Please use a PC Browser to access Register-Tadawul

Kingsoft Cloud (KC) Is Up 11.6% After Analyst Concerns Over Revenue Growth and Valuation

Kingsoft Cloud Holdings KC | 11.04 | +1.89% |

- In the past month, Kingsoft Cloud Holdings drew considerable attention following a very large annual share price increase, sparking widespread discussion about its fundamentals. While the upward momentum has been striking, analysts express concerns that the company’s revenue growth may not justify current valuation multiples compared to industry trends.

- This raises important questions about whether Kingsoft Cloud Holdings can deliver sustainable revenue expansion to support its elevated price-to-sales ratio.

- Given the rising focus on whether revenue trends can justify valuation levels, let’s assess how this concern may influence the broader investment narrative.

Kingsoft Cloud Holdings Investment Narrative Recap

To be a shareholder in Kingsoft Cloud Holdings today, you need to believe that the company’s partnerships and AI-focused strategy will drive sustained revenue growth strong enough to support its current high valuation. The recent sharp share price surge may bring short-term optimism, but it does not materially change the fact that slower-than-industry revenue growth remains the biggest immediate risk, while the company’s success in expanding its AI revenues is the primary catalyst.

Among recent developments, the completion of two follow-on equity offerings stands out, as these moves bolster the company’s financial flexibility to support investments in AI infrastructure. This may help address some near-term risks but does not resolve concerns that capital expenditures could pressure margins and earnings if growth underperforms expectations.

However, investors should also be alert to the contrasting possibility that, even with new capital, reliance on the Xiaomi Kingsoft ecosystem could...

Kingsoft Cloud Holdings is projected to reach CN¥13.5 billion in revenue and CN¥854.8 million in earnings by 2028. This outlook assumes annual revenue growth of 19.1% and an earnings increase of CN¥2.75 billion from current earnings of CN¥-1.9 billion.

Exploring Other Perspectives

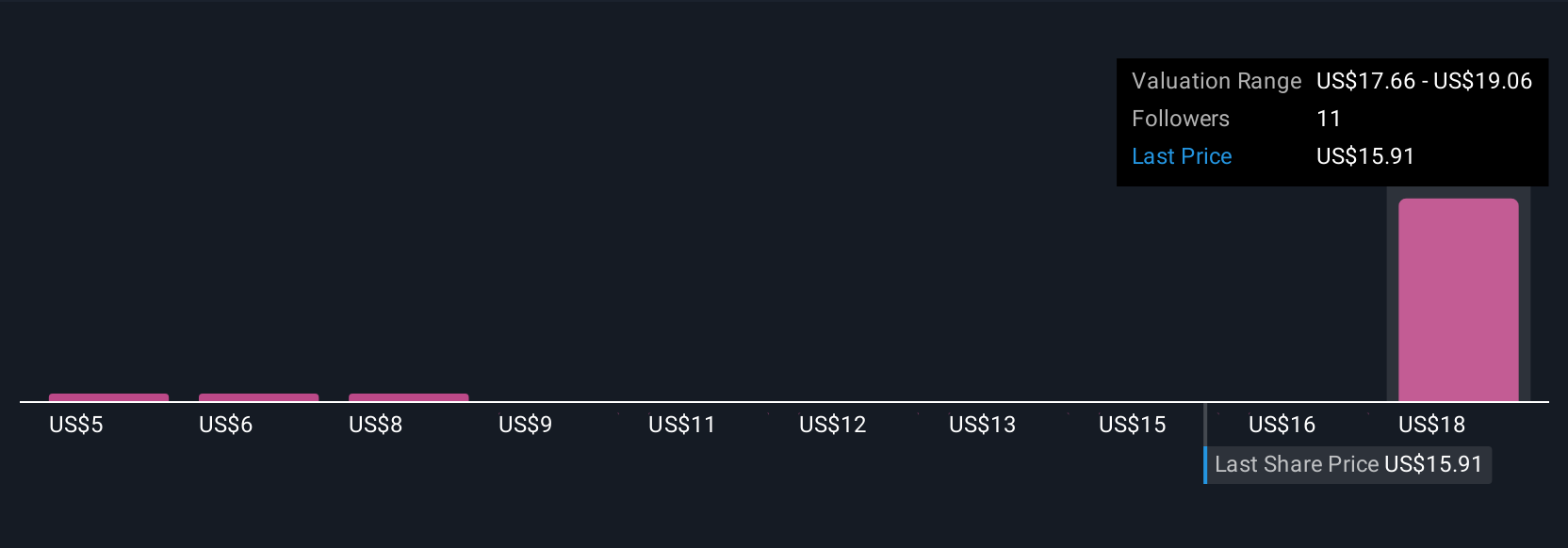

The Simply Wall St Community contributed five distinct fair value estimates for Kingsoft Cloud, ranging from CN¥5.06 to CN¥19.06 per share. While some see long-term upside from ongoing AI-related partnerships, others caution that slower-than-expected revenue growth could challenge current pricing, making it essential to weigh differing views before evaluating your own position.

Build Your Own Kingsoft Cloud Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kingsoft Cloud Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Kingsoft Cloud Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kingsoft Cloud Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.