Please use a PC Browser to access Register-Tadawul

Kite Realty Group Trust (KRG): Exploring Current Valuation and Investor Sentiment Shift

Kite Realty Group Trust KRG | 24.68 24.68 | -0.76% 0.00% Post |

Kite Realty Group Trust (KRG) shares have edged lower recently, slipping about 2% in the past day and down roughly 4% over the past week. Investors are weighing the company’s latest performance in comparison to sector trends and broader market sentiment.

Despite some recent dips, Kite Realty Group Trust’s share price is down just over 10% for the year to date. Its standout 162% total shareholder return over five years shows solid long-term momentum is still in play, even as current sentiment feels cautious.

If you’re curious about what the broader market has to offer, this is a perfect moment to branch out and discover fast growing stocks with high insider ownership

With the stock trading at a double-digit discount to analyst targets and long-term performance remaining robust, investors must now consider whether Kite Realty Group Trust is undervalued or if the market is correctly anticipating its growth ahead.

Most Popular Narrative: 13% Undervalued

Compared to its most followed narrative, Kite Realty Group Trust’s fair value estimate sits noticeably higher than the latest market close. This suggests potential upside if key projections hold. The following excerpt highlights one of the main drivers supporting this valuation.

Strategic portfolio transformation through active capital recycling, exiting at-risk tenants and noncore markets (for example, select California sales), while acquiring or expanding prime assets (such as Legacy West in a joint venture with GIC), is improving asset quality and tenant mix. This is leading to higher net margins and enhanced earnings stability.

What hidden levers justify this bullish stance? The narrative centers on a significant improvement in asset quality, premium tenant selection, and a market environment expected to reward these precise strengths. Want the full story behind the future estimates and the notable valuation target? Explore the details and see which forward-looking numbers analysts are highlighting for Kite Realty Group Trust.

Result: Fair Value of $25.58 (UNDERVALUED)

However, lingering concerns about tenant bankruptcies and ongoing interest rate pressures could quickly shift market sentiment and challenge the current bullish outlook.

Another View: What Do the Ratios Say?

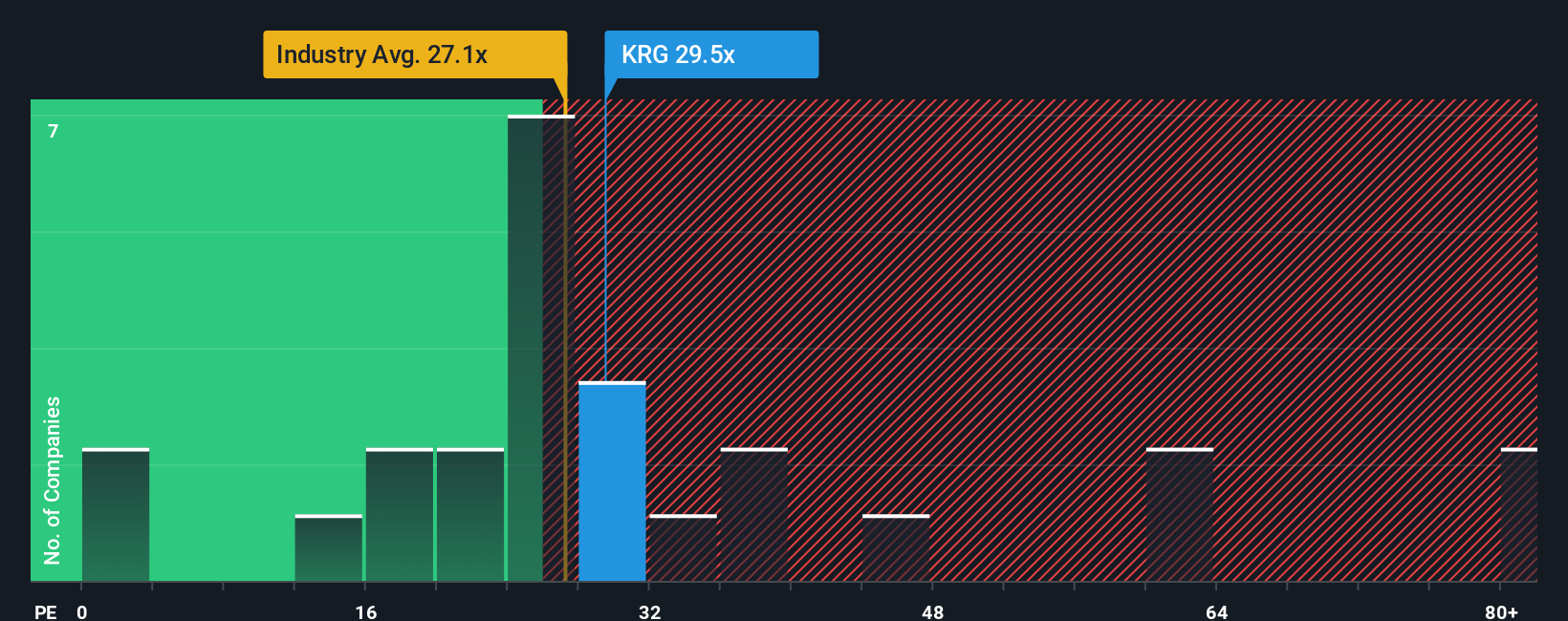

Looking at Kite Realty Group Trust's price-to-earnings ratio, the story changes. The current ratio stands at 28.3x, higher than the industry average of 26.9x and well above the fair ratio of 19.8x. This suggests the stock is priced for optimism, but does it leave investors open to disappointment if expectations slip?

Build Your Own Kite Realty Group Trust Narrative

If these conclusions aren't your own, or if you're eager to dig deeper into the numbers, you can craft your own big-picture in moments: Do it your way

A great starting point for your Kite Realty Group Trust research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on today’s market momentum by zeroing in on opportunities you won’t want to miss. With these tailored screeners, you can spot high-potential stocks making their mark right now.

- Fuel your portfolio with growth by targeting breakthrough businesses in artificial intelligence using these 26 AI penny stocks. These companies are redefining industries.

- Unlock strong and reliable income streams by checking out these 21 dividend stocks with yields > 3%, which boasts eye-catching yields and consistent payout records.

- Seize the upside in undervalued companies as you browse these 856 undervalued stocks based on cash flows. These selections are poised for long-term appreciation based on robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.