streamlining leasing and expense recovery processes, increasing efficiency and reducing G&A and operating expenses, which should incrementally improve net margins and free cash flow.”

Hungry for the numbers behind this value call? This narrative hinges on bold assumptions about sustained revenue increases, margin evolution, and ambitious growth targets set years ahead. Want to see which hidden factors are powering this “undervalued” thesis and where Wall Street’s projections might surprise you? Explore the full narrative to uncover the key factors that analysts are considering.

Result: Fair Value of $24.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the company’s reliance on grocery-anchored centers and persistent sector headwinds could challenge rental stability and margin expansion if market conditions shift.

Find out about the key risks to this Kimco Realty narrative.Another View: Testing Fair Value Another Way

To stress test the initial value call, our SWS DCF model offers a more conservative perspective by focusing on Kimco Realty’s future cash flows. This method also points to shares trading below intrinsic value. However, will these long-range assumptions prove reliable if market dynamics shift?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kimco Realty Narrative

If you see things differently or want to dig into the figures yourself, you can map out your own view in just a few minutes. Do it your way

A great starting point for your Kimco Realty research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop with Kimco Realty. Fast-track your strategy and get ahead of the pack by uncovering dynamic stocks and fresh opportunities with these specialized tools:

- Tap into high-yield potential and steady income streams with dividend stocks with yields > 3%, delivering consistent performance from companies paying strong dividends.

- Spot undervalued gems by checking out undervalued stocks based on cash flows for stocks that could be flying under the radar based on cash flow analysis.

- Ride the wave of innovation and identify tomorrow’s tech leaders through AI penny stocks. This screener highlights companies pioneering advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.